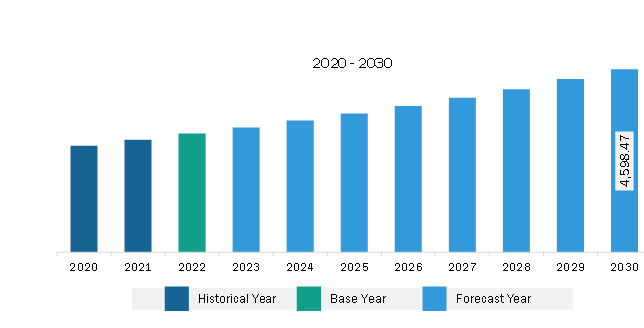

The North America feed premix market was valued at US$ 2,988.27 million in 2022 and is expected to reach US$ 4,598.47 million by 2030; it is estimated to grow at a CAGR of 5.5% from 2022 to 2030.

The feed fortification with premixes is linked to an improvement in animal health and welfare. Animal feed are fortified with vitamins, minerals, amino acids, antioxidants, antibiotics, etc. The high prevalence of micronutrient deficiency diseases among livestock boosts the demand for fortified feed which results to increase in adoption of premixes. Feed fortification helps increase the strength of bone and decrease the mortality of animals. Feed fortified with minerals is beneficial in treating bone fractures in livestock. Feed fortified with amino acids helps grow performance and increase the immunity of livestock. The addition of amino acids boosts metabolism and makes the feed highly nutritious. Moreover, the feed conversion rate is significantly increased by fortification, which is helpful in the optimization of production costs.

Additionally, antibiotics, acidifiers, antioxidants, vitamins, minerals, amino acids, binders, and enzymes are a few of the most popular types of premixes used for feed fortification. The growing demand for these premixes due to the health benefits associated with each premix drives the North America feed premix market. Moreover, owing to the rising awareness about feed fortification, key market players are adopting strategies for fortification. For instance, in November 2022, DSM revised Optimum Vitamin Nutrition (OVN) guidelines for vitamin fortification among all animal species to achieve peak health and performance of livestock.

North America is one of the significant markets for feed premix due to the increased demand for premixes as a feed additive, rise in meat consumption, changes in weather conditions, increase in consumption of livestock products despite the rising prices, and well-established animal feed and agriculture industries. Increasing number of individuals opting for protein-rich and healthier products, growing disposable income, and changing lifestyles and eating patterns contribute to a surge in demand for protein-rich meat in the US, Canada, and Mexico. Thus, with the rising consumption of meat products, the demand for animal feed increases and further drives the market for feed premix. As per the report of Alltech Global, in 2020, the region produced more than 254 million metric tons of animal feed products. The mass production of animal feed in North America and the rise in food safety concerns, especially about meat and dairy products, have led to the increased consumption of nutritional animal feed infused with various nutrients in the form of feed premix in the region. The significant rise in cattle farming in North America is also expected to drive the demand for animal feed during 2022-2030. This significant rise is attributed to the rising demand for fresh meat products, which has soared the import of cattle stock. Further, as per the report of the United States Department of Agriculture (UDSA), in 2021, North America recorded over 114 million cattle stock and over 109 million pig stock. Thus, the increasing cattle stock and demand for healthy animal feed additives such as feed premix is expected to boost the market share in the region. Moreover, governments are taking initiatives and providing funding to maintain or increase animal stock. For instance, the Government of Canada has introduced Pig SAFE (a food safety and biosecurity program) and Pig CARE (an animal care program) to provide hogs with healthy animal feed and prevent them from African swine fever. Under this program, the Canadian Government has announced more than US$ 3.8 million in funds to allocate throughout the country. These factors are expected to drive the North America feed premix market growth in the region.

Strategic insights for the North America Feed Premix provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,988.27 Million |

| Market Size by 2030 | US$ 4,598.47 Million |

| Global CAGR (2022 - 2030) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Feed Premix refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America feed premix market is segmented based on type, form, livestock, and country.

Based on type, the North America feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. The blends segment held the largest share in 2022.

By form, the North America feed premix market is bifurcated into dry and liquid. The dry segment held a larger share in 2022.

In terms of livestock, the North America feed premix market is categorized into research poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest share in 2022.

Based on country, the North America feed premix market is segmented into the US, Canada, and Mexico. The US dominated the North America feed premix market in 2022.

Agrifirm Group BV, Archer-Daniels-Midland Co, Cargill Inc, De Heus Voeders BV, Kemin Industries Inc, Koninklijke DSM NV, and Nutreco NV are some of the leading companies operating in the North America feed premix market.

1. Agrifirm Group BV

2. Archer-Daniels-Midland Co

3. Cargill Inc

4. De Heus Voeders BV

5. Kemin Industries Inc

6. Koninklijke DSM NV

7. Nutreco NV

The North America Feed Premix Market is valued at US$ 2,988.27 Million in 2022, it is projected to reach US$ 4,598.47 Million by 2030.

As per our report North America Feed Premix Market, the market size is valued at US$ 2,988.27 Million in 2022, projecting it to reach US$ 4,598.47 Million by 2030. This translates to a CAGR of approximately 5.5% during the forecast period.

The North America Feed Premix Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Feed Premix Market report:

The North America Feed Premix Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Feed Premix Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Feed Premix Market value chain can benefit from the information contained in a comprehensive market report.