Simulation for Training Autonomous Vehicle Driving Systems Algorithm

Autonomous vehicles must undergo extensive research and testing in various environments to be used on the road. It is difficult to experience the uncommon and hazardous events required for thorough autonomous vehicle validation. These issues are addressed by NVIDIA DRIVe Sim, a physically accurate simulation platform that can produce synthetic data close to real-world situations. With DRIVE Sim, autonomous vehicle (AV) engineers can increase output, efficiency, and test coverage while reducing real-world driving and speeding up time to market. Using high-fidelity and physically accurate simulation, the driving simulator develops a cost-efficient, scalable method of introducing self-driving cars to the road. It uses foundational technologies, such as artificial intelligence (AI), to provide a robust, cloud-based computing platform that can produce a variety of real-world situations for the creation and validation of AV. A drive Simulator builds digital twins of actual settings using precision map data and can create datasets to test or train a vehicle's decision-making or perception systems. It can also be connected to the AV stack in software-in-the-loop (SIL) or hardware-in-the-loop (HIL) configurations to verify the entire integrated systems. Automakers are making significant investments in autonomous vehicle technology and forming alliances to develop exceptional autonomous vehicles since they require a lot of data to be collected and processed. The complete data set is shared among IoT-enabled vehicles and wirelessly uploaded to a cloud system, which is then analyzed and used to enhance automation. Here is a snapshot of the developments in the driving training stimulator market:

After commissioning the most modern Delta S3 DIL simulator, Honda R&D Co. extended its long-term partnership with Ansible Motion in December 2021. At its Sakura engineering site, the adaptable simulator's greater motion space and enhanced dynamic range will make it possible to build future road and race vehicles and the technologies that go with them efficiently.

Volvo Group and NVIDIA inked a contract in March 2021 to work together to create autonomous machines and commercial cars' decision-making systems. The final system will be developed to safely manage autonomous driving on public roads and highways using NVIDIA's end-to-end artificial intelligence platform for training, simulation, and in-vehicle computing.

Companies are investing in autonomous vehicle technology due to the rising demand for safer automobiles, which is the main factor behind the rise in the driving simulator market.

Market Overview

North American countries, such as the US, Canada, and Mexico, are very advanced in terms of road infrastructure and adopting the latest driving solutions. In the US, every year, sports events are conducted by several top automobiles and sports teams, such as Formula 1, Nascar, and Moto GP. These events are also becoming popular globally. Drivers participating in these events practice and use simulator solutions. The driving simulator is effectively used for studying driver and vehicle interaction and developing new vehicle systems. The driving simulator is necessary as drivers get a virtual experience of actual driving in a safe and tightly controlled environment. For example, in the U.S., Driving Tests provides free online driving simulator and is trusted by Driving School Association of the Americas, National Sheriff’s Association.

Strategic insights for the North America Driving Training Simulator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Driving Training Simulator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Driving Training Simulator Strategic Insights

North America Driving Training Simulator Report Scope

Report Attribute

Details

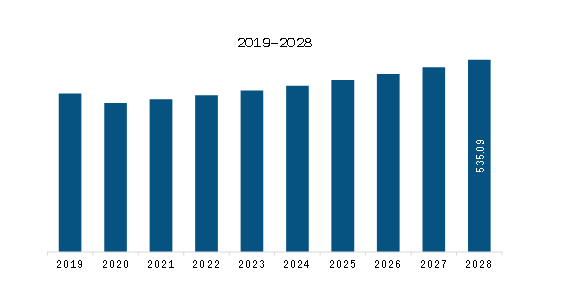

Market size in 2022

US$ 436.58 Million

Market Size by 2028

US$ 535.09 Million

Global CAGR (2022 - 2028)

3.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Simulator Type

By Vehicle Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Driving Training Simulator Regional Insights

North America Driving Training Simulator Market Segmentation

The North America driving training simulator market is segmented into simulator type, vehicle type, end user, and country.

Based on simulator type, the market is segmented into compact simulator and full scale simulator. The full scale simulator segment held the larger market share in 2022.

Based on vehicle type, the market is categorized into car simulator, truck and bus driving simulator, and others. The car simulator segment held the largest market share in 2022.

Based on end user, the North America driving training simulator market is segmented into driving training centres, automotive OEMS, and others. The driving training centres segment held the largest market share in 2022.

Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

AUTOSIM AS; Adacel Technologies Limited; CRUDEN B. V.; DALLARA; ECA Group; IPG Automotive GmbH; Moog Inc.; NVIDIA CORPORATION; TECKNOTROVE; and VI-GRADE GMBH are the leading companies operating in the driving training simulator market in the region.

The North America Driving Training Simulator Market is valued at US$ 436.58 Million in 2022, it is projected to reach US$ 535.09 Million by 2028.

As per our report North America Driving Training Simulator Market, the market size is valued at US$ 436.58 Million in 2022, projecting it to reach US$ 535.09 Million by 2028. This translates to a CAGR of approximately 3.4% during the forecast period.

The North America Driving Training Simulator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Driving Training Simulator Market report:

The North America Driving Training Simulator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Driving Training Simulator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Driving Training Simulator Market value chain can benefit from the information contained in a comprehensive market report.