This research report on the “Fiber optic sensor Market” provides a holistic view of the market size across major regions. The report further elucidates the key driving factors, restraints, growth opportunities, and future trends pertaining to the market growth.

Moreover, the surging applications in oil & gas sector is expected to bolster the market growth during the forecast period.

According to the American Institute of Architects (AIA), the construction sector in the US has been hit hard by the COVID-19 outbreak. The construction activity declined in 2020 and the trend is prevailing in the 2021. The construction activities are declined by approximately 20% which negatively impacted the fiber optic sensor market. The oil & gas industries that install higher volumes of sensors have been hit at various levels of degree by the COVID-19 pandemic. The Canadian and Mexican fiber optic sensor market also witnessed and are experiencing similar tremors owing the widespread of COVID-19 virus. The infrastructure and power & utilities sector in the two countries have been witnessing significant shocks. Apart from oil & gas and manufacturing sector in Canada and Mexico also observed decline in sales owing to the concerns over rapid spread of the virus under cooler environments.

Strategic insights for the North America Fiber Optic Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

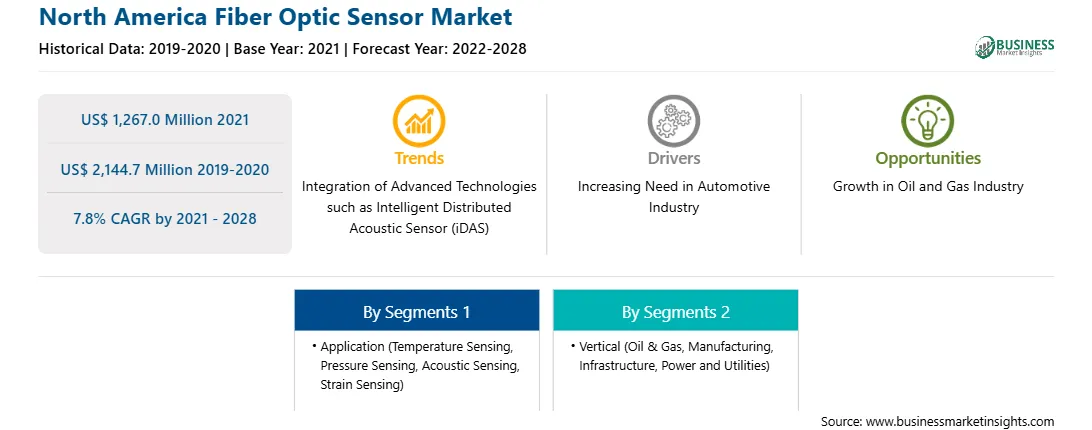

| Market size in 2021 | US$ 1,267.0 Million |

| Market Size by 2028 | US$ 2,144.7 Million |

| Global CAGR (2021 - 2028) | 7.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Fiber Optic Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America fiber optic sensor market is projected to reach US$ 2,144.7 million by 2028 from US$ 1,267.0 million in 2021; it is anticipated to grow at a CAGR of 7.8% from 2021 to 2028. Various governments are taking initiatives to propel the development of smart cities in their respective economies. In March 2021, Optromix, Inc. announced fiber optic sensors that can be installed as a component of smart transport. The company is engaged in providing intelligent traffic analysis and route planning services in large cities. These services are based on fiber optic solutions for the collection and processing of vehicle movement data. Thus, the growth in such efforts to develop smart cities are providing significant opportunities for the growth of the fiber optic sensor market players.

In terms of vertical, the oil & gas segment accounted for the largest share of the North America fiber optic sensor market in 2020. Further, based on application, the temperature sensing segment held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the fiber optic sensor market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AOMS Technologies, Davidson Instruments, Omnisens SA, Solifos AG, Baumer Holding AG, Keyence Corporation, OMRON Corporation, Luna Innovations Inc., SICK AG, and Yokogawa Electric Corporation.

By Vertical

By Application

By Country

US

Canada

Mexico

The North America Fiber Optic Sensor Market is valued at US$ 1,267.0 Million in 2021, it is projected to reach US$ 2,144.7 Million by 2028.

As per our report North America Fiber Optic Sensor Market, the market size is valued at US$ 1,267.0 Million in 2021, projecting it to reach US$ 2,144.7 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The North America Fiber Optic Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Fiber Optic Sensor Market report:

The North America Fiber Optic Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Fiber Optic Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Fiber Optic Sensor Market value chain can benefit from the information contained in a comprehensive market report.