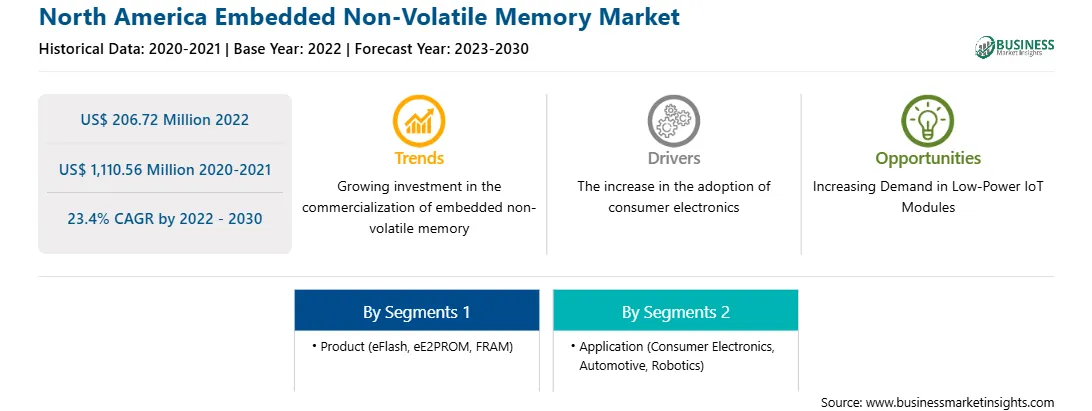

The North America embedded non-volatile memory market was valued at US$ 206.72 million in 2022 and is expected to reach US$ 1,110.56 million by 2030; it is estimated to grow at a CAGR of 23.4% from 2022-2030.

Embedded non-volatile memory plays a crucial role in the consumer electronics industry. Embedded non-volatile memory is placed in microcontrollers, which are used in embedded systems and further integrated into numerous consumer electronic devices such as cameras, smartphones, smartwatches, microwave ovens, washing machines, smart TVs, tablets, printers, gaming consoles, smart speakers, digital cameras, and home security systems. The embedded non-volatile memory supports data storage that is found in microcontrollers and other electronics. The user keeps this data for further processing, including data redundancy, trimming, programming, identification, and encryption. Embedded non-volatile memory allows users to store data in the absence of electric power, which increases the demand among consumers and drives the embedded non-volatile memory market. Embedded non-volatile memory is used in memory cards and USB sticks that are integrated into a variety of consumer devices such as smartphones, smartwatches, and digital cameras for data storage.

These devices use embedded MultiMediaCard (eMMC) memory chips to store controller code in storage drives and personal electronic devices. The growing adoption of consumer electronics devices among consumers is driving the embedded non-volatile memory market. According to Canalys, the demand for smartwatches has grown by 3%, and for basic watches, the demand increased by 21% in 2022.

Consumers across the globe adopt smartwatches to track fitness and health data. Major players in the smartwatch industry are engaging in adding features to smartwatches to attract more customers. For instance, in July 2023, Apple Inc. developed a smartwatch capable of identifying Parkinson’s disease, diabetes, and Lyme disease, which is expected to be popular among the elderly population. The embedded non-volatile memory supports embedded systems to process the data generated by smartwatches to track users’ health and fitness. Moreover, new specifications are currently being developed by server, storage, and application vendors to improve product interaction with NVM. The constant generation of new mobile devices fuels the expansion of NVM products. In 2021, 30-nm node technologies were ramping up, 20-nm node technologies were transitioning to mass production, and a 10-nm node technology was developing to fulfill the demand. Furthermore, to serve a massive amount of data correspondence, the future market requires high-speed operation up to about 1,500 MB/s. These factors are fueling the production of consumer electronics, thereby boosting the demand for embedded non-volatile memory.

