The increasing prevalence of dental diseases is one of the main factors contributing to the growth of the dental industry. According to the National Center for Health Statistics (US), in April 2021, ~13.2% of children (5–19 years) and 25.9% of adults (20–44 years) in North America had untreated dental caries. Additionally, the National Center for Health Statistics reported that 64.9% of US adults with age 19 and older and 85.9% of children of age 2–17 visited the dentist at least once in 2019; in March 2020, ~3.5 billion people suffered from dental conditions such as untreated tooth decay (dental caries).Therefore, the increasing number of dental clinics and dentists offering extensive dental care in response to the rising prevalence of dental diseases and escalating geriatric population drives the dental CAD/CAM market growth. According to the United Nations World Aging Population, about 703 million people worldwide aged 65 or older in 2019, and the number is expected to double to 1.5 billion in 2050. Oral health is directly linked to aging due to biological, behavioral, and socioeconomic factors, thus leading to deterioration in oral health among the geriatric population. As the geriatric population is increasing worldwide, the demand for dental procedures is also likely to surge, thereby fueling the growth of the dental CAD/CAM market.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America dental CAD/CAM market growth at a notable CAGR during the forecast period.

Strategic insights for the North America Dental CAD/CAM provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

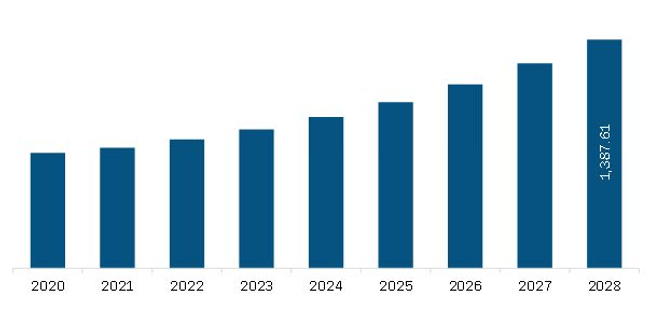

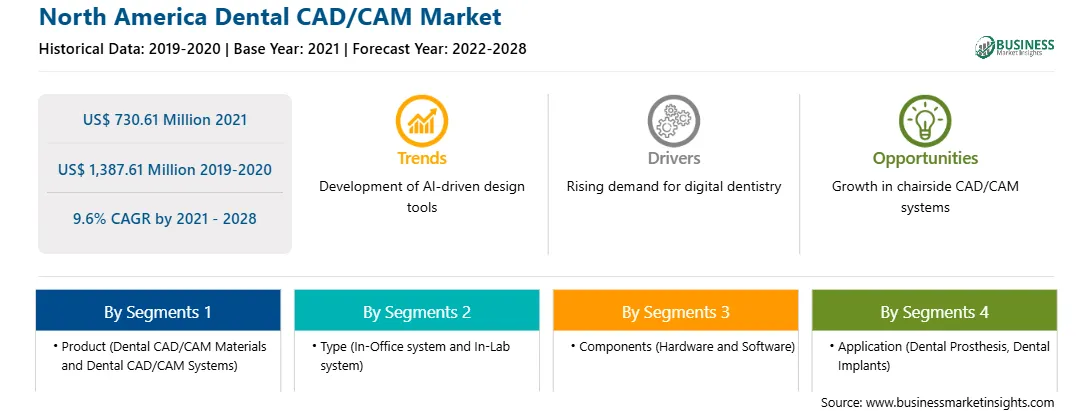

| Market size in 2021 | US$ 730.61 Million |

| Market Size by 2028 | US$ 1,387.61 Million |

| Global CAGR (2021 - 2028) | 9.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Dental CAD/CAM refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America dental CAD/CAM market is segmented on the basis of product, type, components, application, and end user. Based on product type, the market is segmented into dental CAD/CAM materials and dental CAD/CAM systems. The North America dental CAD/CAM market, by type, is segmented into in-office system and in-lab system. Based on component, the North America dental CAD/CAM market is segmented into hardware and software. The North America dental CAD/CAM market, based on application, is segmented into dental prosthesis, dental implants, and others. Based on end user, the market is segmented into dental clinics, dental laboratories, milling centres, and others. In terms of country, the North America dental CAD/CAM market is segmented into the (US, Canada, Mexico).

Dentsply Sirona, PLANMECA OY, Zimmer Biomet, Carestream Dental LLC, ENVISTA HOLDINGS CORPORATION, 3M, Ivoclar Vivadent AG, DATRON AG, Align Technology, Inc., Institute Straumann AG, Amann Girrbach AG, Roland DGA Corporation, and CIM system are among the leading companies in the North America dental CAD/CAM market.

The North America Dental CAD/CAM Market is valued at US$ 730.61 Million in 2021, it is projected to reach US$ 1,387.61 Million by 2028.

As per our report North America Dental CAD/CAM Market, the market size is valued at US$ 730.61 Million in 2021, projecting it to reach US$ 1,387.61 Million by 2028. This translates to a CAGR of approximately 9.6% during the forecast period.

The North America Dental CAD/CAM Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Dental CAD/CAM Market report:

The North America Dental CAD/CAM Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Dental CAD/CAM Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Dental CAD/CAM Market value chain can benefit from the information contained in a comprehensive market report.