North America Embedded Die Packaging Technology Market

No. of Pages: 130 | Report Code: TIPRE00022132 | Category: Electronics and Semiconductor

No. of Pages: 130 | Report Code: TIPRE00022132 | Category: Electronics and Semiconductor

Technological advancements have led to a highly competitive market in the region as populations attract several technological developments owing to high spending powers. With the high adoption of consumer electronic devices, the consumer electronics industry is blooming in the region. Smartphones, personal computers, tablets, washing machines, television sets, and other consumer electronics devices have found a wider user base in North America. The embedded die packaging technology enables manufacturers to offer electronic devices with small form factor. Additionally, the rising adoption of 5G networks is creating strong opportunity for the market players to develop advanced RF modules using system in package technology for connectivity. According to the Ericsson’s mobility report, the share of 5G network in the North America market is expected to grow from 4% in 2020 to 80% by 2026, while the rest 20% would be held by the 4G technology. This highlights the opportunities for electronic companies to develop new electronics devices comprising ICs packed with embedded die packaging technology to meet the evolving performance requirements. Rising demand for miniaturization of electronic devices and growing developments in embedded die packaging technology are the major factor driving the growth of the North America embedded die packaging technology market.

In case of COVID-19, North America is highly affected specially the US. Post lockdown, the market witnessed increasing demand for digital devices. North America is among the eminent regions in adopting smart or IoT-based devices due to favorable infrastructure support for high-speed internet services. The adoption of the 5G network is supposed to drive the market growth post lockdown. The COVID-19 outbreak has a major impact on manufacturing facilities as production capacities were lowered. As the demand for electronics remained constant, it helped the market to resume the growth. For instance, in December 2020, Qualcomm Inc, a leading manufacturer of microprocessors has predicted that the shipments of 5G smartphones will double in 2022, with the increasing 5G network deployment. Such increasing adoption of 5G smartphones is lowering the COVID- 19 impact for the post lockdown period; while in lockdown, it certainly hampered the market growth.

Strategic insights for the North America Embedded Die Packaging Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