The North America embedded non-volatile memory market is segmented into the US, Canada, and Mexico. As the adoption of consumer electronic devices is high, the consumer electronics industry is booming in the region. Smartphones, tablets, television sets, personal computers, washing machines, and other consumer electronics devices have found a wider consumer base in the region. Additionally, the rising adoption of 5G networks is creating a strong opportunity for the market players. According to Ericsson's mobility report, North America has the second-largest penetration of 5G devices after Asia Pacific. Several network providers have already rolled out 5G services focusing on mobile broadband and fixed wireless access. Further, the number of 5G subscriptions is expected to increase faster than that of 4G in the coming years. By 2026, the region is projected to hold the largest share of the total 5G subscriptions globally, accounting for 360 million subscriptions. Automobile ownership is a widespread trend in North America. According to the International Council on Clean Transportation Report 2021, the US recorded ~330,000 new sales of electric vehicles in 2020, making it the third-largest electric vehicle market. As per the data published by the International Energy Agency (IEA), the demand for battery electric vehicles (BEV) in the US grew from 231 thousand units in 2020 to 466 thousand units in 2021; also, the demand for plug-in hybrid electric vehicles (PHEV) increased from 64 thousand units in 2020 to 165 thousand units in 2021. Thus, such growth prospects in the EV industry are increasing the deployment of embedded non-volatile memories. More than 2 million EVs have been registered in the US, and the count is anticipated to reach 18.7 million by 2030. Moreover, electric companies are investing ~US$ 3 billion in the deployment of charging infrastructure, thus boosting electrically powered transportation. The advent of connected and autonomous cars in North America is propelling the growth of the embedded non-volatile memory market by creating the demand for microchips. The increasing adoption of electric, autonomous, and connected vehicles has surged the demand for advanced electronic devices. Advanced driver-assistance systems (ADAS), AI support, 5G antennas, and advanced processors use microchips and components. Moreover, the integration of devices is done using advanced packaging technology, which is driving technology adoption in the automotive sector. The evolution of on-board diagnostic (OBD) platforms equipped with microelectronics is accelerating the market growth with increased demand for embedded non-volatile memory chips.

Strategic insights for the North America Embedded Non-Volatile Memory provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Embedded Non-Volatile Memory refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Embedded Non-Volatile Memory Strategic Insights

North America Embedded Non-Volatile Memory Report Scope

Report Attribute

Details

Market size in 2022

US$ 206.72 Million

Market Size by 2030

US$ 1,110.56 Million

Global CAGR (2022 - 2030)

23.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Embedded Non-Volatile Memory Regional Insights

The North America embedded non-volatile memory market is segmented based on product, application, and country. Based on product, the North America embedded non-volatile memory market is categorized into eFlash, eE2PROM, FRAM, and others. The eFlash segment held the largest market share in 2022.

Based on application, the North America embedded non-volatile memory market is segmented into consumer electronics, automotive, robotics, and others. The others segment held the largest market share in 2022.

Based on country, the North America embedded non-volatile memory market is segmented into the US, Canada, and Mexico. The US dominated the North America embedded non-volatile memory market share in 2022.

Microchip Technology Inc, Tower Semiconductor, GlobalFoundries Inc, eMemory Technology Inc, Texas Instruments Inc, Hua Hong Semiconductor Ltd, Taiwan Semiconductor Manufacturing Co Ltd, United Microelectronics Corp, Semiconductor Manufacturing International Corp, and Synopsys Inc are some of the leading companies operating in the North America embedded non-volatile memory market.

The North America Embedded Non-Volatile Memory Market is valued at US$ 206.72 Million in 2022, it is projected to reach US$ 1,110.56 Million by 2030.

As per our report North America Embedded Non-Volatile Memory Market, the market size is valued at US$ 206.72 Million in 2022, projecting it to reach US$ 1,110.56 Million by 2030. This translates to a CAGR of approximately 23.4% during the forecast period.

The North America Embedded Non-Volatile Memory Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Embedded Non-Volatile Memory Market report:

The North America Embedded Non-Volatile Memory Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Embedded Non-Volatile Memory Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Embedded Non-Volatile Memory Market value chain can benefit from the information contained in a comprehensive market report.