Chemical processes involve additives and corrosive chemicals such as hydrochloric acid, phenol, toluene, ethyl acetate, acetone, and ethylene dichloride. Exposure to such chemicals and additives can reduce the service life of conventional pipes made of steel, metal, plastics, or other materials. Also, conventional pipes are coated with titanium to impart chemical resistance to the pipe, but this is an expensive option. Thus, solvent-resistant and cost-effective resin systems are selected to develop fiberglass pipes for chemical applications.

According to the Office of Energy Efficiency & Renewable Energy (the US Department of Energy), the US marks the operational presence of ∼2,574.9 km of hydrogen pipelines located in petroleum refineries and chemical facilities, among others. The department highlights research on technical concerns of hydrogen pipeline infrastructure and potential solutions, including the utilization of fiberglass pipes for hydrogen transmission. The installation costs of fiberglass pipelines are 20% lower than steel pipelines. In 2021, the operation of the EPIC Ethylene project was commenced, collectively owned by EPIC Consolidated Operations LLC, Chevron Corporation, and Salt Creek Midstream LLC. The 247 km pipeline project aimed at the transmission of ethylene in the US. Therefore, the rising demand for fiberglass pipes in the chemical industry is fueling the fiberglass pipes market.

The US, Canada, and Mexico are the major countries in North America. The region has a massive network of inter and intrastate pipelines that serve an important role in transporting water, hazardous liquids, and raw materials. According to the Pipeline and Hazardous Materials Safety Administration, in North America, approximately 2.6 million miles of pipelines deliver hundreds of billions of tons of liquid petroleum products and trillions of cubic feet of natural gas yearly. Per the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. In 2020, Canada exported 82% of the crude oil it produced. In North America, the oil & gas industry requires higher-pressure rated and larger diameter piping to control challenges related to corrosion caused by contamination of water with salt, sulfur, and other corrosive elements in produced fluid lines. The flame retardant and noncorrosive characteristics of fiberglass pipes provide an effective solution for these issues. Thus, with growing oil & gas production, the demand for fiberglass pipes is rising in North America. Countries such as the US and Canada use pipelines to transport crude oil to refineries in the region as other transport medium such as rail is more expensive than pipeline and tanker.

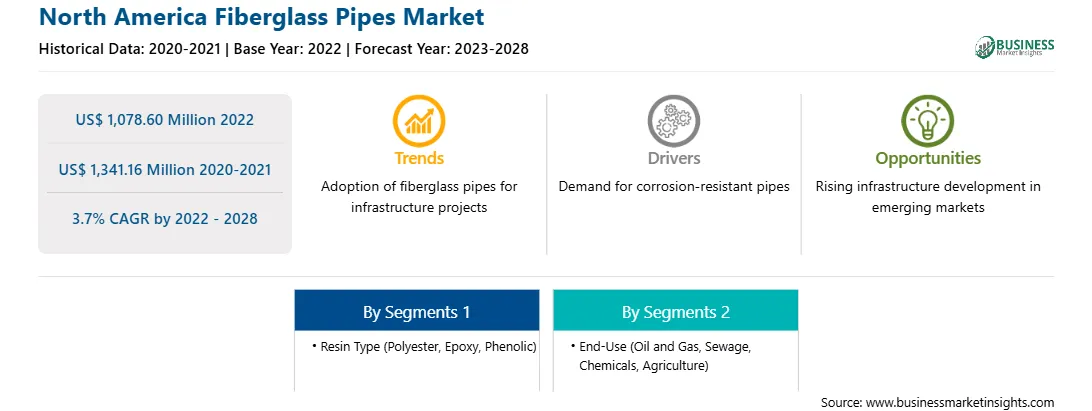

The North America fiberglass pipes market is segmented into resin type, end user, and country.

Based on resin type, the North America fiberglass pipes market is segmented into polyester, epoxy, phenolic, and others. The polyester segment held a largest North America fiberglass pipes market share in 2022.

Based on end use, the North America fiberglass pipes market is segmented into oil and gas, sewage, chemicals, agriculture, and others. The oil and gas segment held the largest North America fiberglass pipes market share in 2022.

Based on country, the North America fiberglass pipes market has been categorized into the US, Canada, and Mexico. The US dominated the North America fiberglass pipes market in 2022.

Amiblu Holding GmbH, Chemical Process Piping Pvt Ltd, EPP Composites Pvt Ltd, Fibrex FRP Piping Systems, Future Pipe Industries LLC, NOV Inc, Sunrise Industries (India) Ltd, Poly Plast Chemi Plants (I) Pvt Ltd, and Plasticon Germany GmbH are some of the leading companies operating in the North America fiberglass pipes market.

Strategic insights for the North America Fiberglass Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,078.60 Million |

| Market Size by 2028 | US$ 1,341.16 Million |

| Global CAGR (2022 - 2028) | 3.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Fiberglass Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Fiberglass Pipes Market is valued at US$ 1,078.60 Million in 2022, it is projected to reach US$ 1,341.16 Million by 2028.

As per our report North America Fiberglass Pipes Market, the market size is valued at US$ 1,078.60 Million in 2022, projecting it to reach US$ 1,341.16 Million by 2028. This translates to a CAGR of approximately 3.7% during the forecast period.

The North America Fiberglass Pipes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Fiberglass Pipes Market report:

The North America Fiberglass Pipes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Fiberglass Pipes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Fiberglass Pipes Market value chain can benefit from the information contained in a comprehensive market report.