North America is one of the technologically advanced regions with the presence of major economies, such as the US, Canada, and Mexico. The developed countries in the region are known for adopting advanced technologies, high standards of living, and developed infrastructure. North American countries have strong military departments, especially the US and Canadian military forces have adopted advanced technologies to provide soldiers a better version of military products and solutions. These countries are significantly investing in the military sector, which is influencing the growth of the drone simulator market. For instance, according to SIPRI data, the defense ministry of the US, Canada, and Mexico spent US$ 778,232 million, US$ 22,755 million, and US$ 6,116 million, respectively, in 2020. Rising military spending boosts the adoption of drone simulators. In North America, it has been observed that significant investments have been made in the development of artificial intelligence (AI). As, artificial intelligence has significance in the drone simulator. Moreover, North America has many manufacturers of drone simulators such as CAE Inc.; L3Harris Technologies, Inc.; and FRASCA International, Inc. Therefore, the presence of several drone simulator manufacturers and the growth of military expenditure are fueling the growth of the drone simulator market in North America.

North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities in the country, to control the spread of infection. The led the drone manufacturers and drone MRO service providers witness significant loss during the pandemic. The drone manufacturer’s production volume decreased drastically, thereby hindering the adoption rate of different simulation solution. However, the governments of the US and Canada have maintained their defense spending levels. For instance, the defense spending in the US reached US$ 778 billion in 2020, with a yearly increase on 4.4% which led several drone manufacturers, UGV manufacturers, weapon, and combat system manufacturers to expedite the procurement rate of simulation systems. As a result, the COVID-19 pandemic and its consequences have had a nominal impact on the Drone Simulator market in North America.

Strategic insights for the North America Drone Simulator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

