North America Data Center Construction Market

No. of Pages: 83 | Report Code: TIPRE00005735 | Category: Technology, Media and Telecommunications

No. of Pages: 83 | Report Code: TIPRE00005735 | Category: Technology, Media and Telecommunications

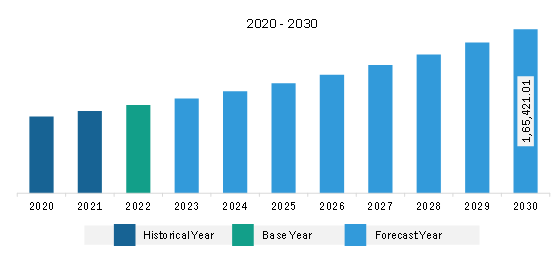

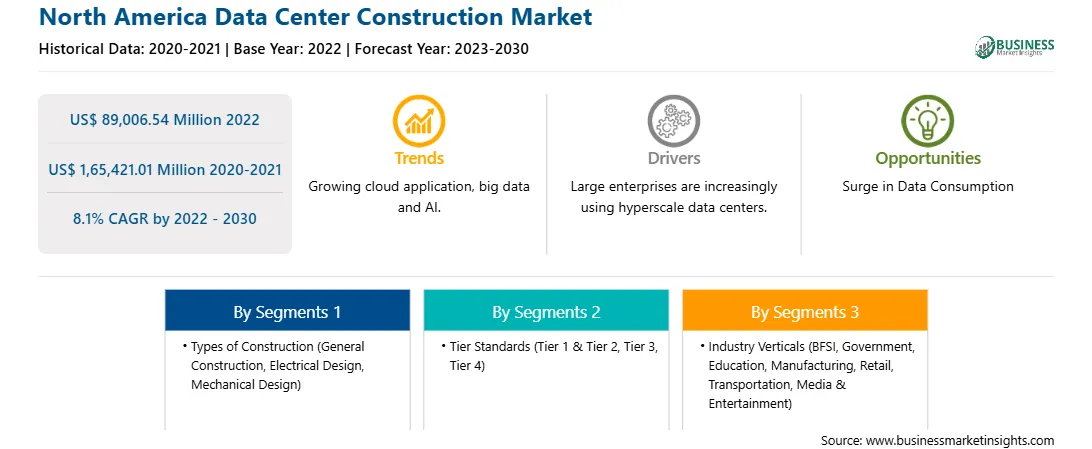

The North America data center construction market was valued at US$ 89,006.54 million in 2022 and is expected to reach US$ 1,65,421.01 million by 2030; it is estimated to register at a CAGR of 8.1% from 2022 to 2030.

A green data center is designed to achieve maximum energy efficiency and decrease the environmental impact. As a result, strategies to reduce carbon footprint are used within the data centers, including the use of low-emission building materials, minimizing carbon footprints, water and waste recycling, and making use of alternative energy technologies. These alternative technologies include heat pumps, photovoltaic, and evaporative cooling. To achieve energy efficiency and control operations costs, several companies, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are already implementing measures to reduce electricity and water usage in the data centers. Microsoft has made significant investments in renewable energy to power its data centers. The company has also implemented innovative cooling technologies, such as underwater data centers and modular data center designs, to improve energy efficiency and reduce water usage. Furthermore, these companies are installing water-saving cooling devices and energy-efficient equipment in addition to making essential changes in the data center's design. Although the construction of a green data center is initially expensive, it offers savings on operations, power, and maintenance in the long run. Also, green data centers offer a healthy work environment for the employees. Various companies are launching new green data centers. The increasing adoption of green data centers is anticipated to fuel the North America data center construction market in the coming years.

The data center construction market in North America witnessed continued growth in 2023 which was majorly attributed to the substantial rise in demand and blockchain from cloud providers. In the US, Texas, Austin, North California, and certain areas of San Antonio registered relatively higher cloud activity. However, the overall absorption and demand for data centers in the US and other prominent countries have been derived from the trends of the previous year.

The data center construction market in North America is increasing significantly. For instance, in October 2023, JE Dunn resumed construction on a US$ 800 million Meta data center project in Temple, Texas. Similarly, in April 2023, Equinix announced plans for the construction of a new data center in Montreal, Canada. Also, in November 2023, Vertiv introduced Vertiv SmartMod Max CW, a prefabricated modular data center designed to address the growing demand for rapid deployment of computing across North America. Thus, the data center construction market in North America is growing with the increasing number of data center launches.

Strategic insights for the North America Data Center Construction provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 89,006.54 Million |

| Market Size by 2030 | US$ 1,65,421.01 Million |

| Global CAGR (2022 - 2030) | 8.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Types of Construction

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Data Center Construction refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America data center construction market is segmented based on types of construction, tier standards, industry verticals, and country.

Based on types of construction, the North America data center construction market is segmented into general construction, electrical design, and mechanical design. The electrical design segment held the largest share in 2022.

In terms of tier standards, the North America data center construction market is segmented into tier 1 & tier 2, tier 3, and tier 4. The tier 3 segment held the largest share in 2022.

By industry verticals, the North America data center construction market is segmented into IT & telecommunication, BFSI, government, education, manufacturing, retail, transportation, media & entertainment, and others. The IT & telecommunication segment held the largest share in 2022.

Based on country, the North America data center construction market is categorized into the US, Canada, and Mexico. The US dominated the North America data center construction market in 2022.

Rittal GmbH & Co KG, Schneider Electric SE, DPR Construction Inc, STO Building Group Inc, AECOM, HOLDER CONSTRUCTION COMPANY, Turner Construction Co, and Eaton Corp Plc are some of the leading companies operating in the North America data center construction market.

The North America Data Center Construction Market is valued at US$ 89,006.54 Million in 2022, it is projected to reach US$ 1,65,421.01 Million by 2030.

As per our report North America Data Center Construction Market, the market size is valued at US$ 89,006.54 Million in 2022, projecting it to reach US$ 1,65,421.01 Million by 2030. This translates to a CAGR of approximately 8.1% during the forecast period.

The North America Data Center Construction Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Data Center Construction Market report:

The North America Data Center Construction Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Data Center Construction Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Data Center Construction Market value chain can benefit from the information contained in a comprehensive market report.