Cosmetic surgical procedures have gained popularity over the years. In 2020, the top five cosmetic surgeries performed were nose reshaping, eyelid surgery, facelift, liposuction, soft tissue filler, chemical peel, laser skin resurfacing, Intense Pulsed Light (IPL) treatment, scar revision, and laceration repair.

As per the International Society of Aesthetic Plastic Surgery report, the US spent US$ 16.7 billion on cosmetic procedures, and South Atlantic recorded the highest number of cosmetic procedures performed in the country with ~3.8 million (25%) procedures. Furthermore, The Cleveland Clinic Foundation report states that liposuction is the second most commonly performed cosmetic surgery in the US and surgical procedure in patients between the age group of 35–64. Short surgery time (typically under 3 hours), short recovery period, unobstructed scars, permanent results, low complication rates, and low morbidity rates related to other surgical procedures are a few advantages associated with liposuction, which propel the demand for dermatology devices. Such aforementioned factors are driving the growth of the North America dermatology devices market.

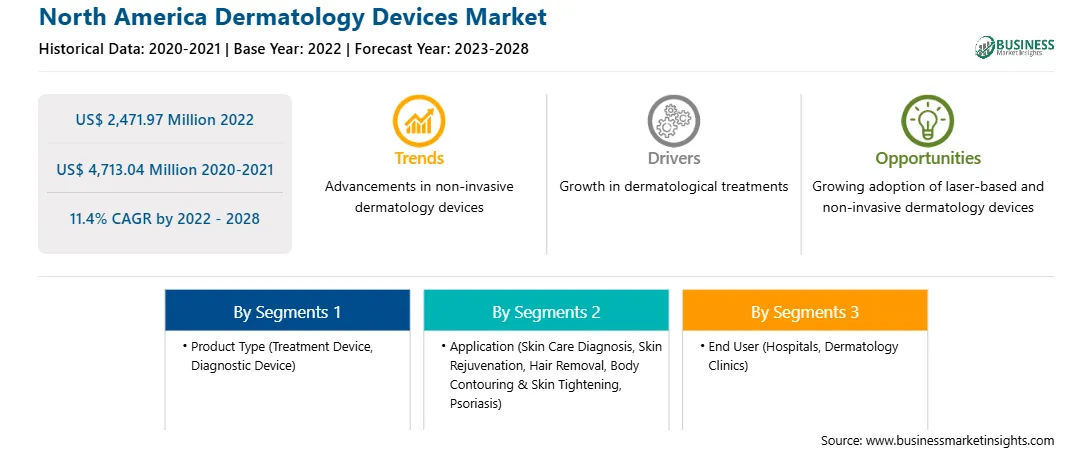

North America Dermatology Devices Market

Overview

The North America dermatology devices market is segmented into the US, Canada, and Mexico. North America holds the largest market for dermatology devices across the globe. Rising advanced diagnostic imaging & treatment techniques acts as a standalone factor responsible for the high adoption of dermatology devices in North America. Additionally, the rising prevalence of skin disorders and increasing awareness of aesthetic procedures led to lucrative opportunities for North America, thereby contributing to the overall growth of the dermatology devices market during the forecast period. According to estimates provided by The National Council on Skin Cancer Prevention report, skin cancer is the most common cancer in the US, with one in five Americans developing skin cancer in their lifetime. Approximately 9,500 people in the US are diagnosed with skin cancer every day, with two people dying of skin cancer in the US every hour. Additionally, the US comprises several skin disorders such as acne, psoriasis, rosacea, and others. Acne is the most common skin condition in the US, affecting 50 million Americans annually. Also, approximately 7.5 million people in the US have psoriasis among adults, with the highest proportion between ages 45 and 64. In addition, the US also witnessed growth owing to the presence of top competitive players involved in launching innovative medical device product portfolios. For instance, in January 2020, 3Derm Systems, Inc. (3Derm), a pioneer in the skin imaging & diagnostics industry, announced granting of two Food and Drug Administration (FDA) breakthrough device designations intended for 3DermSpot, an algorithm that uses Artificial Intelligence (AI) and highly standardized skin images that autonomously detect melanoma, squamous cell carcinoma, and basal cell carcinoma. Such factors are responsible for accelerating the demand for dermatology devices in the US.

North America Dermatology Devices Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Dermatology Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,471.97 Million |

| Market Size by 2028 | US$ 4,713.04 Million |

| Global CAGR (2022 - 2028) | 11.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Dermatology Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Dermatology Devices Market Segmentation

The North America dermatology devices market is segmented on the basis of product type, application, end user, and country. Based on product type, the North America dermatology devices market is bifurcated into treatment device and diagnostic device. The treatment device segment held a larger share of the market in 2022.

Based on application, the North America dermatology devices market is segmented into skin cancer diagnosis, skin rejuvenation, hair removal, body contouring & skin tightening, psoriasis, and others. The skin cancer diagnosis segment held the largest share of the North America dermatology devices market in 2022.

Based on end user, the North America dermatology devices market is segmented into hospitals, dermatology clinics, and others. The hospitals segment held the largest share of the market in 2022.

Based on country, the North America dermatology devices market is segmented into the US, Canada, and Mexico. The US dominated the North America dermatology devices market in 2022.

Aerolase Corp, Alma Lasers, Candela Corporation, Cutera Inc., Cynosure, El.En. S.p.A., FotoFinder Systems GmbH, Leica Microsystems, Lumenis, and Solta Medical are the leading companies operating in the North America dermatology devices market.

The North America Dermatology Devices Market is valued at US$ 2,471.97 Million in 2022, it is projected to reach US$ 4,713.04 Million by 2028.

As per our report North America Dermatology Devices Market, the market size is valued at US$ 2,471.97 Million in 2022, projecting it to reach US$ 4,713.04 Million by 2028. This translates to a CAGR of approximately 11.4% during the forecast period.

The North America Dermatology Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Dermatology Devices Market report:

The North America Dermatology Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Dermatology Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Dermatology Devices Market value chain can benefit from the information contained in a comprehensive market report.