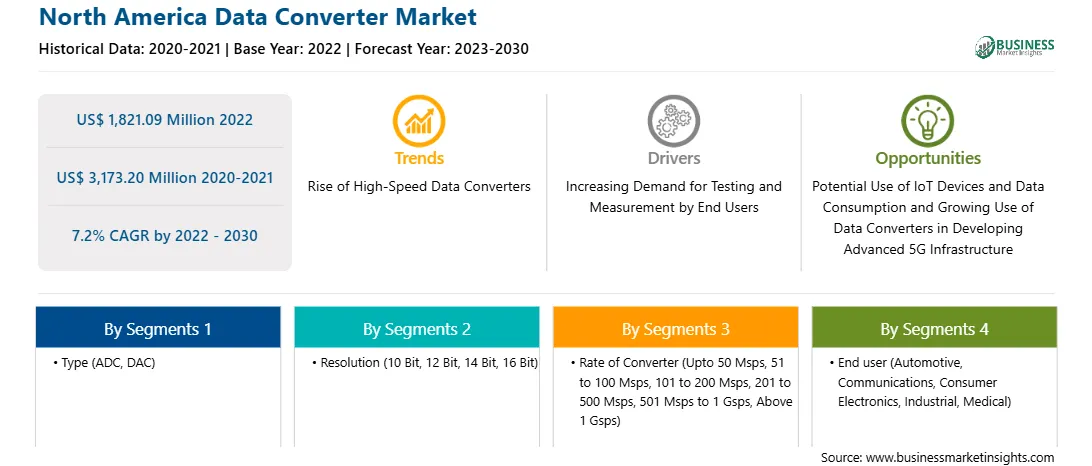

The North America data converter market was valued at US$ 1,821.09 million in 2022 and is expected to reach US$ 3,173.20 million by 2030; it is estimated to register a CAGR of 7.2% from 2022 to 2030.

5G operates at higher frequencies and wider bandwidths compared to previous generations. As 5G infrastructure expands across the world, from base stations to user devices, the need for high-speed data converters will grow across various segments for efficient signal processing. Due to the massive amount of data produced by several devices and increased data consumption by smartphones, high-bandwidth equipment used in wireless networks such as routers, repeaters, wireless antennas, and access points will experience congestion in data networking in the coming years. The deployment of 5G technology is anticipated to boost the demand for high-speed communication networks and network congestion control. The 5G technology is expected to enable aggregate data rates that are faster than those of the current 4G and 3G networks. The growth of 5G infrastructure would significantly increase the number of mobile subscribers, forming a requirement for developed infrastructure that can handle user data requests.

Governments of many countries are taking initiatives to increase their 5G infrastructure. In September 2023, the US National Science Foundation Directorate for Technology, Innovation and Partnerships (TIP) announced that it is tackling 5G communication infrastructure and operational challenges through a US$ 25 million investment to advance five convergent teams from Phase 1 to Phase 2 of NSF Convergence. NSF selected 16 teams for Phase 1 of Track G. Over the next two years, the Phase 2 teams will take part in an innovation and entrepreneurial curriculum that includes technology development, intellectual property, financial management and planning, sustainability planning, and communications and outreach. In April 2023, US Secretary of Commerce Gina M. Raimondo announced the launch of the Public Wireless Supply Chain Innovation Fund, which aimed to invest US$ 1.5 billion in the development of open and interoperable networks. Funded by the CHIPS and Science Act of 2022, this investment is part of the Biden-Harris Administration’s Investing in America agenda, aiming to drive wireless innovation, foster competition, and strengthen supply chain resilience. Thus, the growing use of data converters in developing 5G infrastructure and increasing government initiatives are expected to offer significant opportunities for the North America data converter market in the coming years.

The North America data converter market is segmented into the US, Canada, and Mexico. The market growth in the region is attributed to the rising demand for high-resolution images in healthcare applications. The improved image quality can enable quick diagnosis and treatment of any disease, enhancing physicians' productivity. The rising adoption of data converters in technologically advanced data acquisition systems further drives the growth of the market in North America. The electronics industry is shifting toward a trend that combines flexible software and modular hardware. Several market players are introducing data converters used in data acquisition systems. For instance, in November 2023, Texas Instruments TXN introduced device-screening specifications called space high-grade plastic (SHP) and SHP-compatible analog-to-digital converters (ADCs), namely ADC12DJ5200-SP and ADC12QJ1600-SP. TXN also bolstered its radiation-tolerant Space Enhanced Plastic (Space EP) portfolio with a new family of pulse-width modulation (PWM) controllers, namely TPS7H5005-SEP. Similarly, in December 2021, Texas Instruments Incorporated introduced the minimum 24-bit wideband analog-to-digital converter (ADC). The converter helps deliver industry-leading signal-measurement precision at wider bandwidths. The ADS127L11 can achieve ultra-precise data acquisition in a 50% smaller package, considerably optimizing power consumption, measurement bandwidth, and resolution for a wide range of industrial systems. Thus, all these factors surge the demand for data converters in North America during the forecast period. According to the article published by the Balance, in 2022, the automotive industry contributes more than US$ 1 trillion to the US economy each year. In the automotive industry, data converters are used for various applications, including wireless transceivers, to communicate with other vehicles or with a fixed network. Also, analog sensors such as automotive radar, LiDAR, and cameras require an ADC interface. Thus, the increasing application of data converters in the automotive industry is favoring the data converters market.

Texas Instruments Incorporated, Analog Devices, Omni Design Technologies, Synopsys, and Microchip Technology are the key data converter manufacturers operating in North America. Therefore, the parameters mentioned above are driving the growth of the North America data converter market.

Strategic insights for the North America Data Converter provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,821.09 Million |

| Market Size by 2030 | US$ 3,173.20 Million |

| Global CAGR (2022 - 2030) | 7.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Data Converter refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America data converter market is categorized into type, resolution, rate of converter, end user, and country.

Based on type, the North America data converter market is bifurcated ADC and DAC. The ADC segment held a larger market share in 2022.

By resolution, the North America data converter market is segmented into 10 bit, 12 bit, 14 bit, 16 bit, and others. The others segment held the largest market share in 2022. The 10 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 12 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 14 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 16 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The others bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps.

Based on rate of converter, the North America data converter market is segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1 Gsps, and Above 1 Gsps. The 501 Msps to 1 Gsps segment held the largest market share in 2022.

In terms of end user, the North America data converter market is segmented into automotive, communications, consumer electronics, industrial, medical, and others. The consumer electronics segment held the largest market share in 2022.

By country, the North America data converter market is segmented into the US, Canada, and Mexico. The US dominated the North America data converter market share in 2022.

Analog Devices Inc, Asahi Kasei Microdevices Corp, Cirrus Logic Inc, Microchip Technology Inc, On Semiconductor Corp, Renesas Electronics Corp, ROHM Co Ltd, STMicroelectronics NV, Teledyne Technologies Inc, and Texas Instruments Inc are some of the leading companies operating in the North America data converter market.

The North America Data Converter Market is valued at US$ 1,821.09 Million in 2022, it is projected to reach US$ 3,173.20 Million by 2030.

As per our report North America Data Converter Market, the market size is valued at US$ 1,821.09 Million in 2022, projecting it to reach US$ 3,173.20 Million by 2030. This translates to a CAGR of approximately 7.2% during the forecast period.

The North America Data Converter Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Data Converter Market report:

The North America Data Converter Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Data Converter Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Data Converter Market value chain can benefit from the information contained in a comprehensive market report.