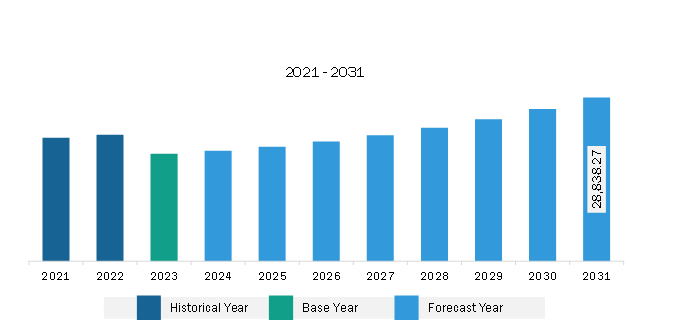

The North America event logistics market was valued at US$ 18,953.99 million in 2023 and is expected to reach US$ 28,838.27 million by 2031; it is estimated to register a CAGR of 5.4% from 2023 to 2031.

The need for proper transport and logistics services has been rising owing to population growth worldwide. Many countries are shifting to green logistics and services to reduce the environmental impacts of conventional logistics. Sustainable and environment-friendly logistics services highlight lowering emissions by utilizing clean energy sources, such as wind and solar, to power fleet vehicles. As the world is already facing high air pollution levels, especially in major countries such as US, Canada, Saudi Arabia, UAE, Germany, France, China, and India, this sustainable approach is significantly beneficial. By shifting to green transport and logistics for efficient event management, companies are anticipated to take various measures to reduce these emissions. Many large and medium-sized organizations are opting for initiatives to optimize their business processes to reduce carbon footprints. According to the US Environmental Protection Agency, (EPA), the transportation and logistics sectors are among the major contributors to carbon emissions, accounting for ~29% of the total GHG emissions in 2022. Several event logistics companies across the globe are involved in green logistics practices. Many event logistics firms are supporting shippers to enhance mobility by suggesting environmentally friendly modes of transportation. In 2023, the event logistics arm of DHL Group-DHL Supply Chain's Green Transport Policy-became a part of the company's investment in decarbonized transport solutions and introduced the Green Transport Policy.

Historically, the engineering of pallets and packing technologies has prioritized economic effectiveness and secure shipping over sustainability; however, many event logistics providers are now rapidly moving to eco-friendly packaging to reduce their environmental impact. As recycled waste is utilized in the creation of eco-friendly packaging, fewer harmful resources are leveraged, which lowers overall carbon emissions. Logistic providers such as Borderline help reduce carbon emissions during freight forwarding by raising the fill rate per transport unit per tank of fuel, using higher-capacity vehicles, and performing routine maintenance of transport vehicles. Thus, the increasing adoption of sustainable solutions that focus on reducing carbon footprints aligns with organizations' business strategy, which is anticipated to create lucrative opportunities for the North America event logistics market growth during the forecast period.

North America event logistics market has been categorized into the US, Canada and Mexico. The US accounted for majority of the share in the North America event logistics market, followed by Canada and Mexico in 2024. Some of the major companies that operate in North America are Event Logistics Inc, Kuehne+Nagel, Gefco, Ceva Logistics, DB Schenker, and DHL International GmbH. These companies are constantly working to understand the market demands and cater to the different requirements of their respective customers to remain competitive in the highly competitive market for event logistics. Further, the majority of the demand for event logistics in the North America region is mainly driven by the corporate events/trade fairs, sports events including rugby/basketball/soccer/baseball etc., and music concerts organized across different countries in the region. Further, in 2024, the North America region is likely to host more than 1700 corporate events/trade fairs across the US, Canada, and Mexico which is further expected to drive the market for event logistics in the region for the coming year.

Strategic insights for the North America Event Logistics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Event Logistics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Event Logistics Strategic Insights

North America Event Logistics Report Scope

Report Attribute

Details

Market size in 2023

US$ 18,953.99 Million

Market Size by 2031

US$ 28,838.27 Million

Global CAGR (2023 - 2031)

5.4%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Event Logistics Regional Insights

The North America event logistics market is categorized into type, end user, and country.

Based on type, the North America event logistics market is segmented inventory management, delivery management, freight forwarding, pallets and packaging services, and others. The freight forwarding segment held the largest market share in 2023.

In terms of end user, the North America event logistics market is categorized into media and entertainment, sports events, corporate events and trade fairs, cultural events, and others. The corporate events and trade fairs segment held the largest market share in 2023.

By country, the North America event logistics market is segmented into the US, Canada, and Mexico. The US dominated the North America event logistics market share in 2023.

C H Robinson Worldwide Inc, CEVA Logistics AG, DB Schenker, Deutsche Post AG, DSV AS, FedEx Corp, GEODIS SA, Kuehne + Nagel International AG, United Parcel Service Inc, and XPO Inc are some of the leading companies operating in the North America event logistics market.

The North America Event Logistics Market is valued at US$ 18,953.99 Million in 2023, it is projected to reach US$ 28,838.27 Million by 2031.

As per our report North America Event Logistics Market, the market size is valued at US$ 18,953.99 Million in 2023, projecting it to reach US$ 28,838.27 Million by 2031. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Event Logistics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Event Logistics Market report:

The North America Event Logistics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Event Logistics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Event Logistics Market value chain can benefit from the information contained in a comprehensive market report.