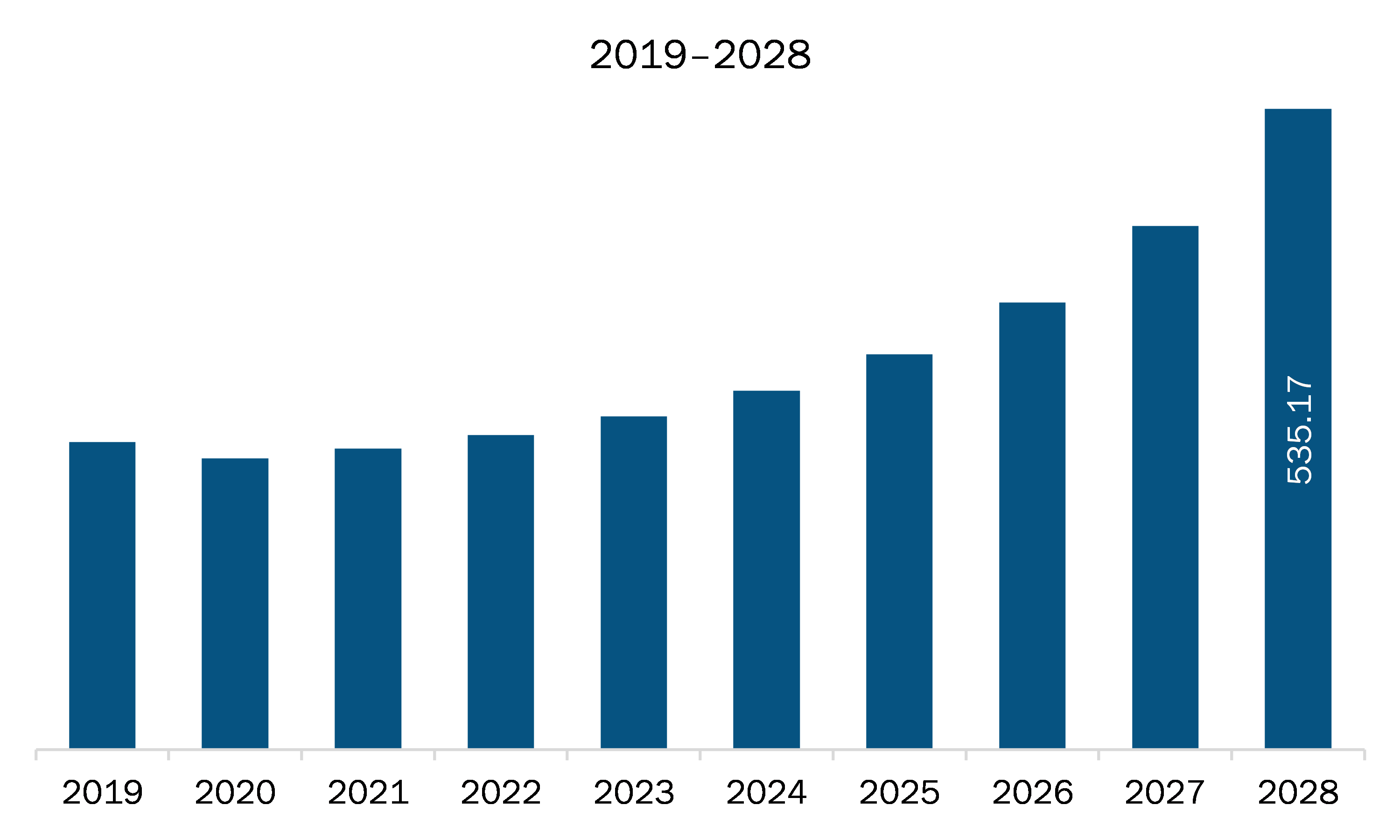

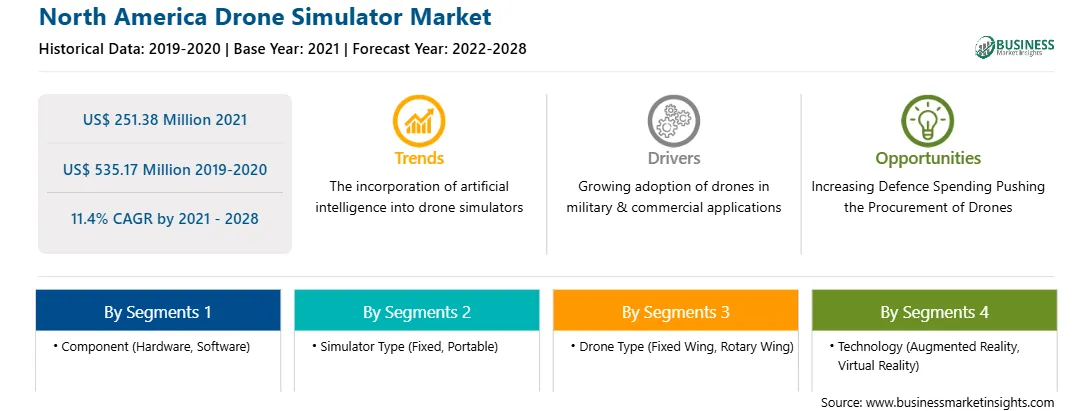

| Market size in 2021 | US$ 251.38 Million |

| Market Size by 2028 | US$ 535.17 Million |

| Global CAGR (2021 - 2028) | 11.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Drone Simulator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The drone simulator market in North America is expected to reach US$ 535.17 million by 2028 from US$ 251.38 million in 2021; it is estimated to grow at a CAGR of 11.4% from 2021 to 2028. sAmid the COVID-19 outbreak, drones were used for agriculture spraying and the delivery of medical supplies. They were also used by governments to monitor the compliance of social distancing rules. According to the NPD’s retail tracking service, consumer drone sales from March to November 2020 in the US have increased more than doubles (+114%) compared to the same timeframe in 2019. Also, owing to the high demand for drones in the defense sector, the installation of drone simulators has increased in the region. Therefore, the COVID-19 outbreak has had a positive impact on the North America drone simulator market.

North America drone simulator market is segmented into component, simulator type, drone type, technology, and country. Based on component, the North America drone simulator market is bifurcated into hardware and software. Hardware segment held the largest market share in 2020. Based on simulator type, the North America drone simulator market is bifurcated into fixed and portable. Fixed segment held the largest market share in 2020. Based on drone type, North America drone simulator market is bifurcated into fixed wing and rotary wing. Fixed wing segment held the largest market share in 2020. Similarly based on technology the North America drone simulator market is bifurcated into augmented reality and virtual reality. Virtual reality segment held the largest market share in 2020. Based on country, the North America drone simulator market is segmented into US, Canada, and Mexico. US held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the drone simulator market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BLUEHALO; CAE Inc.; General Atomics; HAVELSAN A.S.; Israel Aerospace Industries Ltd.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Quantum3D; SIMLAT UAS SIMULATION; and SINGAPORE TECHNOLOGIES ELECTRONICS LIMITED.

The North America Drone Simulator Market is valued at US$ 251.38 Million in 2021, it is projected to reach US$ 535.17 Million by 2028.

As per our report North America Drone Simulator Market, the market size is valued at US$ 251.38 Million in 2021, projecting it to reach US$ 535.17 Million by 2028. This translates to a CAGR of approximately 11.4% during the forecast period.

The North America Drone Simulator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Drone Simulator Market report:

The North America Drone Simulator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Drone Simulator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Drone Simulator Market value chain can benefit from the information contained in a comprehensive market report.