Unmanned aerial vehicles (UAV) have been designed and developed for military and civilian applications. The UAV manufacturing sector in North America is in the growth phase of its life cycle. These vehicles are widely used for fighter combat, surveillance, aircraft carrier operations, stealth missions, and military communications applications. The drone technology is interdisciplinary with the integration of aerospace structures, telemetry, electronics, and other components. The production of UAVs requires a substantial number of electronic components for the data recording and transmission applications, and also for avionic functions. The antennas are among the most vital electronic components of any UAV, as these antennas enable the vehicle to transmit data to and receive data from other systems, as well as the people on the ground. The antennas which are utilized on unmanned vehicles are, in general, flexible, rugged dipole or blade antennas with the omnidirectional coverage. Thus, as UAVs' demand increases across North America, the need for a broader range of antennas increases for data communications systems, payloads, command and control systems. Factors such as growing drone procurement by military forces due to higher defense budgets and rising interest in circular omni directional antennas are expected to drive the North America defense drone antenna market. Furthermore, in case of COVID-19, North America is highly affected specially the US. North America is one of the most important regions for the adoption and growth of new technologies owing to favorable government spending capabilities, the presence of a drone manufacturing companies, UAV component manufacturing companies, and high purchasing power, especially in developed countries such as the US and Canada. The majority of the manufacturing plants in region are either temporarily shut or operating with minimum staff; the supply chain of components and parts is disrupted; these are some of the critical issues faced by the country. Since the US has a larger density of UAV manufacturers and component manufacturers, the outbreak has severely affected the production of each. The lower number of manufacturing staff has resulted in fall in production quantity. In addition, the demand for defense equipment has been showcasing a slowdown since the outbreak of the virus in the country. The supply side shocks are some of the most noticeable effects of the pandemic’s impact on the defense sector. In addition, the US Department of Defense has postponed contracts for several UAV systems and their components across the globe, which is another concern for the antenna manufacturers, and this in turn is hindering the procurement rate.

Strategic insights for the North America Defense Drone Antenna provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

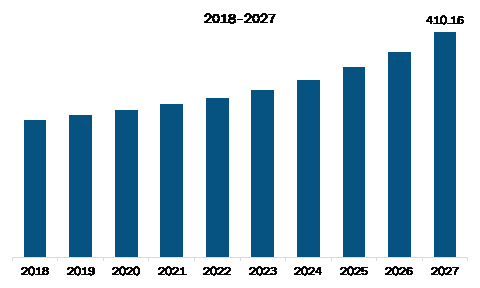

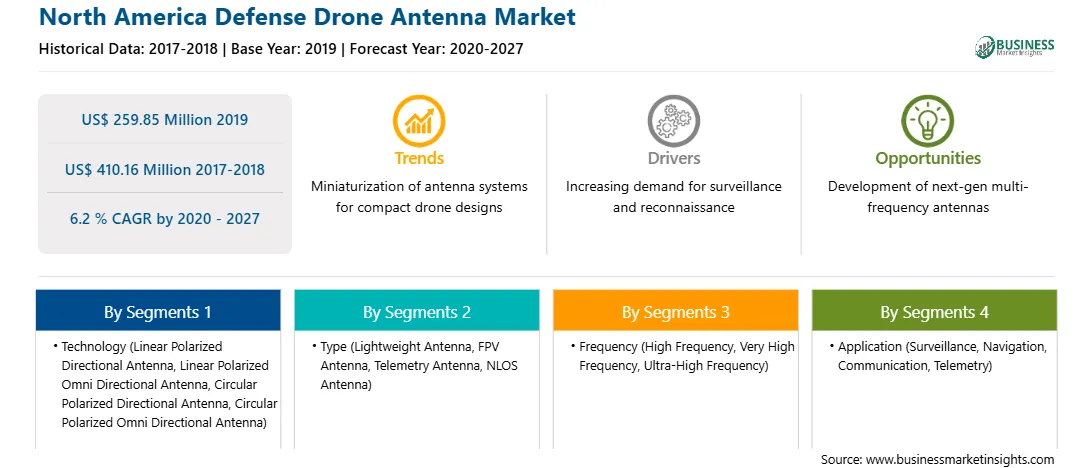

| Market size in 2019 | US$ 259.85 Million |

| Market Size by 2027 | US$ 410.16 Million |

| Global CAGR (2020 - 2027) | 6.2 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Defense Drone Antenna refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America defense drone antenna market is expected to grow from US$ 259.85 million in 2019 to US$ 410.16 million by 2027; it is estimated to grow at a CAGR of 6.2 % from 2020 to 2027. Progressive advancements in drone antenna is expected to affect the North America defense drone antenna market in a positive way. The stupendous increase in the drone usage among the defense forces across North America is leading several companies, universities, and research labs to channelize their efforts toward technological enhancements. An antenna is among the key technologies on unmanned aerial vehicles (UAVs) since the component facilitates the communication between the UAVs and Base Station (BS). With an objective to enhance the communication capabilities of the modern-day military UAVs, a group of researcher in North America has developed compact, sabre-like antenna that can switch between two radiation patterns for better communication coverage which is called novel antenna technology. The novel antenna technology incorporates two metal radiators; the first is a monopole radiator, while the second is a dipole radiator. The monopole radiator is perpendicular to the ground with an omnidirectional signal transmission pattern, and the dipole is parallel to the ground with a broadside pattern, which allows creating a signal that fills the technological gap of the blind spot (communication with satellites) in conventional sabre-like antennas. So the progressive advancements in drone antenna such as novel antenna technology is expected to increase the demand of drone antenna which will drive the North America defense drone antenna market.

In terms of technology, the linear polarized omni directional antenna segment accounted for the largest share of the North America defense drone antenna market in 2019. In terms of type, the lightweight antenna segment held a larger market share of the North America defense drone antenna market in 2019. Similarly, in terms of frequency, the ultra-high frequency segment held a larger market share of the North America defense drone antenna market in 2019. Further, the communication segment held a larger share of the market based on application in 2019.

A few major primary and secondary sources referred to for preparing this report on North America defense drone antenna market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alaris Holdings Limited; Antcom Corporation; Antenna Research Associates, Inc.; JEM Engineering; MP Antenna, LTD; SOUTHWEST ANTENNAS, INC; TE Connectivity; Trimble Inc.

The List of Companies - North America Defense Drone Antenna Market

The North America Defense Drone Antenna Market is valued at US$ 259.85 Million in 2019, it is projected to reach US$ 410.16 Million by 2027.

As per our report North America Defense Drone Antenna Market, the market size is valued at US$ 259.85 Million in 2019, projecting it to reach US$ 410.16 Million by 2027. This translates to a CAGR of approximately 6.2 % during the forecast period.

The North America Defense Drone Antenna Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Defense Drone Antenna Market report:

The North America Defense Drone Antenna Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Defense Drone Antenna Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Defense Drone Antenna Market value chain can benefit from the information contained in a comprehensive market report.