Increased Use of Elevators with Rapid Urbanization is Driving the North America Elevator Safety System Market

The migration of people from rural to urban areas at a steady pace over the years has been a common phenomenon worldwide, particularly in developing countries. According to the United Nations Conference on Trade and Development (UNCTAD), 56.2% of the global population resided in urban areas in 2020, compared to 51.6% in 2010. The percentage of urban dwellers was above 79% in developed countries, including the US and the UK. With the growing urban population, the need for high-rise buildings has increased in urban areas. According to the Council on Tall Buildings and Urban Habitat (CTBUH), 1,480 skyscrapers with heights greater than 200 m have been built in the last 20 years in the US. The number also includes 40 new residential skyscrapers constructed during 2019–2022. Moreover, urban populations are compelled to move to multistorey buildings as owning a house in cities is becoming difficult with elevating land and high property taxes, and complex documentation requirements.

In addition to the initial purpose of showcasing progressive architecture, high-rise buildings are now being constructed to solve the accommodation crisis emerging from the surging urban population. As a result, elevators are losing their status as a premium feature and are becoming a common feature in most multistorey buildings having more than two floors. Modern-day elevators come with different default safety systems, including infrared door protection, terminal slowdown switches, travel limit switches, terminal buffers, interlocking, over-speed governors, alarm bells, emergency stop switches, elevator phones, safety edges, and intercoms. With the increasing installation of elevators in multistorey buildings, elevator safety system manufacturers are witnessing high demand for their products. Additionally, elevator manufacturers are increasing the number of safety features provided in their products to better comply with relevant regulations and distinguish their products from their competitors. For example, manufacturers are offering elevators integrated with microcomputer-enabled monitoring technology and smart auxiliary braking systems to attract new customers and boost the installation of their elevators. Thus, increased use of elevators with rapid urbanization is driving the North America elevator safety system market during the forecast period.

North America Elevator Safety System Market Overview

The North America elevator safety system market is analyzed based on three major countries: the US, Canada, and Mexico. With new innovative elevator systems being developed yearly, the industry continues to evolve in technology implementation. Builders and elevator inspectors comprehend the tested and proven safety code developed and provided by several associations, such as the American Society of Mechanical Engineers (ASME), National Association of Elevator Contractors (NAEC), Canadian Standards Association (CSA), and National Association of Elevator Contractors (North America), in the region.

The American Society of Mechanical Engineers (ASME) has developed eight major codes addressing safety in the design, construction, inspections, testing, maintenance, installation, operation, alteration, and repair of elevators, as well as for other types of lifts and moving walks. Additionally, ASME safety codes were mainly created to set a standard in the elevator industry to minimize accidents, injury, and costly downtime and further boost consistency in elevator construction and installation across North America. Several elevator safety system companies continue to provide complete elevator remodeling services, improvements, maintenance, renovations, repairs, and modernization for the vertical commute. In addition, key players in the market provide industry-leading safety systems by working directly with elevator manufacturers and installers, contributing to the increasing demand for North America elevator safety system market.

Strategic insights for the North America Elevator Safety System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

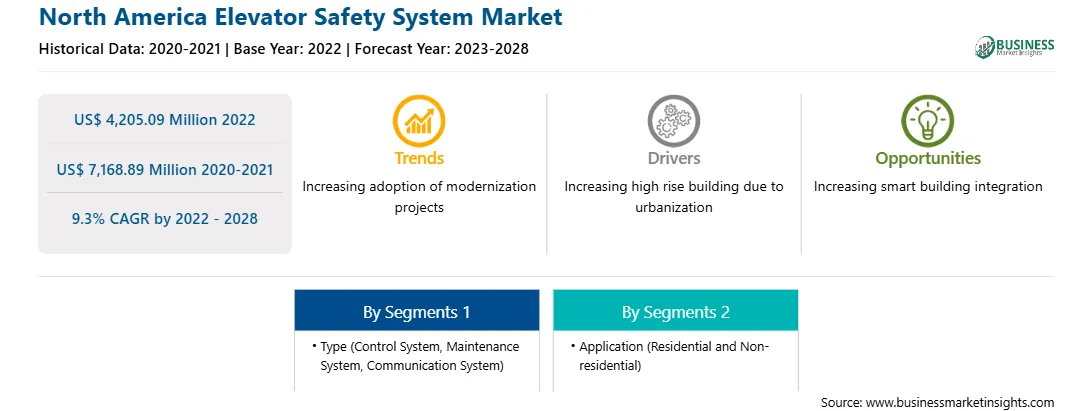

| Market size in 2022 | US$ 4,205.09 Million |

| Market Size by 2028 | US$ 7,168.89 Million |

| Global CAGR (2022 - 2028) | 9.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Elevator Safety System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Elevator Safety System Market Segmentation

The North America elevator safety system market is segmented into type, application, and country.

Based on type, the North America elevator safety system market is segmented into control system, maintenance system and communication system. The control system segment held the largest market share in 2022.

Based on application, the North America elevator safety system market is bifurcated into residential, and non-residential. The residential segment dominated the market share in 2022.

Based on country, the North America elevator safety system market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

2N Telekomunikace AS; Chr Mayr GmbH + Co KG; Electronic Controls Inc; Flexco Industries Inc; GAL Manufacturing Co LLC; Janus Elevator Products Inc; OLEO International Ltd; Otis Elevator Co; TK Elevator GmbH are the leading companies operating in the North America elevator safety system market.

The North America Elevator Safety System Market is valued at US$ 4,205.09 Million in 2022, it is projected to reach US$ 7,168.89 Million by 2028.

As per our report North America Elevator Safety System Market, the market size is valued at US$ 4,205.09 Million in 2022, projecting it to reach US$ 7,168.89 Million by 2028. This translates to a CAGR of approximately 9.3% during the forecast period.

The North America Elevator Safety System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Elevator Safety System Market report:

The North America Elevator Safety System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Elevator Safety System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Elevator Safety System Market value chain can benefit from the information contained in a comprehensive market report.