Developments in technology across North America have contributed to a highly competitive market for all industries. The region is characterized by the presence of key global manufacturing companies having production plants in the region and the strong economy of the countries. Thus, the region is highly industrialized and offers a wide range of industrial work including fiber laser application for the marking, engraving, cutting, molding, pressing, welding, and micro processing of industrial hardware. The aerospace industry—which comprises commercial airlines, military jets, private jets, transportation jets, and spacecraft—has an extensive applications of fiber laser work, such as drilling and welding together different kinds of metals to create various parts of aircraft body. North America hosts a large number of fiber laser suppliers, who are engaged in providing fiber laser solutions to aerospace manufacturers. For instance, nLIGHT, Inc. is a world Leader in optical and fiber laser solution. Similarly, Coherent, Inc., provides fiber laser solutions for the defense and aerospace sector. In addition, Coherent, Inc. offers fiber laser solutions to a wide range of sectors including semiconductor manufacturers, medical device manufactures, and E-Mobility companies. Thus, North America is characterized with the presence of key market players of fiber laser market. Factors such as continuous technological advancements, high beam quality and lower cost of ownership, and eco-friendly technology are impelling companies from many industries to shift from CO2 laser system to fiber laser cutting system in North America.

In case of COVID-19, North America is among the worst-hit regions by the pandemic. The US, Canada, and Mexico have witnessed a significant rise in the number of COVID-19 infected patients. This led the governments to impose lockdowns to limit human movement; as a result, manufacturing facilities have been reporting lower than usual production volumes, which has had severe impacts on production, and subsequently, it has negatively impacted the demand for fiber laser solutions in the North American region. The US reported a decline in the production and other activities in electronics and automotive industries along with the reduction in FDIs, which also interrupted other industries’ trade. As the US is a home to the manufacturing of semiconductor equipment, the pandemic has caused a slump in the electronics and semiconductor sector’s growth, thereby limiting the scope of fiber laser application in the manufacturing industries. However, the region is reviving its economy with eased lockdown norms, which is gradually helping manufacturing industries to resume their business. This, in turn, expected to increase the demand of fiber laser solutions in the upcoming years.

Strategic insights for the North America Fiber Laser provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

