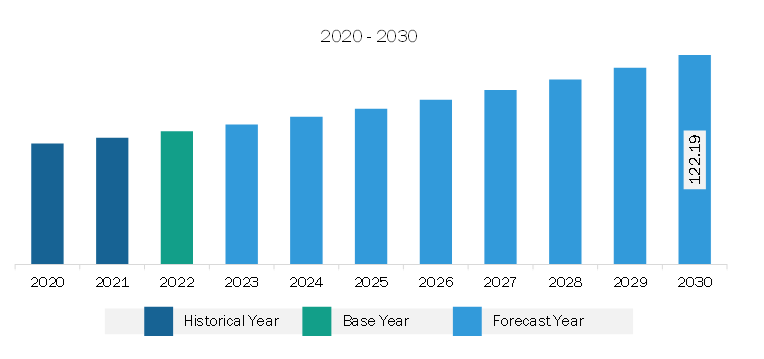

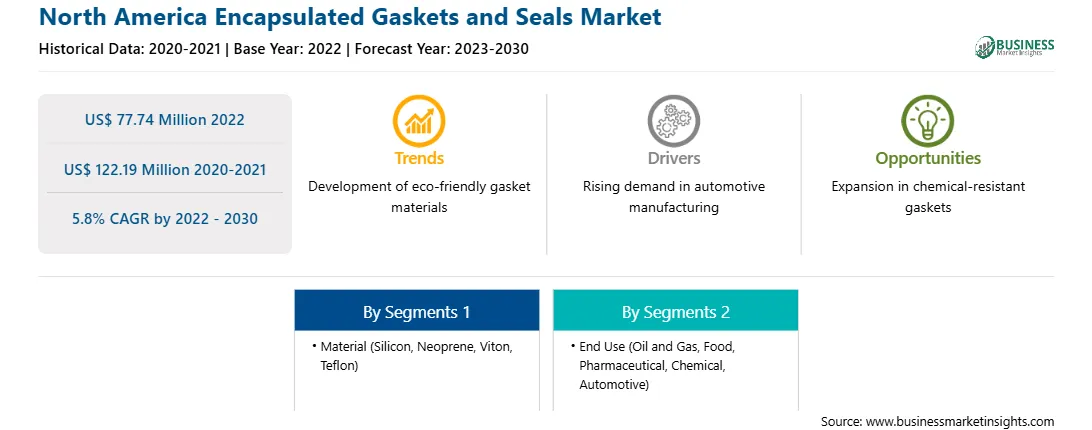

The North America encapsulated gaskets and seals market was valued at US$ 77.74 million in 2022 and is expected to reach US$ 122.19 million by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Encapsulated gaskets and seals are used to seal flanges in pipelines and equipment within the oil & gas industry infrastructure. Gaskets provide a secure and leak-resistant seal between connected flanges, preventing the escape of fluids and gases. In oil & gas wellheads, where pressure and temperature conditions can be extreme, encapsulated gaskets and seals are used to seal critical connections. During the construction and maintenance of pipelines, encapsulated gaskets and seals are used to seal the connections between pipeline segments, as well as in tanks and vessels used for storing and transporting oil and gas.

According to the Pipeline and Hazardous Materials Safety Administration, ?2.6 million miles of pipelines in North America deliver hundreds of billions of tons of liquid petroleum products and trillions of cubic feet of natural gas yearly. As per the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. Therefore, the tremendous growth of the oil & gas industry propels the encapsulated gaskets and seals market growth.

The encapsulated gaskets and seals market in North America has experienced substantial growth in recent years, driven by a confluence of factors such as growing demand for advanced materials for sealing purpose, shaping various industrial sectors. These specialized sealing solutions have become integral in applications where robust performance in challenging conditions is paramount. In the automotive industry, encapsulated gaskets and seals play an important role in enhancing engine efficiency, meeting stringent emission standards, and ensuring long-term durability. For instance, the International Organization of Motor Vehicle Manufacturers (OICA) quotes that vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022. The aerospace sector also significantly contributes to the market demand, with an increasing focus on lightweight and high-performance materials for various components.

The increasing emphasis of the oil & gas industry on sealing solutions that can withstand extreme pressures, temperatures, and corrosive environments has further fueled the market growth. The regulatory landscape, marked by stringent safety and environmental standards, has accelerated the adoption of advanced encapsulated gaskets and seals across industries. For instance, the US produces 75% of its crude oil supply and 90% of its natural gas supply domestically. By 2021, it was producing about eleven million barrels of crude oil per day and around one hundred billion cubic feet of gas per day.

North America benefits from the presence of well-established manufacturers, leveraging cutting-edge technologies and investing heavily in research and development to stay ahead in the market. The continuous innovation in material science and manufacturing processes enhances the durability and reliability of encapsulated gaskets and seals. As industries prioritize efficiency, safety, and sustainability, the encapsulated gaskets and seals market in North America is poised for sustained growth, with a trajectory driven by technological advancements and evolving industrial needs.

Strategic insights for the North America Encapsulated Gaskets and Seals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 77.74 Million |

| Market Size by 2030 | US$ 122.19 Million |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Encapsulated Gaskets and Seals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America encapsulated gaskets and seals market is categorized into material, end use, and country.

Based on material, the North America encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest market share in 2022.

Based on end use, the North America encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022.

By country, the North America encapsulated gaskets and seals market is segmented into the US, Canada, and Mexico. The US dominated the North America encapsulated gaskets and seals market share in 2022.

AS Aston Seals SPA, Gasco Inc, Marco Rubber & Plastics LLC, MCM SPA, ROW Inc, Seal & Design Inc, Trelleborg AB, VH Polymers, and Vulcan Engineering Ltd are some of the leading companies operating in the North America encapsulated gaskets and seals market.

The North America Encapsulated Gaskets and Seals Market is valued at US$ 77.74 Million in 2022, it is projected to reach US$ 122.19 Million by 2030.

As per our report North America Encapsulated Gaskets and Seals Market, the market size is valued at US$ 77.74 Million in 2022, projecting it to reach US$ 122.19 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The North America Encapsulated Gaskets and Seals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Encapsulated Gaskets and Seals Market report:

The North America Encapsulated Gaskets and Seals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Encapsulated Gaskets and Seals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Encapsulated Gaskets and Seals Market value chain can benefit from the information contained in a comprehensive market report.