The US, Canada, and Mexico are the key countries in North America. Food inclusions such as chocolate, fruits, and nuts; flavored sugars; and caramel are used as ingredients that are primarily responsible for the characteristic appearance, texture, and flavor of most bakery and confectionery products. In addition, food inclusions can effectively modify these characteristics and contribute toward high quality of products. According to the National Confectioners Association (NCA), chocolate represents 60% of the confectionery industry in the US, which is worth ~US$ 35 billion. Chocolate is a consumer favorite that is loved by people of all ages from various socioeconomic groups, races, and geographies. It is made available by various iconic brands as well as by micro-manufacturers. Chocolate inclusions are used in the production of chocolate chips, crispy bites, chocolate flakes, chocolate curls, and a wide range of other confectionery products. Further, millennial confectionery preferences are highlighting the needs of innovative flavors, ingredients, and textures, thereby driving the demand for food infusions in confectioneries.

The US has the highest number of confirmed cases of coronavirus, as, compared to Canada and Mexico. This has negatively affected the food & beverages industry in the region as the COVID-19 outbreak has negatively affected the supply and distribution chain. The unavailability of raw materials due to lockdown in many raw material supplying countries has halted the production. The food inclusions market has had a major impact on its product trends. The pandemic has propelled consumers to opt for healthy food products with various functional properties. Additionally, to break through the regular routine imposed due to the lockdown, the consumer’s desire for new and innovative products to experience different culinary adventure is also influencing the market trends for food inclusions. Fruits and nuts are expected to witness an increasing demand during the upcoming years owing to the health benefits offered by them. Travel restrictions are influencing the flavor trends in food. Thus, though the COVID-19 pandemic has had a negative impact on the production and supply of food inclusions, it has positively influenced the product trends in the market.

Strategic insights for the North America Food Inclusions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

