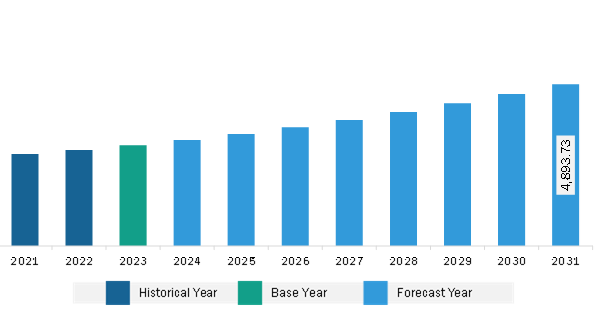

The North America explosion proof equipment market was valued at US$ 3,046.17 million in 2023 and is expected to reach US$ 4,893.73 million by 2031; it is estimated to register a CAGR of 6.1% from 2023 to 2031.

Explosion-proof equipment plays a crucial role in the oil & gas industry. In this industry, flammable liquids, gases, vapors, or combustible dust exist in sufficient quantities; hence, the safety of workers is the top priority. Generally, refineries, oil plants, and offshore facilities are constantly exposed to flammable substances. Manufacturers produce and rigorously test explosion-proof assets to combat the high possibility of ignition. For instance, in November 2023, Mitsubishi Heavy Industries, Ltd. (MHI) carried out autonomous inspections at a refinery using the "ASCENT," a second-generation "EX ROVR" plant inspection robot with explosion-proof features currently under joint development with ENEOS Corporation.

The use of explosion-proof equipment in oil and gas refineries has aided in reinforcing safety measures for unpredictable work environments. Dangerous compounds in oil and gas facilities indicate several safety challenges for the workers. For instance, hydrocarbon processing, including ethane, fossil fuels, methane, and propane, is a critical process that needs to be carried out under stable atmospheres. Additionally, the increasing number of upcoming oil and gas plants in various countries is fueling the requirement for explosion-proof equipment. For instance, in May 2024, Canada’s oil and natural gas production hit record-high levels, and the country is amplifying its status as a global oil and natural gas superpower. This expansion of oil production and crude transportation capacities comes simultaneously while Canada is trying to ramp up its natural gas sector. The first phase of the LNG Canada liquified natural gas export facility, the largest private investment in Canadian history, is now reaching completion in Kitimat, British Columbia. The project is expected to fully start in 2025.

Several companies are engaged in increasing oil production. For instance, the International Monetary Fund expects OPEC and its partners to gradually increase oil production from July 2024. Therefore, with the growth of the oil & gas industry, the demand for explosion-proof equipment is also rising to ensure the safety of all operators and workers working in oil and gas plants.

The North America explosion-proof equipment market consists of several countries, including the US, Canada, and Mexico. In North America, countries such as the US and Canada are known for adopting advanced technologies, high standards of living, and developed infrastructure. High disposable incomes and technological advancements have been propelling the growth of the explosion-proof equipment market as every type of industry, either SMEs or large enterprises, is focusing on deploying explosion-proof equipment in their factories. North America is expected to dominate the explosion-proof equipment market as it has the highest number of manufacturers and oil & gas fields. For instance, according to the National Association of Manufacturers, manufacturers in the US accounted for 10.70% of the total output in the country, employing 8.41% of the workforce. Total output from manufacturing was US$ 2.5 trillion in 2021.

Canada’s total refining capacity is approximately 2 million bpd. New clean fuel regulations established by the Canadian federal government require an increasing number of refiners to reach net-zero emissions by 2050. Due to this, various companies in the region are announcing investments in oil and gas plant facilities. For instance, in January 2023, Imperial Oil announced that it was investing US$ 527 million to build the largest renewable diesel facility in Canada. Initial production has already begun at Imperial’s Strathcona refinery near Edmonton, Alberta. When the module is commissioned in 2025, it will be able to produce 20,000 bpd from a feedstock of locally sourced canola and soy, as well as blue hydrogen. Tidewater Renewables invested US$ 315 million to build Canada’s first stand-alone renewable diesel refinery. The plant, located in Prince George, British Columbia, entered production in mid-2023. With the growth of manufacturing and oil & gas industries in the region, the need to employ a larger number of workers and operators and maintain their safety in the factories is also increasing. Furthermore, in North America, the water and wastewater industry is growing as the governments in the countries are investing in this industry. For instance, in September 2023, the governments of Canada and British Columbia, alongside the municipalities of Burns Lake, Fraser Lake, and the District of Mackenzie, are investing over US$ 10 million into three transformative water and wastewater projects. These initiatives are poised to bring cleaner and more dependable municipal services to the region, marking a crucial step in infrastructure enhancement. Hence, there is an increased demand for explosion-proof equipment in the above industries, which is driving the explosion-proof equipment market is growth in North America.

Strategic insights for the North America Explosion-Proof Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Explosion-Proof Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Explosion-Proof Equipment Strategic Insights

North America Explosion-Proof Equipment Report Scope

Report Attribute

Details

Market size in 2023

US$ 3,046.17 Million

Market Size by 2031

US$ 4,893.73 Million

Global CAGR (2023 - 2031)

6.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Systems

By Protection Method

By Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Explosion-Proof Equipment Regional Insights

The North America explosion proof equipment market is categorized into systems, protection method, industry, and country.

Based on systems, the North America explosion proof equipment market is segmented into junction boxes and enclosures, lighting system, monitoring system, signaling devices, automation system, cable glands, HVAC systems, and others. The cable glands segment held the largest market share in 2023. The monitoring system segment is further sub segmented into cameras, data loggers, sensors, and others.

In terms of protection method, the North America explosion proof equipment market is segmented into explosion prevention, explosion containment, and explosion segregation. The explosion prevention segment held the largest market share in 2023.

By industry, the North America explosion proof equipment market is segmented into oil and gas, manufacturing, mining, chemical and petrochemical, energy and power, pharmaceutical, water and wastewater management, and others. The oil and gas segment held the largest market share in 2023.

By country, the North America explosion proof equipment market is segmented into the US, Canada, and Mexico. The US dominated the North America explosion proof equipment market share in 2023.

ABB Ltd; Cortem S.p.A.; Emerson Electric Co; Pepperl+Fuchs SE; Honeywell International Inc; Xylem Inc.; OMEGA Engineering, Inc.; Spectec Thunderbird International Corp; Motion Sensors, Inc.; BARTEC Top Holding GmbH; Rockwell Automation Inc; Siemens AG; Schneider Electric SE; Detector Electronics, LLC.; and Larson Electronics LLC are some of the leading companies operating in the North America explosion proof equipment market.

The North America Explosion-Proof Equipment Market is valued at US$ 3,046.17 Million in 2023, it is projected to reach US$ 4,893.73 Million by 2031.

As per our report North America Explosion-Proof Equipment Market, the market size is valued at US$ 3,046.17 Million in 2023, projecting it to reach US$ 4,893.73 Million by 2031. This translates to a CAGR of approximately 6.1% during the forecast period.

The North America Explosion-Proof Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Explosion-Proof Equipment Market report:

The North America Explosion-Proof Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Explosion-Proof Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Explosion-Proof Equipment Market value chain can benefit from the information contained in a comprehensive market report.