North America Electronic Design Automation Market

No. of Pages: 127 | Report Code: TIPRE00005732 | Category: Technology, Media and Telecommunications

No. of Pages: 127 | Report Code: TIPRE00005732 | Category: Technology, Media and Telecommunications

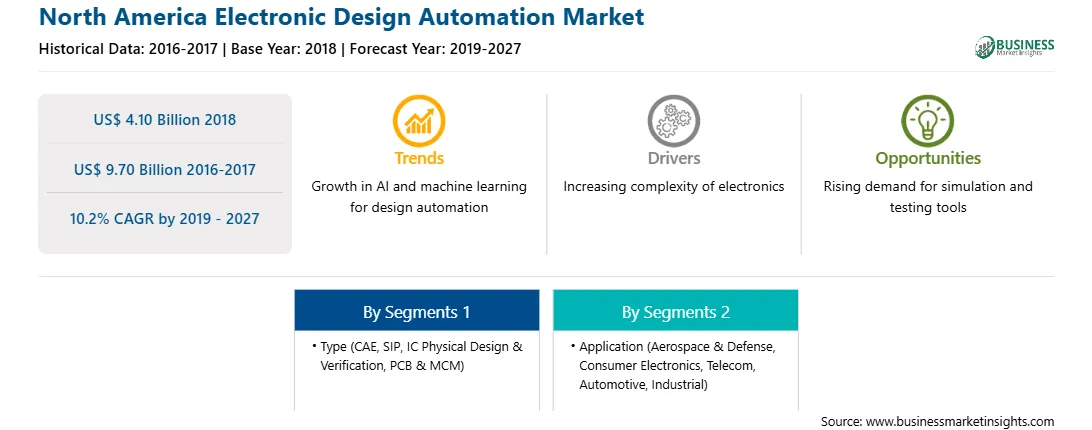

Electronic Design Automation market in North America is expected to grow from US$ 4.10 Bn in 2018 to US$ 9.70 Bn by the year 2027 with a CAGR of 10.2% from the year 2019 to 2027.

The significant growth of the semiconductor industry is boosting the growth of the electronic design automation market. Moreover, the increased focus on miniaturization of electronic devices is anticipated to propel electronic design automation market growth in the forecast period. Further, the increase in significant collaborations among electronic design automation players is driving market growth. The electronic design automation market is heavily captured by several established companies as well as smaller tier2 companies across the globe. These companies are facilitating the semiconductor manufacturers to meet the constantly increasing demand for advanced semiconductor products from their respective clients. Attributing to the fact, the semiconductor manufacturers are pressurizing the market players operating in the electronic design automation market to design robust chipsets and other semiconductor products. These electronic design automation market players are increasingly focusing on partnerships and acquisitions. Some of the recent partnerships and acquisitions in the electronic design automation market include; In 2018, Cadence Design Systems, Inc. announced a strategic partnership with Green Hills Software to accelerate embedded safety and security. Cadence Design Systems, Inc. invested $150 million that is about 16% ownership interest in GreenHill. In 2018, Synopsis and Siemens PLM Software partnered to provide a wide variety of EDA products. The collaboration is aimed at a number of electronic design automation domains ranging from design to verification.

The SIP type dominated the Electronic Design Automation market in the year 2018 with maximum share. However, the segment is expected to lose its dominance to CAE segment during the forecast period. Semiconductor IP is used for building large and complex ICs that are required in the electronic devices. Remarkable growth has been observed in the automotive industry’s semiconductor demand amid the progression of advancements in automotive electronics. Furthermore, dynamic rise for the demand of semiconductor in IT & Telecomm industry continued, especially for processor IP, which in turn, triggering memory semiconductor IP manufacturers to invest in expanding production capacity actively. Thus, this invest helps in bringing a positive outlook over the forecast period in the semiconductor IP market. Increasing demands for advanced system on chip designs has fueled the growth of the market to a significant extent. Further, the rising proliferation of consumer electronics in the North America region, specifically, is supplementing the adoption of semiconductor IP.

The US dominated the electronic design automation market in 2018 and is anticipated to continue its dominance in the market across the North American region through the forecast period. The semiconductor industry has remained critical to the national security, economic strength, and global technology leadership of North America. The US, in terms of the semiconductor industry, is not only the leading economy in North America but also a major contributor to the global market. Furthermore, being a technologically advanced country, the adoption of EDA software is anticipated to remain high. However, soon, the market might attain maturity, owing to the moderating semiconductor industry growth. The figure given below highlights the revenue share of the Mexico in the electronic design automation market in the forecast period:

Strategic insights for the North America Electronic Design Automation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 4.10 Billion |

| Market Size by 2027 | US$ 9.70 Billion |

| Global CAGR (2019 - 2027) | 10.2% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Electronic Design Automation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

NORTH AMERICA ELECTRONIC DESIGN AUTOMATION MARKET SEGMENTATION

By Type

By Application

By Country

Electronic Design Automation Market - Companies Mentioned

The List of Companies - North America Electronic Design Automation Market

The North America Electronic Design Automation Market is valued at US$ 4.10 Billion in 2018, it is projected to reach US$ 9.70 Billion by 2027.

As per our report North America Electronic Design Automation Market, the market size is valued at US$ 4.10 Billion in 2018, projecting it to reach US$ 9.70 Billion by 2027. This translates to a CAGR of approximately 10.2% during the forecast period.

The North America Electronic Design Automation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Electronic Design Automation Market report:

The North America Electronic Design Automation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Electronic Design Automation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Electronic Design Automation Market value chain can benefit from the information contained in a comprehensive market report.