North America Employment Screening Services Market

No. of Pages: 105 | Report Code: TIPRE00023488 | Category: Technology, Media and Telecommunications

No. of Pages: 105 | Report Code: TIPRE00023488 | Category: Technology, Media and Telecommunications

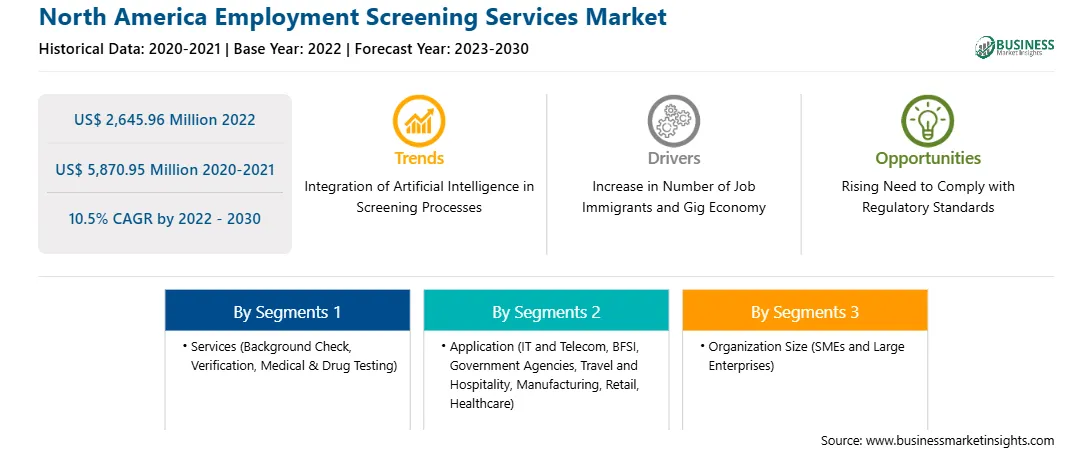

The North America employment screening services market was valued at US$ 2,645.96 million in 2022 and is expected to reach US$ 5,870.95 million by 2030; it is estimated to record a CAGR of 10.5% from 2022 to 2030.

In the 21st century, there has been an enormous influx of population in urban cities in developed and developing countries in search of a better life. High standards of living, better job opportunities, and access to modern amenities and services are a few major factors driving the migration of the rural population to urban areas. The steady growth of developing economies in the post-recession era has led to a rise in consumers' disposable income. According to the World Bank, ~50% of the population lives in urban areas worldwide. By 2045, the world's urban population will increase by 1.5 times to 6 billion. With continued urbanization, the need for jobs in urban areas would grow at full throttle in the coming years. With a subsequent surge in the number of candidates applying for a single job position in any organization, selecting the most suitable candidate for a particular profile has become more tedious. Conventional interview methods for job screening prove time-consuming and inefficient. Employment screening services help evaluate applicants more quickly and efficiently. Employment screening services automate procedures such as reference verification, criminal background checks, and educational verification, saving recruiters a substantial amount of time. Recruiters use screening reports to identify the most qualified prospects rapidly and objectively. Thus, the demand for efficient and quicker employee screening systems triggers the adoption of employment screening services.

The demand for employment screening services is surging in the US due to the robust livestock industry, growing awareness of the nutritional benefits of employment screening services, and increasing adoption of sustainable agricultural practices. According to Horse Industry Statistics, there are 7.25 million horses in the US as of 2024. With the US being a significant player in the equine industry, there is a consistent need for high-quality feed to support the health and productivity of livestock. Also, US is the largest producer of employment screening services, in 2022 the employment screening services production accounted for 48 million tons. The country accounts for almost 48% in exports accounting for approximately 2 billion export value. Additionally, as consumers become more conscious about animal welfare and environmentally friendly farming practices, the demand for employment screening services produced using sustainable methods would continue to grow in the coming years.

Strategic insights for the North America Employment Screening Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,645.96 Million |

| Market Size by 2030 | US$ 5,870.95 Million |

| Global CAGR (2022 - 2030) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Employment Screening Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America employment screening services market is segmented based on services, application, organization size, and country. Based on services, the North America employment screening services market is categorized into background check, verification, and medical & drug testing. The verification segment held the largest market share in 2022.

By application, the North America employment screening services market is segmented into IT and Telecom, BFSI, government agencies, travel and hospitality, manufacturing, retail, healthcare, and others. The IT and Telecom segment held the largest market share in 2022.

In terms of organization size, the North America employment screening services market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger market share in 2022.

Based on country, the North America employment screening services market is segmented into the US, Canada, and Mexico. The US dominated the North America employment screening services market share in 2022.

Accurate Background; A-Check America, Inc.; First Advantage Corp; HireRight LLC; Insperity Inc; Sterling Check Corp; Inflection Risk Solutions LLC; Pinkerton Consulting & Investigations Inc; Triton Inc; and Verity Screening Solutions LLC are some of the leading players operating in the North America employment screening services market.

The North America Employment Screening Services Market is valued at US$ 2,645.96 Million in 2022, it is projected to reach US$ 5,870.95 Million by 2030.

As per our report North America Employment Screening Services Market, the market size is valued at US$ 2,645.96 Million in 2022, projecting it to reach US$ 5,870.95 Million by 2030. This translates to a CAGR of approximately 10.5% during the forecast period.

The North America Employment Screening Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Employment Screening Services Market report:

The North America Employment Screening Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Employment Screening Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Employment Screening Services Market value chain can benefit from the information contained in a comprehensive market report.