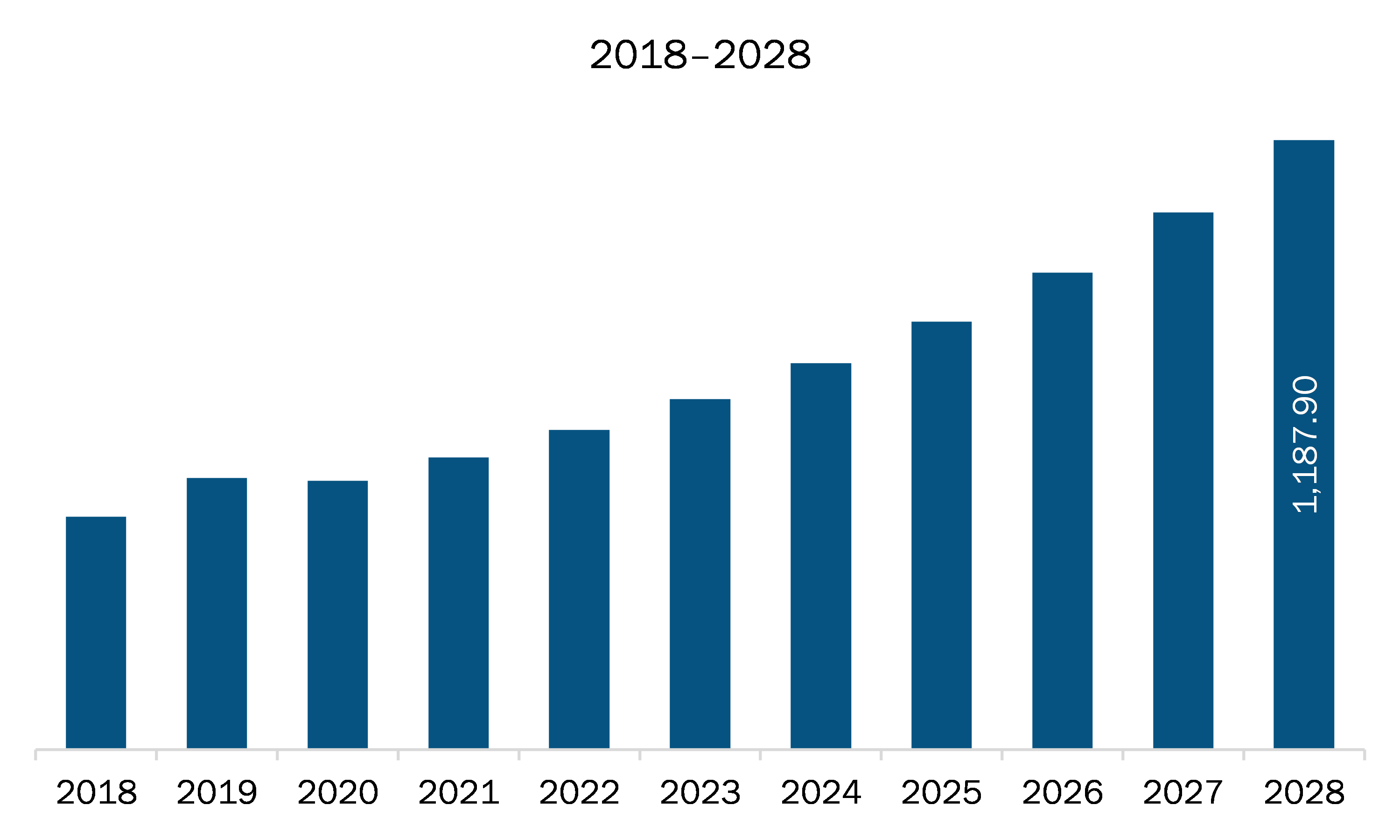

| Market size in 2021 | US$ 569.54 Million |

| Market Size by 2028 | US$ 1,187.90 Million |

| Global CAGR (2021 - 2028) | 11.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Fiber Laser refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America fiber laser market is expected to grow from US$ 569.54 million in 2021 to US$ 1,187.90 million by 2028; it is estimated to grow at a CAGR of 11.1% from 2021 to 2028. The increasing cutting applications (flat sheet cutting, tube cutting, and 3D cutting) of the fiber laser systems in several areas, including aerospace (high-strength components which can withstand the pressures of outer space), military, and in other sectors for manufacturing multiple equipment, is creating a huge growth opportunity for the North America fiber lasers market. Fiber lasers can be used in cutting silicon for solar cells & semi-conductors, cutting parts to shape in manufacturing & industrial settings, cutting stents for the medical industry, and cutting of gems for use in the jewelry industry. Further, fiber lasers are used for cutting of stator plates and battery foils in automotive industry. Moreover, the rapid industrialization across the region has increased the demand for pulsed fiber lasers in cutting application to replace conventional methods such as ink-based printing and chemical etching, which is anticipated to fuel the growth of North America fiber laser market. There is an increase in demand for fiber lasers in cutting applications due to much less power consumption than traditional cutting techniques and waste of much less material. Moreover, the whole laser cutting process is non-contact that will reduce the downtime and increase the profits due to less risk of personal injuries, no wear and tear of moving parts, and no material damage due to contact. Thus, the wide use of fiber lasers for cutting applications in multiple areas is creating huge growth opportunities for the fiber laser providers across North America region.

In terms of type, the infrared fiber laser segment accounted for the largest share of North America fiber laser market in 2020. In terms of application, the high power cutting and welding segment held a larger market share of the North America fiber laser market in 2020.

A few major primary and secondary sources referred to for preparing this report on North America fiber laser market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Coherent, Inc.; Convergent Photonics; Fujikura Ltd.; IPG Photonics Corporation; Jenoptik AG; Maxphotonics Co,.Ltd; nLIGHT, Inc.; TRUMPF GmbH + Co. KG; and Wuhan Raycus Fiber Laser Technologies Co., Ltd.

The North America Fiber Laser Market is valued at US$ 569.54 Million in 2021, it is projected to reach US$ 1,187.90 Million by 2028.

As per our report North America Fiber Laser Market, the market size is valued at US$ 569.54 Million in 2021, projecting it to reach US$ 1,187.90 Million by 2028. This translates to a CAGR of approximately 11.1% during the forecast period.

The North America Fiber Laser Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Fiber Laser Market report:

The North America Fiber Laser Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Fiber Laser Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Fiber Laser Market value chain can benefit from the information contained in a comprehensive market report.