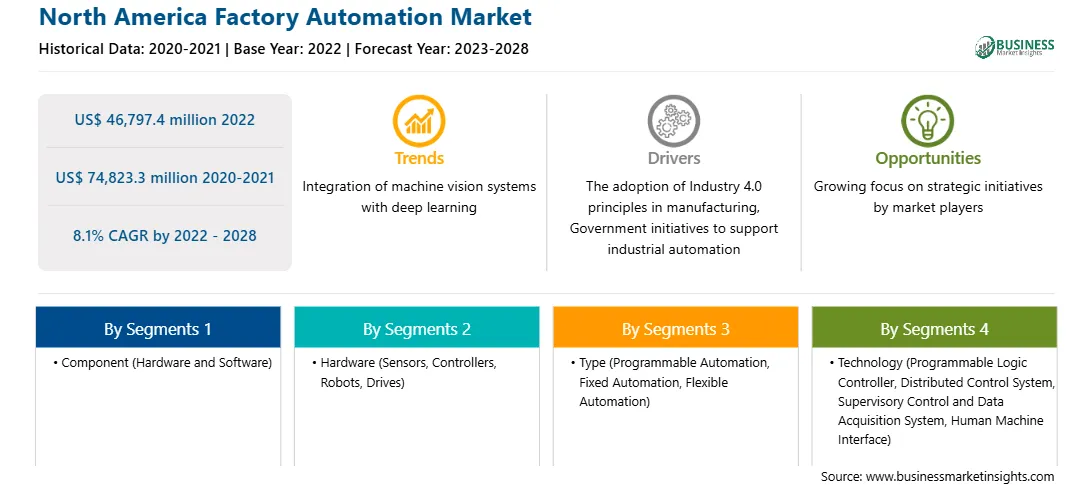

The North America factory automation market is expected to grow from US$ 46,797.4 million in 2022 to US$ 74,823.3 million by 2028; it is estimated to grow at a CAGR of 8.1% from 2022 to 2028.

Market Introduction

Automation frequently uses hydraulic, pneumatic, and robotic arms in production process to build complicated systems. It helps enhance outputs and efficiency while lowering costs in competitive environment. Its use also reduces human operators' risks when handling hazardous equipment. Factory automation uses computer software to control machinery and processes, which replace human beings in performing specific function. The factory automation industry in North America has been revolutionized by combining the digital and physical aspects of manufacturing.

In recent years, the oil & gas industry has been witnessing the heavy implementation of factory automation solutions across upstream, midstream, and downstream processes. The component provider offers connectivity hardware, sensors, and microchips to various factory automation OEMs. Factory automation OEMs play a crucial role in the ecosystem by developing advanced factory automation, such as AI and IoT-based factory automation solutions. These are offered to system integrators, which create a communication link between automated systems that allow plant equipment to communicate efficiently with operators and other machinery. One of the most common types of system integration is a supervisory control and data acquisition (SCADA), as it combines software and hardware elements to allow companies to control and monitor their factory processes on cloud or on-premises.

The US accounted for the largest share of the North America factory automation market size in 2021. The market growth in the region is attributed to the rise in investments by several industry verticals across the country to automate manufacturing processes. Manufacturing, automotive, and food & beverages are among the major industries across the region investing in automating their production plants. In July 2022, PepsiCo announced its intentions to build a 152-acre automated production facility in Denver, which is expected to be operational from September 2023. Similarly, over the years, Nestle has adopted several automated solutions for manufacturing, packing, and assembling its products. Such investments are expected to propel the demand for factory automation solutions across the country in the coming years. Moreover, the increasing government initiative across the country to promote the adoption of automation across production facilities through various incentive schemes, such as Quality Jobs Tax Credit and Qualified Facility for Refundable Tax Credits, is further expected to boost the US factory automation market growth during the forecast period.

Market Overview and Dynamics

The mining industry is adopting automation for the continuous ore supply to the third party, high efficiency, easy transport, and metal extraction improvements to make business profitable. .

Factory automation systems have gradually reduced the role of a miner in the pit and provided a safe work environment for the operator. Also, it offers real-time information and data on mining operations, thereby helping them analyze the overall mining process, make mining process visible, and gain full control of their fleets. Automation also helps reduce capital and labor costs and improve energy efficiency. According to the case study by Telefonaktiebolaget LM Ericsson, by using automation for drilling and blasting, ~US$ 2.48 million were saved annually at the Aitik mine alone. These factors are expected to fuel the demand for automation solutions in the mining industry, thereby contributing to the growth of the factory automation market in North America.

Key Market Segments

Based on type, the North America factory automation market size is segmented into programmable automation, fixed automation, and flexible automation. The rising adoption of Industry 4.0 and IoT-enabled smart technologies has raised the demand for factory automation. The fixed automation segment led the market in 2021. The market growth for this segment is attributed to the rising demand for fixed automation solutions in many industries, including automotive and chemicals. However, the flexible automation segment is expected to register the highest CAGR over the forecast period. Flexible automation is majorly used across manufacturing assembly plants. It is highly adopted across the electronics industry, where flexible machines are used to manufacture printed circuit boards with integrated circuits and other components. The automotive industry is also increasingly adopting flexible automation technology owing to the increased complexity in car manufacturing like rise in integration of smart components and electronics. Thus, the increasing car manufacturing volume across North America bolsters the demand for flexible automation, which would drive the factory automation market growth for the segment during the forecast period.

Mexico has experienced a rise in investment in its manufacturing sectors, especially automotive. The major automotive manufacturers operating across Mexico include Volkswagen, Ford, Toyota, Nissan, Volvo Trucks, Scania, Honda, Isuzu, and Kenworth. The rising investment by these companies in adopting robots across their manufacturing plants is contributing to the growth of the market. Additionally, automotive component manufacturers across the region are investing in integrating robotics across their plants. For instance, Lear, an automotive component manufacturer, has integrated robotics in its Mexico plant to drill the bases of vehicle seats where they are installed. Such factors are driving the Mexico factory automation market size. Additionally, the implementation of the trade agreement in June 2020 between the US, Mexico, and Canada has further boosted the manufacturing sector of Mexico, thereby fueling the Mexico factory automation market share.

Major Sources and Companies Listed

ABB LTD.; Emerson Electric Co.; FANUC; General Electric Company; Honeywell International Inc.; Mitsubishi Electric Corporation; Omron Corporation; Robert Bosch GmbH; Rockwell Automation, Inc.; and Siemens AG are among the top companies operating in the North America factory automation market. Various other companies operating in the factory automation market are coming up with new technologies and offerings, which is helping the market to expand.

Reasons to buy report

Strategic insights for the North America Factory Automation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 46,797.4 million |

| Market Size by 2028 | US$ 74,823.3 million |

| Global CAGR (2022 - 2028) | 8.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Factory Automation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Factory Automation Market is valued at US$ 46,797.4 million in 2022, it is projected to reach US$ 74,823.3 million by 2028.

As per our report North America Factory Automation Market, the market size is valued at US$ 46,797.4 million in 2022, projecting it to reach US$ 74,823.3 million by 2028. This translates to a CAGR of approximately 8.1% during the forecast period.

The North America Factory Automation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Factory Automation Market report:

The North America Factory Automation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Factory Automation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Factory Automation Market value chain can benefit from the information contained in a comprehensive market report.