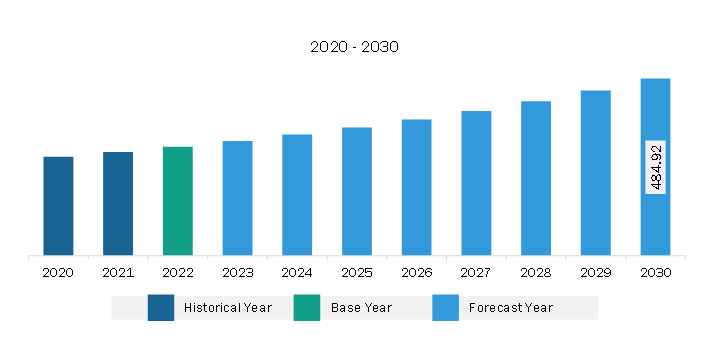

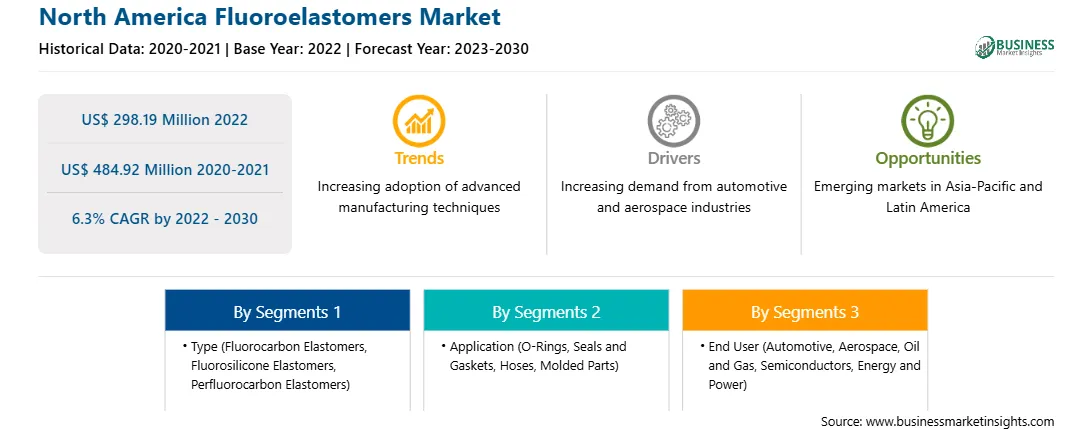

The North America fluoroelastomers market is expected to grow from US$ 298.19 million in 2022 to US$ 484.92 million by 2030. It is estimated to register a CAGR of 6.3% from 2022 to 2030.

Fluoroelastomers are used in a wide range of applications in the automotive industry. It is used in fuel system components, seals, gaskets, and hoses due to its high resistance to heat, chemicals, and fuels. According to a report published by the ACEA, global passenger car production accounted for 68 million units in 2022, a rise of 7.9% compared to 2021. According to the report released by the European Automobile Manufacturers' Association (ACEA) in January 2023, car production in North America increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021.

Further, major automotive companies are strengthening their production capacities and emphasizing advancement in automotive technologies. Automotive manufacturers focus on decreasing the size of powertrains, engines, and engine compartments to reduce fuel consumption, in addition to the development of electric vehicles. The advancement in air management systems increases the temperature of components and exposes them to corrosive fluids and fumes. The heat and chemical-resistant properties of fluoroelastomers offer a wide range of applications in fuel systems, air management systems, and electric vehicle systems. Thus, the rising demand for high-performance materials in the automotive industry drives the fluoroelastomers market.

In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. Fluoroelastomers are known for their exceptional resistance to heat, chemicals, and fuels, making them ideal for critical components like gaskets, seals, and hoses. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022. As the automotive industry continues to evolve and innovate, these high-performance materials are increasingly in demand, contributing to market growth.

According to the International Energy Agency, electric car sales accounted for 630,000 in 2021. In addition, according to the International Energy Agency, between August 2022 (when the Inflation Reduction Act was passed) and March 2023, major electric vehicle and battery makers announced investments totaling a minimum of US$ 52 billion in electric vehicle supply chains in North America. Fluoroelastomers are employed in the manufacturing of critical components in battery systems and electric powertrains. These components often operate at high temperatures and come into contact with aggressive chemicals. Fluoroelastomers are highly resilient in such conditions, ensuring the longevity and safety of EV systems. Their ability to provide robust seals and gaskets for battery enclosures, connectors, and various electrical connections are vital in maintaining the reliability and safety of electric vehicles. The increasing investment from major players, such as General Motors and Tesla, Inc., in the region is boosting the market growth.

Foreign automotive manufacturers are expected to be involved in a part of the mainstream automotive industry in North America to increase their market share, which is expected to benefit the demand for fluoroelastomers.

Furthermore, fluoroelastomers are valued for their ability to perform under extreme conditions, making them essential for critical applications in the aerospace industry. Governments of various countries in North America have significantly invested in technology and research programs in the aerospace sector. For instance, according to the USAFacts, ~41% of federal transportation and infrastructure spending was on highway transportation, and 19% was for rail and mass transit in 2021. The region is a hub for a few major aircraft manufacturing companies, such as Raytheon Technologies Corporation, The Boeing Company, and The Lockheed Martin Corporation. Therefore, the growing aerospace manufacturing in the region is expected to boost the fluoroelastomers market growth.

Strategic insights for the North America Fluoroelastomers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 298.19 Million |

| Market Size by 2030 | US$ 484.92 Million |

| Global CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Fluoroelastomers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America fluoroelastomers market is segmented into type, application, end user, and country.

Based on type, the North America fluoroelastomers market is segmented into fluorocarbon elastomers, fluorosilicone elastomers, and perfluorocarbon elastomers. The fluorocarbon elastomers segment held the largest share of the North America fluoroelastomers market in 2022.

In terms of application, the North America fluoroelastomers market is categorized into O-rings, seals and gaskets, hoses, molded parts, and others. The O-rings segment held the largest share of the North America fluoroelastomers market in 2022.

By end user, the North America fluoroelastomers market is segmented into automotive, aerospace, oil and gas, semiconductors, energy and power, and others. The automotive segment held the largest share of the North America fluoroelastomers market in 2022.

Based on country, the North America fluoroelastomers market is categorized into the US, Canada, and Mexico. The US dominated the North America fluoroelastomers market in 2022.

3M Company, AGC Inc, Daikin Industries Ltd, Eagle Elastomer Inc, Gujarat Fluorochemicals Ltd, Shin-Etsu Chemical Co Ltd, Solvay SA, and The Chemours Co are some of the leading companies operating in the North America fluoroelastomers market.

1. 3M Company

2. AGC Inc

3. Daikin Industries Ltd

4. Eagle Elastomer Inc

5. Gujarat Fluorochemicals Ltd

6. Shin-Etsu Chemical Co Ltd

7. Solvay SA

8. The Chemours Co

The North America Fluoroelastomers Market is valued at US$ 298.19 Million in 2022, it is projected to reach US$ 484.92 Million by 2030.

As per our report North America Fluoroelastomers Market, the market size is valued at US$ 298.19 Million in 2022, projecting it to reach US$ 484.92 Million by 2030. This translates to a CAGR of approximately 6.3% during the forecast period.

The North America Fluoroelastomers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Fluoroelastomers Market report:

The North America Fluoroelastomers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Fluoroelastomers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Fluoroelastomers Market value chain can benefit from the information contained in a comprehensive market report.