Market Introduction

The North America embolization agents market is divided into the US, Canada, and Mexico. The growth of market is widely attributed by the increasing incidences of the neurological disorders such as stroke, brain aneurysms and others across the country. Moreover, the growth of market in Canada is expected to grow due to increasing support from the government to address the rising concerns about the brain diseases. In addition, across the Mexico the market is estimated to grow due to the increasing medical industries and increasing export of medical devices to US and other countries. The embolization agents market is anticipated to grow significantly owing to the rising cases of brain aneurysm. According to the Brain Aneurysm Foundation’s report, approximately 6 million people have unruptured brain aneurysm in the US. Also, the annual rate of rupture is nearly 8 – 10 per 100,000 people, approximately 30,000 people in the country who suffer from a brain aneurysm rupture. In addition, about 4 out of 7 people who recover from a ruptured brain aneurysm are likely to suffer from the disabilities. This neurological disorder generally affects people who are in the age group of 35 – 60 years. However, the brain aneurysm can also be seen in children, the women in the country suffer more than men. Despite the wide availability of brain imaging screening, delays in diagnosis often lead to deteriorating health conditions. Therefore, technological advancements in the development of advanced and less invasive techniques for early diagnosis are bolstering the new product innovation in the country. The companies are launching various products for embolization. These companies are aggressively involved in the developments and are receiving various product approvals from the FDA. For instance, in 2019, MicroVention, Inc. received Premarket Approval from the FDA for the WEB Aneurysm Embolization System. The WEB System is the first of its kind intrasaccular flow disruptor for aneurysm embolization. In July 2021, Terumo Medical Corporation recently launched its AZUR Vascular Plug, the first and only plug compatible with a microcatheter to occlude arteries up to 8mm in diameter. This addition to the embolization portfolio is indicated to reduce or block the rate of blood flow in arteries of the peripheral vasculature.

The United States has the highest number of COVID-19 cases in North America. The epidemic has caused havoc in the medical industry in North American countries, with demand for diagnostic and therapeutic assistance to combat the sickness skyrocketing. Furthermore, the COVID-19 pandemic is posing unprecedented operational and clinical problems to healthcare institutions in the region. Furthermore, a shift in focus from cardiovascular therapy to COVID-19 therapeutic services resulted in a reduction in the growth of the North American embolization agents market in 2020. COVID patients with comorbidities including CVDs and hypertension require critical ICU resources and are at a high risk of developing further problems. As a result, most hospitals and surgical centres have considered cancelling or deferring elective surgery, such as cardiovascular procedures. There was a 52.7 percent decline in adult cardiac surgery volume and a 65.5 percent reduction in elective cases in the United States, according to the Society of Thoracic Surgeons Adult Cardiac Surgery Database and the Johns Hopkins COVID-19 database. Following the first COVID-19 surge, nationwide cardiac surgical case volumes decreased, indicating a COVID-19-related impact on heart surgery patients. In the long run, however, with the widespread deployment of vaccination campaigns and a drop in the transmission rate, healthcare systems are returning to normal, and demand for embolization products is projected to recover to normal in the future years.

Strategic insights for the North America Embolization Agents provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Embolization Agents refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Embolization Agents Strategic Insights

North America Embolization Agents Report Scope

Report Attribute

Details

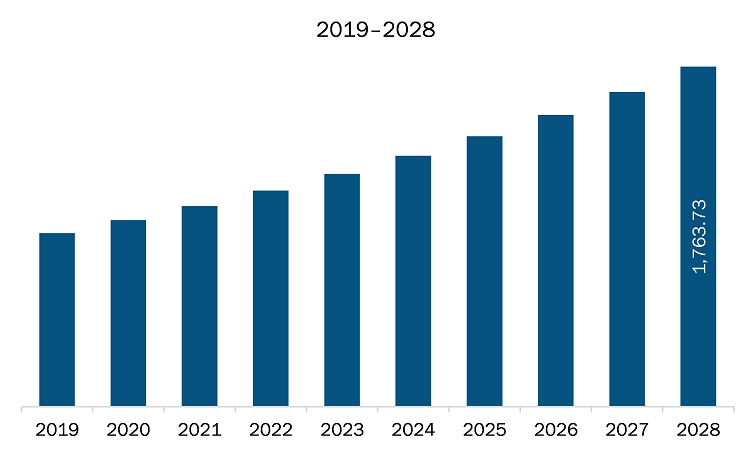

Market size in 2021

US$ 1,041.25 Million

Market Size by 2028

US$ 1,763.73 Million

Global CAGR (2021 - 2028)

