Oral squamous cell carcinoma (OSCC) is the most common oral cavity cancer, constituting 95% of all cancers of this area. OSCC can be localized in the floor of the mouth, tongue, upper and lower gingiva, buccal mucous membrane, the retromolar triangle, and the palate. Every year, over half a million new cases of OSCC are diagnosed worldwide. According to the Global Cancer Observatory (GCO), the annual incidence of OSCC was 377,713 cases globally in 2020, with the number recorded in North America (27,469). According to the same source, the incidence of OSCC is anticipated to rise by up to 40% by 2040, with a corresponding increase in death rates. Smoking and alcohol consumption are among the two major risk factors for oral cancer, and it works collectively to increase the risk by up to 35%. Imaging studies are performed as part of the routine work-up in OSCC. Dental radiographs, panoramic radiographs, magnetic resonance imaging with diffusion-weighted and dynamic sequences, perfusion computed tomography, cone beam computed tomography, single-photon emission computed tomography, hybrid methods (PET/CT, PET/MRI, and SPECT/CT), and ultrasound are the imaging modalities used for this purpose. Cross-sectional imaging has become the foundation in the pretreatment evaluation of oral cancer, as it provides accurate information about the extent and spread of the disease that can help decide the appropriate management strategy and indicate prognosis. Thus, the rising prevalence of oral cancer drives the demand for radiographs, also referred to as x-rays, which boosts the growth of the North America dental radiography equipment market.

North America Dental Radiography Equipment Market Overview

The North America dental radiography equipment market is segmented into the US, Canada, and Mexico. The North America dental radiography equipment market is estimated to have the largest share in the US. The growth of the dental radiography equipment market in the US can be attributed to significant growth in the aging population across the country, regular dental check-ups, and technological improvements across the region. In the US population, untreated caries is present in more than 1 in 5 adults. A research study titled “Update on the Prevalence of Untreated Caries in the US Adult Population, 2017–2020,” published in December 2021, stated that the estimated prevalence of coronal and root caries was 17.9% and 10.1%, respectively, in the US, and the conditions were most prevalent in males belonging to the age group 30–49. Furthermore, the prevalence of untreated caries accounts for ~20% among adults in the country. Therefore, the high prevalence of dental diseases is anticipated to raise the demand for dental disease diagnosis through dental radiographs (X-rays). Moreover, technological advancements in dental imaging methodologies are allowing companies to launch new and innovative products. For instance, in October 2019, Dentsply Sirona, a US-based dental equipment manufacturer, launched Schick AE, a new generation of intraoral sensors with multiple technological improvements and optimizations.

North America Dental Radiography Equipment

Market Revenue and Forecast to 2028 (US$ Million)

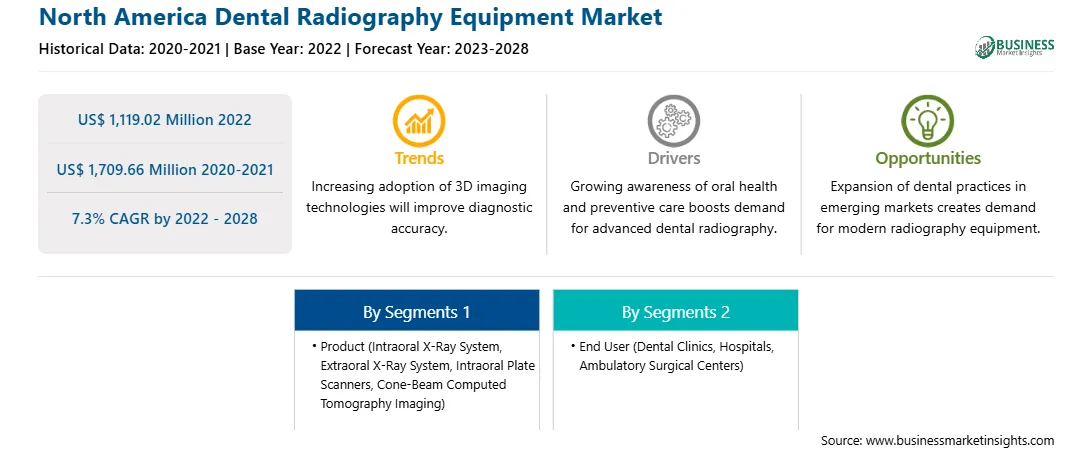

Strategic insights for the North America Dental Radiography Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,119.02 Million |

| Market Size by 2028 | US$ 1,709.66 Million |

| Global CAGR (2022 - 2028) | 7.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Dental Radiography Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Dental Radiography Equipment Market Segmentation

The North America dental radiography equipment market is segmented into product, end user, and country. Based on product, the market is subsegmented into intraoral X-ray system, extraoral X-ray system, intraoral plate scanners, and cone-beam computed tomography imaging. The intraoral X-ray system segment registered the largest market share in 2022.

Based on end user, the North America dental radiography equipment market is segmented into dental clinics, hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2022.

Based on country, the North America dental radiography equipment market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

Acteon Group; Carestream Dental LLC; Dentsply Sirona Inc.; Envista Holdings Corporation; General Electric Co; Koninklijke Philips NV; Planmeca; Siemens Healthcare GmbH; and Vatech Co., Ltd are among the leading companies operating in the North America dental radiography equipment market.

The North America Dental Radiography Equipment Market is valued at US$ 1,119.02 Million in 2022, it is projected to reach US$ 1,709.66 Million by 2028.

As per our report North America Dental Radiography Equipment Market, the market size is valued at US$ 1,119.02 Million in 2022, projecting it to reach US$ 1,709.66 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The North America Dental Radiography Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Dental Radiography Equipment Market report:

The North America Dental Radiography Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Dental Radiography Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Dental Radiography Equipment Market value chain can benefit from the information contained in a comprehensive market report.