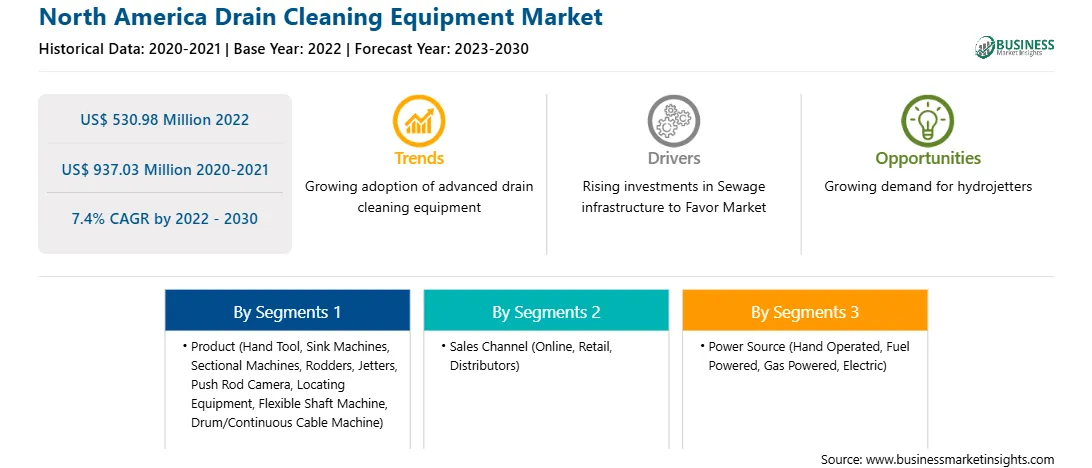

The North America drain cleaning equipment market was valued at US$ 530.98 million in 2022 and is expected to reach US$ 937.03 million by 2030; it is estimated to register a CAGR of 7.4% from 2022 to 2030.

Urbanization is the concentration of human populations in distinct locations. This concentration results in the conversion of land for residential, commercial, industrial, and transportation use. Continuously growing population and improvement in economic conditions are the key factors behind the urbanization globally. As per the data published by the United Nations in 2022, the world's population is predicted to grow by over 2 billion people in the next 30 years, from 8 billion in 2022 to 9.7 billion in 2050. Such a surge in the global population has directly and positively affected urbanization trends. According to the updated list of urban areas provided by the United States Census Bureau in December 2022, the US urban population increased by 6.4% between 2010 and 2020. Urban areas have become denser as a result of urbanization, with an average population density rising from 2,343 in 2010 to 2,553 in 2020.

APAC As per the data published by the United States Census Bureau 2023, in 2023, 1,469,800 building permits were issued. Owing to the growth in the total number of residential constructions, the need for effective drain systems increased, directly affecting the adoption of drain cleaning equipment positively.

North America is at the forefront of technology development and adoption. Thus, the development and adoption of drain cleaning equipment are more common than in other regions. The U.S. is one of the largest economies globally, with highly developed infrastructure. Mexico is experiencing an increase in its infrastructure development owing to the rapid growth of automotive and aerospace sectors in the country. According to the Mexican Chamber of Construction Industry, with the government's recent structural reforms, Mexico's construction industry can expand by 4–5% annually. The growth of the construction industry in Mexico will directly expand the drainage network, ultimately increasing the demand for drain cleaning equipment.

The demand for housing construction in the US is growing due to increased immigration, the need to replenish existing stock, and vacant units in a well-functioning market. In 2020, the US added 140.8 million housing units, including apartments, homes, and pre-fabricated homes. Thus, the growing population, along with increased urbanization, is further expected to drive the growth of North America's construction sector. The growth of the construction sector and the renovation of buildings are anticipated to positively influence the growth of the drain-cleaning equipment market in North America.

Strategic insights for the North America Drain Cleaning Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 530.98 Million |

| Market Size by 2030 | US$ 937.03 Million |

| Global CAGR (2022 - 2030) | 7.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Drain Cleaning Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America drain cleaning equipment market is categorized into product, sales channel, power source, and country.

Based on product, the North America drain cleaning equipment market is segmented into hand tool, sink machines, sectional machines, rodders, jetters, push rod camera, locating equipment, flexible shaft machine, and drum/continuous cable machine. The locating equipment segment held the largest North America drain cleaning equipment market share in 2022. Furthermore, the hand tool segment is subsegmented into snake, auger, plunger, and others. Additionally, the jetters segment is subcategorized into cart jetters, skid mounted jetters, and trailer jetters.

In terms of sales channel, the North America drain cleaning equipment market is segmented into online, retail, and distributors. The retail segment held the largest North America drain cleaning equipment market share in 2022.

By power source, the North America drain cleaning equipment market is divided into hand operated, fuel powered, gas powered, and electric. The electric segment held the largest North America drain cleaning equipment market share in 2022.

By country, the North America drain cleaning equipment market is segmented into the US, Canada, and Mexico. The US dominated the North America drain cleaning equipment market share in 2022.

RIDGID Inc, Nilfisk Holding AS, Spartan Tool LLC, Gator Drain Tools, Gorlitz Sewer & Drain Inc, Flowplant Group Ltd, Duracable Manufacturing Co, Electric Eel Manufacturing Co Inc, and Goodway Technologies Corp. are some of the leading companies operating in the North America drain cleaning equipment market.

The North America Drain Cleaning Equipment Market is valued at US$ 530.98 Million in 2022, it is projected to reach US$ 937.03 Million by 2030.

As per our report North America Drain Cleaning Equipment Market, the market size is valued at US$ 530.98 Million in 2022, projecting it to reach US$ 937.03 Million by 2030. This translates to a CAGR of approximately 7.4% during the forecast period.

The North America Drain Cleaning Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Drain Cleaning Equipment Market report:

The North America Drain Cleaning Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Drain Cleaning Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Drain Cleaning Equipment Market value chain can benefit from the information contained in a comprehensive market report.