The North America equine supplement products market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Equine supplement products are frequently used by horse owners and caregivers to add additional nutrition to their horse’s diet. These supplements aid in preventing the deficiencies of the electrolytes, vitamins, minerals, as well as improve overall health of the horses, thereby balance their diet to improve their athletic performance. Owing to the advantages such as alleviating a health issue, preventing occurrence of health issues, and modifying the equine behavior, the equine supplement products have gained significant importance as a nutritional food. Nutrients such as methionine, biotin, and zinc support the health of the equine family by improving the digestive health from probiotics. Moreover, the consumption of equine supplement products results in increased horn quality, develop healthier coat and skin among horses by enhancing the production of collagen and keratin. Also, equine supplement products help the horses to calm down their nervous system. In addition, some of the specific types of supplements help in better joint health with improved synovial fluid support.

In case of COVID-19, in North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of equine supplement products manufacturing activities. Downfall of other healthcare products manufacturing sectors has negatively impacted the demand for equine supplement products during the early months of 2020. Moreover, decline in the overall supplements manufacturing activities has led to discontinuation of equine supplement products manufacturing projects, thereby reducing the demand for equine supplement products. Similar trend was witnessed in other North America countries, i.e., Mexico, Canada, Panama and Costa Rica. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the North America Equine Supplement Products provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

