Today, the drone industry is considered one of the fastest-growing industries. Drones are used due to the growing need for safe, cost-effective solutions for data collection, mapping & surveying, inspection, logistics, etc. They can perform increasingly complex tasks such as data collection, mapping, and surveying in an extreme environment where manual surveying techniques are risky and impossible. Particularly, using mini and micro quad drones for scanning and surveying solutions is considered extremely beneficial in places where humans cannot perform tasks in a timely and efficient manner.

Various industry players are adopting drone technologies in construction, photography, agriculture, and other industries. Drones helps study aerial data in these industries that helps to provide accurate data in short, the time compared to manual surveying. It can simultaneously collect and provide critical information for a variety of fields, including agricultural fields, construction sites, building inspections, and mining inspections. Surveillance by these drones helps better analyze situations to make certain decisions beneficial to increase productivity. For example, surveillance of drones in agricultural fields helps detect insect and pest situations which can be treated and prevented with early analysis by drone. Thus, using drones as a cost-effective solution to increase productivity is fueling the demand for drones, further propelling the drone battery market.

North America is a hub of technological developments and has economically robust countries. The adoption of technologically advanced solutions in North America strengthens the region’s economy. Hence, being strong in technology, North America is a potential market for drone battery implementations. Owing to the wide application of drones in the industry such as agriculture and mining, various companies are developing drones for surveillance activities, which is driving the demand for drone batteries in the region. Further, several companies in the region are engaged in investing in expansions and strengthening drone technologies. These investments and funding are expected to help drone providers expand their business and provide solutions to various end users. The growing demand for drones is boosting the need for batteries to improve the performance of drones. Thus, rising investments in drones is expected to further contribute to the growing demand for drone batteries in North America.

Strategic insights for the North America Drone Battery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

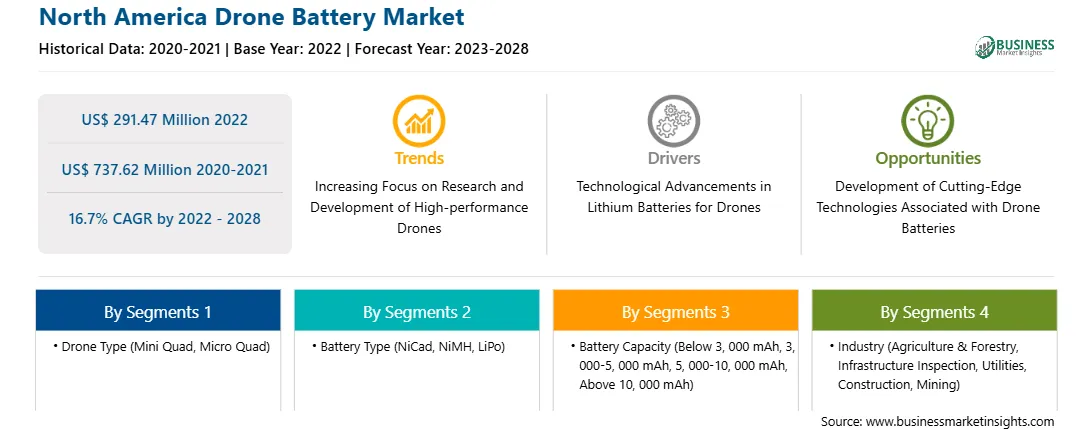

| Market size in 2022 | US$ 291.47 Million |

| Market Size by 2028 | US$ 737.62 Million |

| Global CAGR (2022 - 2028) | 16.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Drone Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Drone Battery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America drone battery market is segmented into drone type, battery type, battery capacity, industry, and country.

Based on drone type, North America drone battery market is segmented into mini quad and micro quad. The mini quad segment held the largest market share in 2022.

Based on battery type, North America drone battery market is segmented into below NiCad, NiMH, and LiPo. The LiPo segment held the largest market share in 2022.

Based on battery capacity, North America drone battery market is segmented into below 3,000 mAh, 3,000-5,000 mAh, 5,000-10,000 mAh, above 10,000 mAh. The below 3000 mAh segment held the largest market share in 2022.

Based on Industry, North America drone battery market is segmented into agriculture and forestry, infrastructure inspection, utilities, construction, mining, others. The agriculture and forestry segment held the largest market share in 2022.

Based on country, the North America drone battery market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

AMIT industries L.T.D; SES AI Corporation; RRC Power Solutions; Austin Else LLC; and SZ DJI Technology Co Ltd are the leading companies operating in the North America drone battery market.

The North America Drone Battery Market is valued at US$ 291.47 Million in 2022, it is projected to reach US$ 737.62 Million by 2028.

As per our report North America Drone Battery Market, the market size is valued at US$ 291.47 Million in 2022, projecting it to reach US$ 737.62 Million by 2028. This translates to a CAGR of approximately 16.7% during the forecast period.

The North America Drone Battery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Drone Battery Market report:

The North America Drone Battery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Drone Battery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Drone Battery Market value chain can benefit from the information contained in a comprehensive market report.