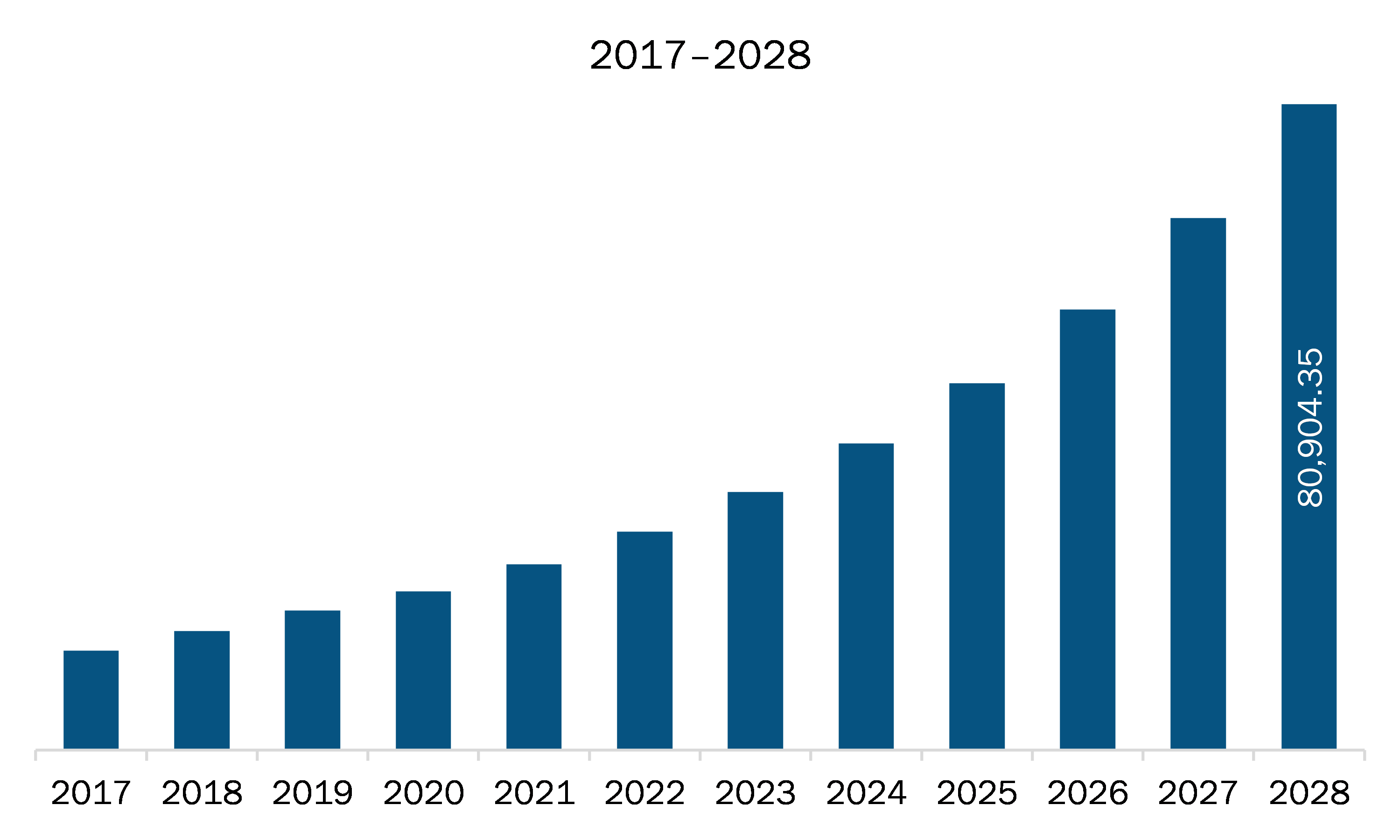

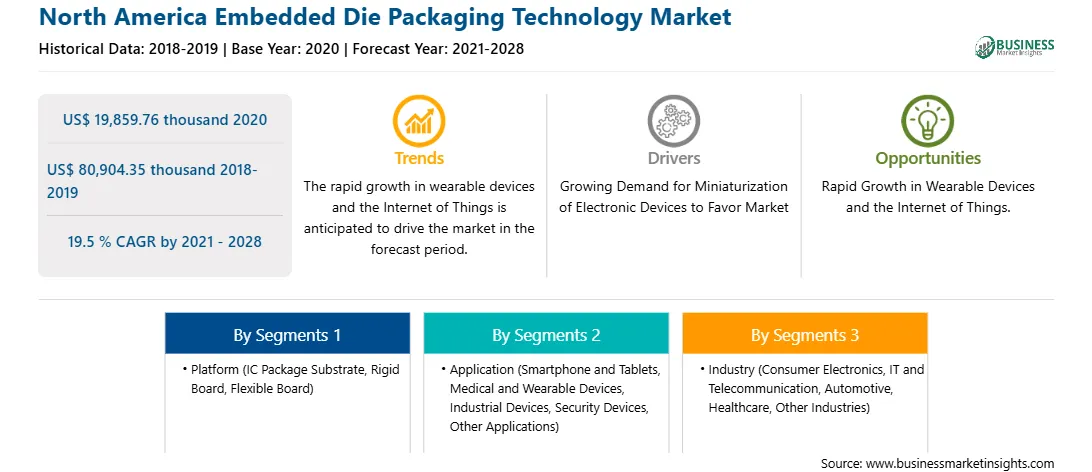

| Market size in 2020 | US$ 19,859.76 thousand |

| Market Size by 2028 | US$ 80,904.35 thousand |

| Global CAGR (2021 - 2028) | 19.5 % |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Embedded Die Packaging Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America embedded die packaging technology market is expected to grow from US$ 19,859.76 thousand in 2020 to US$ 80,904.35 thousand by 2028; it is estimated to grow at a CAGR of 19.5 % from 2021 to 2028. Increasing demand to enhance smartphone and automotive device performance will drive the market growth. The embedded die packaging technology has a huge opportunity in the smartphone and PC market to offer advanced processors, transmitters, and other components. Embedded die packaging technology enhances the device performance and provides better space utilization solutions. A few market players across North America are developing ICs and other components using the embedded die packaging technology, while for others, it is an excellent opportunity to innovate new solutions for smartphones and tablets. For instance, market players such as AT&S, SHINKO, and ASE Group offer the embedded die packaging technology for smartphones. The rising consumption of smartphones is a major supporting factor for the market growth in coming years. To grab a leading position, companies need to develop new processors with compact size and high-performance level. Similarly, the rise in demand for embedded die packaging technology in automotive applications is expected to offer new growth opportunities for players in the North America market. For instance, Infineon Technologies AG is offering embedded power ICs for automotive motor control solutions. Further, increasing electrification and the advent of IoT devices in vehicles create a lucrative opportunity for the market.

In terms of platform, the IC package substrate segment accounted for the largest share of the North America embedded die packaging technology market in 2020. In terms of application, the smartphone and tablets segment held a larger market share of the North America embedded die packaging technology market in 2020. Further, the consumer electronics segment held a larger share of the North America embedded die packaging technology market based on industry in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America embedded die packaging technology market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amkor Technology, Inc.; ASE Group; AT & S Austria Technologie & Systemtechnik Aktiengesellschaft; Fujikura Ltd.; General Electric Company; Infineon Technologies AG; Microsemi; Schweizer Electronic AG; Shinko Electric Industries Co., Ltd.; and Taiwan Semiconductor Manufacturing Company, Limited

The North America Embedded Die Packaging Technology Market is valued at US$ 19,859.76 thousand in 2020, it is projected to reach US$ 80,904.35 thousand by 2028.

As per our report North America Embedded Die Packaging Technology Market, the market size is valued at US$ 19,859.76 thousand in 2020, projecting it to reach US$ 80,904.35 thousand by 2028. This translates to a CAGR of approximately 19.5 % during the forecast period.

The North America Embedded Die Packaging Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Embedded Die Packaging Technology Market report:

The North America Embedded Die Packaging Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Embedded Die Packaging Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Embedded Die Packaging Technology Market value chain can benefit from the information contained in a comprehensive market report.