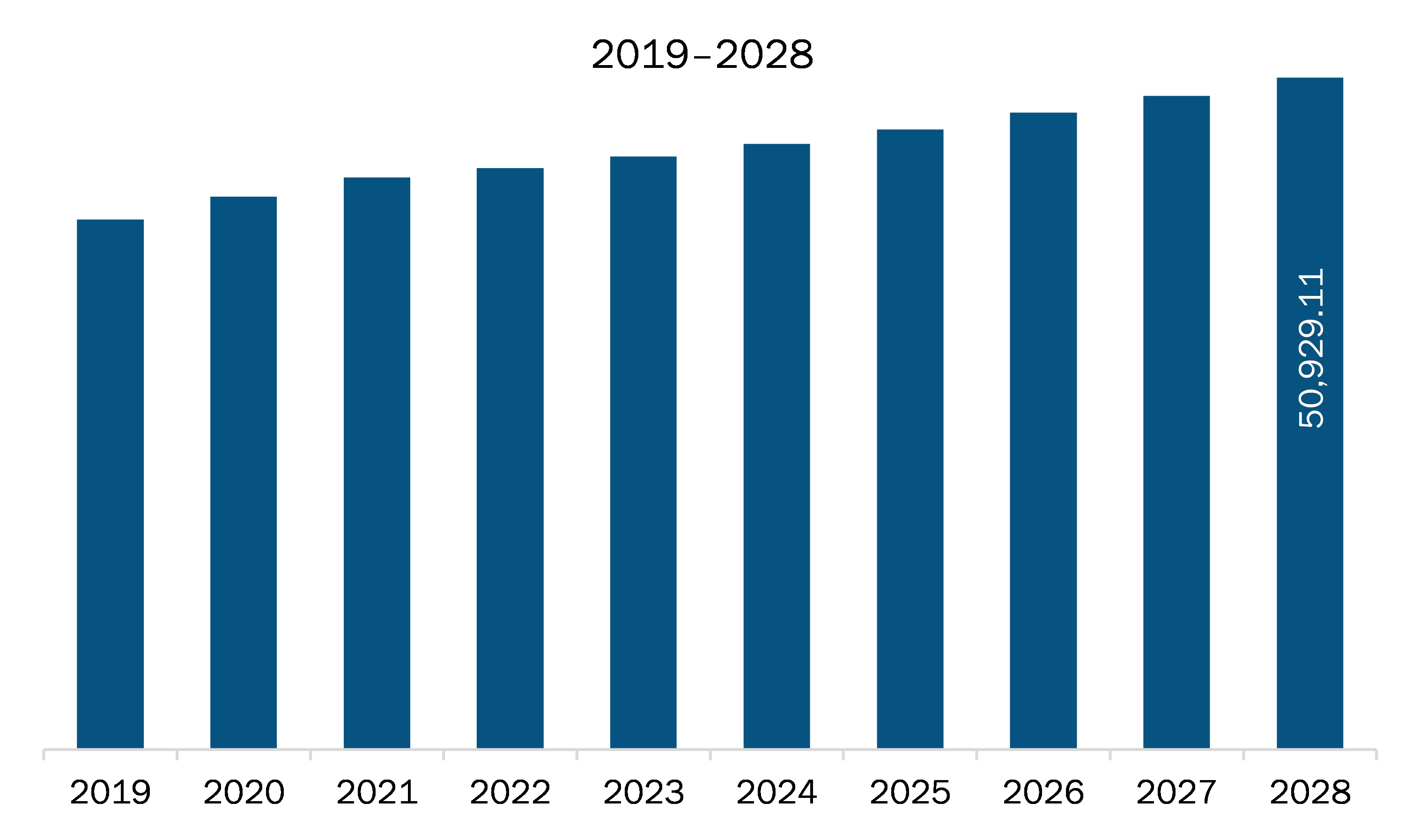

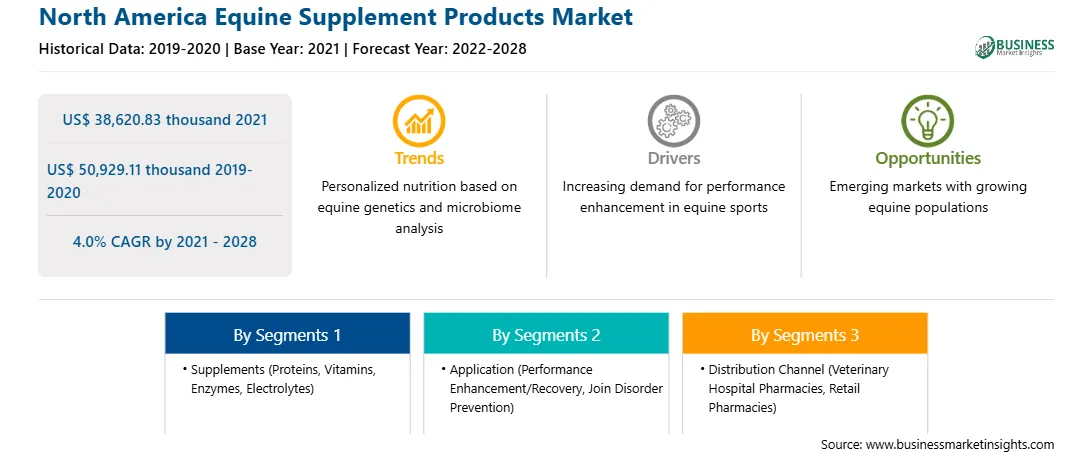

| Market size in 2021 | US$ 38,620.83 thousand |

| Market Size by 2028 | US$ 50,929.11 thousand |

| Global CAGR (2021 - 2028) | 4.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Supplements

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Equine Supplement Products refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The equine supplement products market in North America is expected to grow from US$ 38,620.83 thousand in 2021 to US$ 50,929.11 thousand by 2028; it is estimated to grow at a CAGR of 4.0% from 2021 to 2028. The veterinary care industry has been witnessing rapid transformations during the previous years. Countries across the world have preferred advanced solutions and supplements that are simple for use and effective in healthcare. The increasing rate of pet ownership, disposable income, and pet health-related awareness are among the factors that are expected to drive the market growth in the coming years. Further, rising animal welfare across the countries and implementation of regulations for animal food and nutritional supplements manufacturing is also an important step toward the growth of the market in the region. There has been a standard shift in the business approach of animal health companies that have evolved from therapeutics to preventive to productivity enhancement and now to overall healthcare of the animals. This is likely to promote the adoption of the equine supplements in the potential market and untapped economies.

Based on supplements, the electrolytes / minerals segment accounted for the largest share of the North America equine supplement products market in 2020. Based on application, the performance enhancement / recovery segment accounted for the largest share of the North America equine supplement products market in 2020. Based on distribution channel, the veterinary hospital pharmacies segment accounted for the largest share of the North America equine supplement products market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America equine supplement products market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Boehringer Ingelheim International GmbH, Kentucky Equine Research, Lallemand, Inc., Plusvital Limited, Purina Animal Nutrition LLC, Vetoquinol SA, Virbac, Zoetis Inc. and Cargill, Incorporated.

The North America Equine Supplement Products Market is valued at US$ 38,620.83 thousand in 2021, it is projected to reach US$ 50,929.11 thousand by 2028.

As per our report North America Equine Supplement Products Market, the market size is valued at US$ 38,620.83 thousand in 2021, projecting it to reach US$ 50,929.11 thousand by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The North America Equine Supplement Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Equine Supplement Products Market report:

The North America Equine Supplement Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Equine Supplement Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Equine Supplement Products Market value chain can benefit from the information contained in a comprehensive market report.