Advancements in medical technology and innovations and an increase in investments in R&D by manufacturers have resulted in the launch of various medical devices, including ECMO. Market players are involved in various product development activities. In October 2020, FDA granted 510(k) clearance to Abiomed’s ECMO system called Abiomed Breethe OXY-1 System. It can be used for treating patients suffering from COVID-19 and cardiogenic shock. The system provides cardiopulmonary bypass support for patients whose lungs cannot provide sufficient end organ oxygenation. Similarly, in April 2020, Getinge received a temporary expansion of the availability of devices used for ECMO therapy in the US. As per this extension, Cardiohelp and HLS Advanced Sets can be used for >6 hours for COVID-19 patients with respiratory/cardiopulmonary support. Further, in February 2020, FDA cleared Novalung, a heart and lung support system used to treat acute respiratory and cardiopulmonary failure. Novalung is the first extracorporeal membrane oxygenation system to be cleared for more than six hours of use as extracorporeal life support. Many product approvals and developments in the ECMO market are enabling healthcare professionals to provide improved services. These developments help system manufacturers meet the rising demand for technically advanced systems that can efficiently treat patients suffering from cardiac and respiratory failure conditions. Thus, growing product development and approvals of ECMO products are expected to drive the growth of the North America ECMO market during the forecast period.

The North America is the largest market for ECMO. The US, Canada, and Mexico are main contributors to the regional market. The US dominated the North America ECMO market in 2022. According to the US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the US increased by 9.7% in 2019 to reach US$ 4.1 trillion in 2020. Furthermore, national health spending is expected to grow at a 5.4% annual rate from 2019 to 2028, and it is expected to reach US$ 6.2 trillion by 2028. The rising healthcare expenditure is estimated to increase the adoption of various equipment for patient care, which would fuel the demand for ECMO in the country during the forecast period. The prevalence of cardiovascular diseases in the US is much higher, as more than 50% population is suffering from different types of cardiovascular disease. According to the Centers for Disease Control and Prevention (CDC), every year, more than 0.6 million people die due to cardiovascular disease; this nearly accounts for one in every four deaths. The primary cause of cardiovascular disease among people is hypertension, obesity, and diabetes. According to the American Heart Association, in January 2019, it was reported that over 130 million or 45.1% of people are likely to have some form of cardiovascular disease by 2035. Thus, the growing prevalence of cardiovascular diseases is expected to propel the demand for ECMO in the coming years.

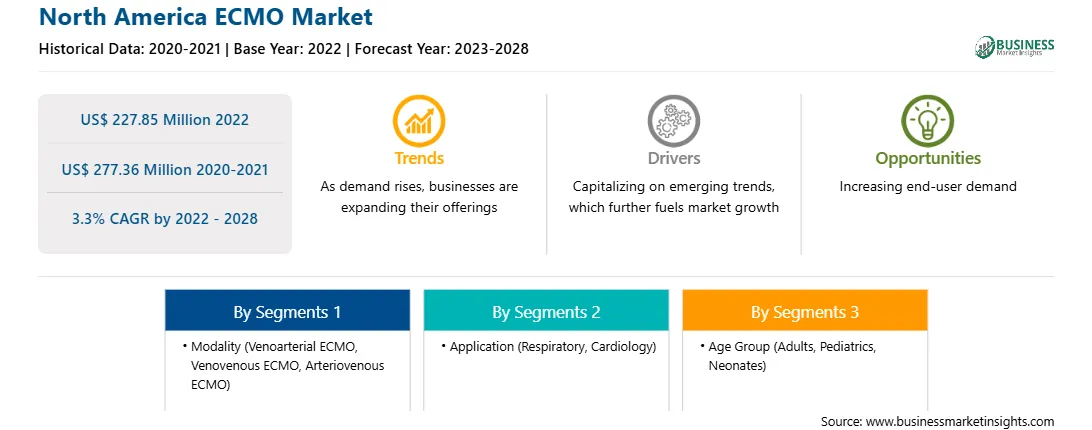

Strategic insights for the North America ECMO provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 227.85 Million |

| Market Size by 2028 | US$ 277.36 Million |

| Global CAGR (2022 - 2028) | 3.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America ECMO refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America ECMO market is segmented on the basis of modality, application, age group, and country.

Based on modality, the North America ECMO market is segmented into venoarterial ECMO, venovenous ECMO, and arteriovenous ECMO. The venoarterial ECMO segment held the largest market share in 2022.

Based on application, the North America ECMO market is bifurcated into respiratory and cardiology. The respiratory segment held a larger market share in 2022.

Based on age group, the North America ECMO market is segmented into adults, pediatrics, and neonates. The adults segment held the largest market share in 2022.

Based on country, the North America ECMO market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

ABIOMED Inc, Braile Biomedica, Eurosets S.R.L., Fresenius Medical Care AG & Co KGaA, Getinge AB, LivaNova Plc, Medtronic Plc, MicroPort Scientific Corporation, Nipro Medical Corporation, and Terumo Group are among the leading companies operating in the North America ECMO market.

The North America ECMO Market is valued at US$ 227.85 Million in 2022, it is projected to reach US$ 277.36 Million by 2028.

As per our report North America ECMO Market, the market size is valued at US$ 227.85 Million in 2022, projecting it to reach US$ 277.36 Million by 2028. This translates to a CAGR of approximately 3.3% during the forecast period.

The North America ECMO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America ECMO Market report:

The North America ECMO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America ECMO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America ECMO Market value chain can benefit from the information contained in a comprehensive market report.