North America Facility Management Solution Market

No. of Pages: 122 | Report Code: TIPRE00026776 | Category: Technology, Media and Telecommunications

No. of Pages: 122 | Report Code: TIPRE00026776 | Category: Technology, Media and Telecommunications

Market Introduction

Facility management is described by the International Facility Management Association (IFMA) as the process of integrating a physical workplace with an organization's people and work, which includes tasks such as equipment maintenance, space planning, and portfolio forecasting. Emergency preparedness & business continuity, environmental sustainability, human aspects, communication, project management, quality, real estate & property management, leadership & strategy, and others are all part of facility management.

Strategic insights for the North America Facility Management Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Facility Management Solution refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Facility Management Solution Strategic Insights

North America Facility Management Solution Report Scope

Report Attribute

Details

Market size in 2021

US$ 349.0 Million

Market Size by 2028

US$ 624.29 Million

Global CAGR (2021 - 2028)

8.7%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Component

By Deployment

By Enterprise Size

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Facility Management Solution Regional Insights

Market Overview and Dynamics

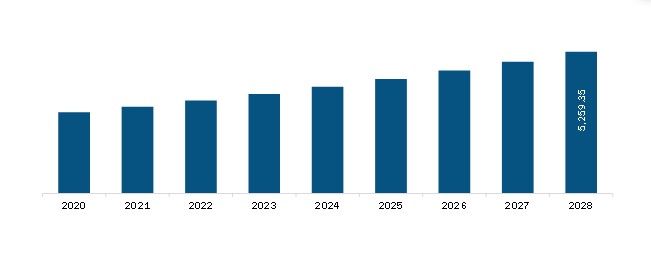

The North America facility management solution market is expected to reach US$ 624.29 million by 2028 from US$ 349.0 million in 2021; it is estimated to grow at a CAGR of 8.7% from 2021 to 2028. Factors such as growing infrastructure sector across North America and better management, productivity, and efficiency with multiple facility management solutions compared to conventional solutions propel the growth of the market. However, the lack of awareness and standardization about facility management solutions hamper the market growth.

Governments across the world invest in infrastructure growth. For instance, as per the Department for Promotion of Industry and Internal Trade, FDIs in the construction development sector (townships, housing, built-up infrastructure, and construction development projects) and construction activities stood at US$ 26.14 billion and US$ 25.38 billion, respectively, between April 2000 and June 2021. In FY2021, infrastructure activities accounted for a 13% share of the total FDI inflows of US$ 81.72 billion. Also, there are several investments observed in the construction of railways, ports, and airports. Significant growth in the real estate sector due to rising focus on a safe, clean, and secure environment is one of the primary factors bolstering the growth of the facility management solution market. Additionally, the growing concept of a green building along with the enactment of the Real Estate (Regulation and Development) Act 2016, which protects home buyers and helps boost the real estate sector, stimulates the market growth. In addition, the booming information technology industry and the growing popularity of e-commerce platforms propel the need for infrastructure and organized spaces, which also fuels the market growth. Apart from this, several companies are using AI (artificial intelligence) and IoT (internet of things) technologies to automate facility management services for energy efficiency audits. Furthermore, the post-pandemic rising emphasis on hybrid workspaces and return-to-the-workplace strategies augment the demand for facility management services to maintain safety and productivity in companies across the region. Therefore, the growing infrastructure sector across North America propels the demand for facility management solutions.

The North America facility management solution market suffered considerable economic losses in the first two quarters of 2020, owing to the high count of COVID-19 positive cases, especially in the US. The economic growth was slowed, which negatively impacted the logistics and supply chain across the region. The COVID-19 pandemic has resulted in economic turmoil owing to subsequent lockdowns. The increasing awareness of clients and rising need for maintenance and security management are expected to drive the North America facility management solution market growth in the coming years. Moreover, governments in the region are investing in facility management services to make the containment zones COVID-19 free. Further, market players are offering end-to-end facility management services to businesses and government sectors, allowing them to work efficiently in restricted areas. Hence, the contribution of facility management service providers during the COVID-19 pandemic boosts the government-initiated schemes for combating the virus spread across North America. Therefore, the market in North America is experiencing a positive impact during the COVID-19 outbreak.

Key Market Segments

Based on component, the North America facility management solution market is bifurcated into software and services. The software segment held a larger market share in 2020 and is estimated to register a higher CAGR in the market during the forecast period.

Based on deployment, the North America facility management solution market is bifurcated into on-premise and cloud-based. The cloud-based segment led the market with a larger share in 2020 and is expected to register a higher CAGR during 2021–2028.

Based on enterprise size, the North America facility management solution market is bifurcated into small and medium enterprises and large enterprises. The large enterprises segment is likely to hold a larger share of the market in the coming years. Moreover, the same segment is expected to register a higher CAGR from 2021 to 2028.

Based on application, the North America facility management solution market is segmented into government, retail, pharmaceuticals, BFSI, transportation and logistics, IT and telecom, manufacturing, and others. The IT and telecom segment held the largest share of the market and is expected to register the highest CAGR during the forecast period.

Major Sources and Companies Listed

A few of the market players associated with the report on the North America facility management solution market are Quickbase, Inc.; Infraspeak; and IBM Corporation.

Reasons to buy the report

NORTH AMERICA FACILITY MANAGEMENT SOLUTION MARKET SEGMENTATION

By Component

By Deployment

By Enterprise Size

By Application

By Country

Company Profiles

The North America Facility Management Solution Market is valued at US$ 349.0 Million in 2021, it is projected to reach US$ 624.29 Million by 2028.

As per our report North America Facility Management Solution Market, the market size is valued at US$ 349.0 Million in 2021, projecting it to reach US$ 624.29 Million by 2028. This translates to a CAGR of approximately 8.7% during the forecast period.

The North America Facility Management Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Facility Management Solution Market report:

The North America Facility Management Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Facility Management Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Facility Management Solution Market value chain can benefit from the information contained in a comprehensive market report.