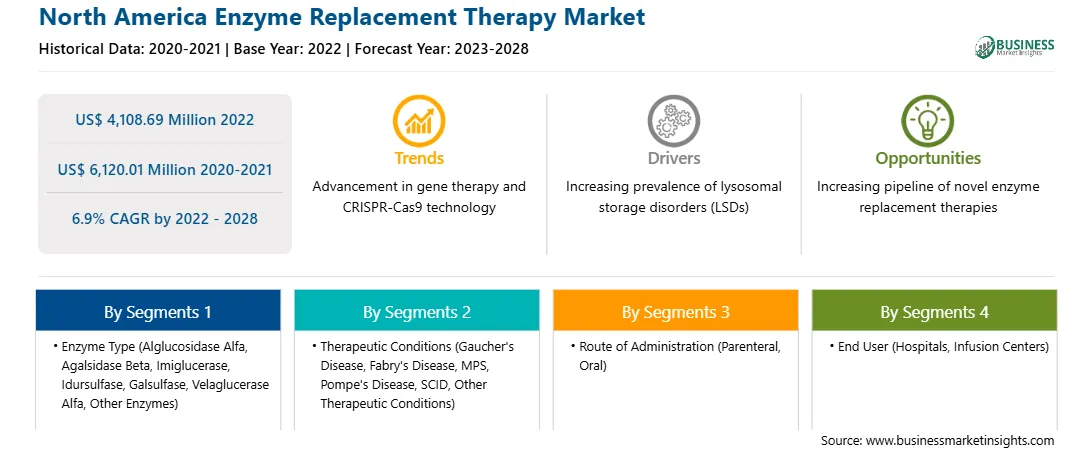

North America Enzyme Replacement Therapy Market

No. of Pages: 162 | Report Code: BMIRE00027296 | Category: Life Sciences

No. of Pages: 162 | Report Code: BMIRE00027296 | Category: Life Sciences

A condition that affects fewer than 200,000 people nationwide is termed as orphan disease. Fabry's disease, Pompe disease, and Hunter syndrome are among a few examples. Supporting the development and evaluation of new therapies for rare diseases is a key priority for the Food and Drug Administration (FDA). The FDA has the authority to grant orphan drug designation to a drug or biological product. Additionally, stakeholders involved in the development of orphan drug molecules are eligible for the following benefits:

Thus, the rapid regulatory approval with other marketing benefits for the drug with orphan drug designation is driving the enzyme replacement therapy market growth.

The North America enzyme replacement therapy market is segmented into the US, Canada, and Mexico. The US enzyme replacement therapy market holds the largest share of the market. The market growth is due to the rise in the prevalence of lysosomal storage diseases and increasing regulatory approval of enzyme replacement therapy products. Intravenous (IV) infusions are used in enzyme replacement therapy (ERT) to treat the underlying enzyme shortage that underlies rare diseases, including Gaucher, Fabry's, and Hunter's syndrome. With the help of a modified form of the enzyme, ERT balances low levels of the glucocerebrosidase (GCase) enzyme, which builds up in the bodies of patients with Gaucher, Hunter, and Fabry's disease and is broken down by this enzyme. Therefore, rising cases of these rare diseases will require the need of developing novel treatments. For instance, according to the National Organization for Rare Disorders (NORD), the number of people in the US who had Gaucher disease was ~6,000 in 2021. According to statistics released by the National Institute of Neurological Disorders and Stroke in August 2021, there are an estimated 32,950 cases of Pompe disease in the US, affecting 1 in 40,000 persons. The National Fabry Foundation estimates that there were ~7,713 Fabry patients in the US as of May 2020. Thus, a restricted number of rare diseases are treated through enzyme replacement therapies, which is boosting the market growth across the region.

Strategic insights for the North America Enzyme Replacement Therapy provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,108.69 Million |

| Market Size by 2028 | US$ 6,120.01 Million |

| Global CAGR (2022 - 2028) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Enzyme Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Enzyme Replacement Therapy refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America enzyme replacement therapy market is segmented into enzyme type, therapeutic conditions, route of administration, end user, and country.

Sanofi; BioMarine Pharmaceutical Inc; Takeda Pharmaceutical Company Limited; AbbVie Inc; Janssen Pharmaceutical (Johnson & Johnson Services, Inc.); Alexion Pharmaceutical, Inc. (AstaZeneca); Amicus Therapeutics; Recordati S.p.A; Recordati S.p.A; CHIESI farmaceutici S.p.A; and Pfizer Inc are the leading companies operating in the enzyme replacement therapy market in North America.

The North America Enzyme Replacement Therapy Market is valued at US$ 4,108.69 Million in 2022, it is projected to reach US$ 6,120.01 Million by 2028.

As per our report North America Enzyme Replacement Therapy Market, the market size is valued at US$ 4,108.69 Million in 2022, projecting it to reach US$ 6,120.01 Million by 2028. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America Enzyme Replacement Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Enzyme Replacement Therapy Market report:

The North America Enzyme Replacement Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Enzyme Replacement Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Enzyme Replacement Therapy Market value chain can benefit from the information contained in a comprehensive market report.