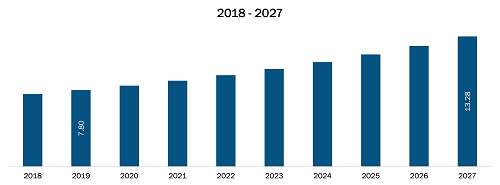

The North America ENT chairs market was valued US$ 81.05 Mn in the year 2018 and is expected to reach US$ 158.26 Mn by 2027 growing at a CAGR of 7.9% over the forecast period.

Key factors driving the market are rising prevalence of ENT diseases and increasing number of otolaryngologists. However, high cost of programmed ENT chairs is expected to hamper the market in the forecasted period.

Ear, nose, throat (ENT) problems are widespread due to which a person visits a doctor in both rural and urban communities. Several types of ENT diseases are prevalent in the US, such as sinusitis, tinnitus, allergic rhinitis, pharyngitis, tonsillitis, and more. Tinnitus is a common ailment for millions of individuals and can affect substantial adverse effects on the quality of life. As per various studies, tinnitus and its management patterns are deficient in the US adult population. For instance, as per the data of the American Medical Association 2016, the prevalence of tinnitus is around 1 in 10 adults in the US. The durations of work-related and ease time noise exposures associated with rates of tinnitus and are expected targetable risk factors. Allergic rhinitis is the symptoms of nasal pruritus, sneezing, airflow obstruction, and typically clear nasal discharge caused by IgE-mediated reactions beside inhaled allergens and involving mucosal inflammation due to type 2 helper T (Th2) cells. According to the data of the National Center for Biotechnology Information (NCBI), the incidence of sensitization to inhalant allergens is growing. It is above 40% of the population in the US and Europe. The prevalence of allergic rhinitis in the US is around 15% based on physician diagnoses and more than 30% based on self-reported nasal symptoms. The rising prevalence of various ENT diseases has increased the use of ENT chairs in the market. The need for the chairs by various otolaryngologists for treatment will eventually grow the ENT chairs market.

In 2018, the manual chairs accounted for the largest market share in the North America ENT chairs market by type owing to key factors like easy accessibility online and offline and deep market penetration. In addition, manual chairs are relatively affordable and have very low cost as compared to those of the programmed ones making them an ideal buy for small and mid-sized ENT clinic owners.

In 2018, US accounted largest share in the North America ENT chairs market. The growth of the ENT chairs market in this region is primarily due to increasing number of otolaryngology practitioners, rising disposable income of the population, and increasing concerns for ENT among patients. The US ENT chairs market is anticipated to grow at a CAGR of 8.2% in the forecast period.

Strategic insights for the North America ENT Chairs provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America ENT Chairs refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Mexico ENT Chairs Market Revenue and Forecasts to 2027 (US$ Mn)

North America ENT Chairs Strategic Insights

North America ENT Chairs Report Scope

Report Attribute

Details

Market size in 2018

US$ 81.05 Million

Market Size by 2027

US$ 158.26 Million

Global CAGR (2018 - 2027)

7.9%

Historical Data

2016-2017

Forecast period

2019-2027

Segments Covered

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America ENT Chairs Regional Insights

NORTH AMERICA ENT CHAIRS MARKET– MARKET SEGMENTATION

North America ENT chairs Market – By

Type

North America ENT chairs Market – By

End User

By Geography

Company Profiles

The List of Companies in North America ENT Chairs Market

The North America ENT Chairs Market is valued at US$ 81.05 Million in 2018, it is projected to reach US$ 158.26 Million by 2027.

As per our report North America ENT Chairs Market, the market size is valued at US$ 81.05 Million in 2018, projecting it to reach US$ 158.26 Million by 2027. This translates to a CAGR of approximately 7.9% during the forecast period.

The North America ENT Chairs Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America ENT Chairs Market report:

The North America ENT Chairs Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America ENT Chairs Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America ENT Chairs Market value chain can benefit from the information contained in a comprehensive market report.