7.8%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Product

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Embolization Agents Regional Insights

Market Overview and Dynamics

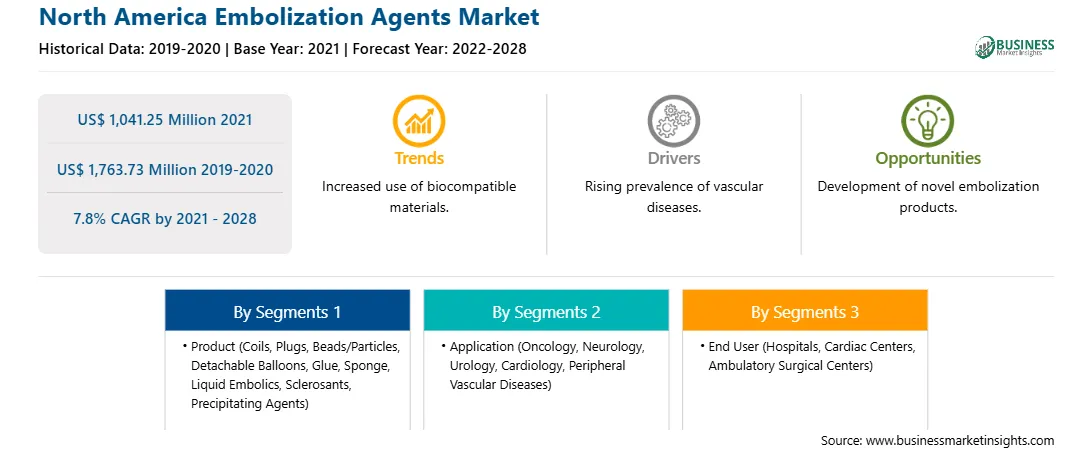

The embolization agents market in North America is expected to grow from US$ 1,041.25 million in 2021 to US$ 1,763.73 million by 2028; it is estimated to grow at a CAGR of 7.8% from 2021 to 2028. Growing geriatric population base; growing geriatric population and the rise in associated neurological disorders and cancers, is likely to create growth opportunities for the market. The accumulation of health risks across a lifespan of disease, injury, and chronic illness contributes to higher disability rates among older people. As per the US Census Bureau, there were 54 million US residents with age 65 and above in the July 2019. Further, the Urban Institute estimated that number of US population belonging to this age group would reach 80 million by 2040. Thus, growing geriatric population base is likely to favor the growth of the North America embolization agents market.

Key Market Segments

Based on product, the market is segmented into coils, beads/particles, plugs, detachable balloons, glue, sponge, liquid embolics, sclerosants, precipitating agents, others. The beads/particles segment held the largest share of the market in 2020. Based on coils the market is divided into detachable coils and pushable coils. The pushable coils segment held the largest share of the market in 2020. Based on beads/particles the market is divided into spherical and non-spherical. The pushable non-spherical segment held the largest share of the market in 2020. Based on application, the market is segmented into neurology, oncology, cardiology, peripheral vascular diseases, and others. In 2020, the oncology segment is likely to hold the largest share of the market. The embolization agents market by end user, is segmented into hospitals, ambulatory surgical centers, cardiac centers, and others. The hospitals segment held the largest share of the market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the embolization agents market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott; Boston Scientific Corporation; Cook Medical LLC; DePuy Synthes; KANEKA CORPORATION; Medtronic; Merit Medical Systems Inc; Penumbra, Inc.; Stryker Corporation; and Terumo Corporation among others.

Reasons to buy report

NORTH AMERICA EMBOLIZATION AGENTS MARKET SEGMENTATION

By Country

Company Profiles

The North America Embolization Agents Market is valued at US$ 1,041.25 Million in 2021, it is projected to reach US$ 1,763.73 Million by 2028.

As per our report North America Embolization Agents Market, the market size is valued at US$ 1,041.25 Million in 2021, projecting it to reach US$ 1,763.73 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The North America Embolization Agents Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Embolization Agents Market report:

The North America Embolization Agents Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Embolization Agents Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Embolization Agents Market value chain can benefit from the information contained in a comprehensive market report.