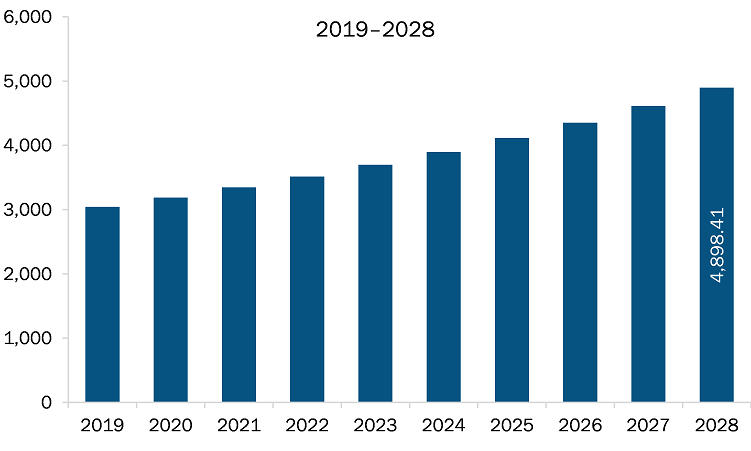

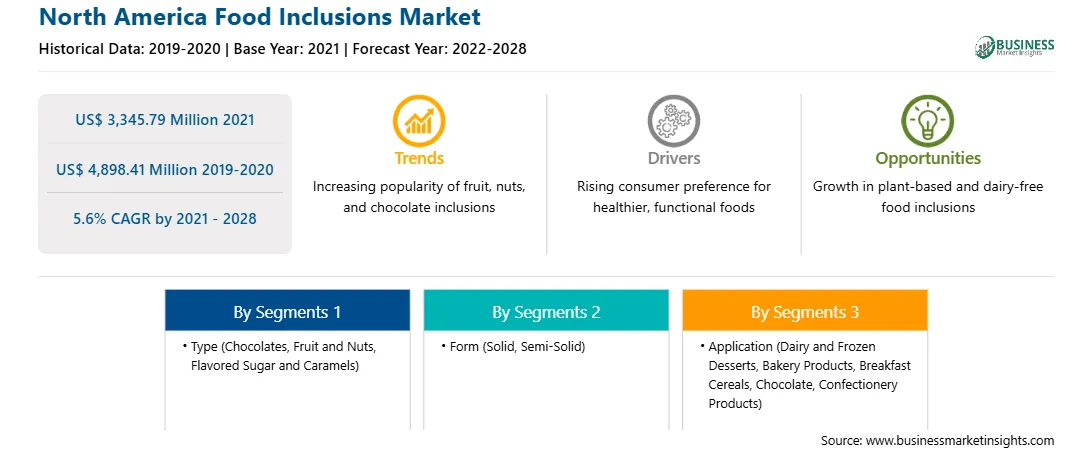

| Market size in 2021 | US$ 3,345.79 Million |

| Market Size by 2028 | US$ 4,898.41 Million |

| Global CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Food Inclusions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The food inclusions market in North America is expected to grow from US$ 3,345.79 million in 2021 to US$ 4,898.41 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028. Food inclusions were mainly been associated with indulgence for a long period of time. However, nowadays, they are also being associated with health and nutrition, apart from delivering flavor, texture, color, and aroma. The COVID-19 pandemic has had a huge impact on the consumer buying behavior. Rising health concerns as well as growing awareness regarding the consumption of natural and functional food have given rise to new food & beverage trends. Majority of the consumers are opting for immunity-boosting functional food products. Rising consumer preference for products that offer, both, indulgence and health attributes is propelling food manufacturers to use fitting inclusions in their products. Super-foods such as blueberries, cranberries, elderberry, and aronia berries are being used as food inclusions as they provide high levels of antioxidants that boost immunity. The demand for such fruit inclusions in functional food such as yogurt and cottage cheese that help maintain gut health is on rise. Moreover, surging demand for food products and beverages with low sugar content, lower synthetic additive content, and clean label ingredients is triggering the demand for food inclusions such as fruit purees, juices, concentrates, and exotic fruits and vegetables. Fruit-based inclusions, which are sources of natural sugars, are rapidly substituting sugar in several food products and beverages. The demand for whole-food inclusion is increasing in the worldwide market as they feature a complete package of texture, flavor, and function. Whole foods undergo minimal or zero processing and are thus considered as natural ingredients. For instance, nuts are identified as whole-food inclusions with a clean label listing and having health halo. Walnuts are majorly being used as a food inclusions in several food products such as yogurt, snacks, and breakfast cereals. Apart from providing flavor, walnuts also offer functional health benefits, as they are rich in plant-based ALA omega-3 fatty acids. Similarly, almonds are an excellent source of proteins, vitamin E, fiber, magnesium, calcium, potassium, riboflavin, and phosphorous. Legumes are also a crucial ingredient used in functional and healthy food products, as they are rich source of fiber and protein. Black beans are emerging as a lucrative food inclusions as majority of consumers resonate with the health benefits of black beans. Thus, surging demand for functional and healthy food products is emerging as a lucrative opportunity for the food inclusions market players.

In terms of type, the chocolate segment accounted for the largest share of the North America food inclusions market in 2020. In term of form, the solid segment held a larger market share of the food inclusions market in 2020. Further, the bakery products segment held a larger share of the market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the food inclusions market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; AGRANA Beteiligungs-AG; Puratos; Barry Callebaut; Cargill, Incorporated; Kerry Group; Georgia Nut Company; Taura Natural Ingredients Ltd.; and Sensient Technologies among others.

The North America Food Inclusions Market is valued at US$ 3,345.79 Million in 2021, it is projected to reach US$ 4,898.41 Million by 2028.

As per our report North America Food Inclusions Market, the market size is valued at US$ 3,345.79 Million in 2021, projecting it to reach US$ 4,898.41 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The North America Food Inclusions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Food Inclusions Market report:

The North America Food Inclusions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Food Inclusions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Food Inclusions Market value chain can benefit from the information contained in a comprehensive market report.