North America Data Center Colocation Market

No. of Pages: 122 | Report Code: TIPRE00026082 | Category: Technology, Media and Telecommunications

No. of Pages: 122 | Report Code: TIPRE00026082 | Category: Technology, Media and Telecommunications

The data center colocation market is anticipated to witness significant growth in North America, owing to a wide selection of data center service providers and suppliers of services such as colocation dedicated servers, managed hosting, IP transit, and cloud servers. The US and Canada are among the primary data center colocation markets in North America. Increase in concerns of the costs associated with running a data center, data storage issues, and non-availability of strategic locations for data centers have increased the demand for colocation facilities in North America. Business expansion has led to the increased requirements of space and utilities in the US. Data centers are enabling companies to strengthen their operations by taking advantage of high-quality managed data center services, which is bolstering the market growth. Rising enterprise demands for cost-effective solutions to reduce overall IT cost is the major factor driving the growth of the North America data center colocation market.

The COVID-19 pandemic has been affecting every business globally since December 2019. The continuous growth in the number of virus-infected patients compelled governments to put a bar on the transportation of humans and goods. The manufacturing sector witnessed severe loss due to temporary factory shutdowns and low production volumes, which hindered the growth of electronics & semiconductor, automotive, and retail sectors. Additionally, the social or physical distancing measures imposed by governments have put limitations on the operations of logistics and other service providers. This disruption resulted in the decline of the data center colocation market across all regions. Despite the disruption caused by the COVID-19 pandemic, the trade is likely to surge as businesses resume after a long lockdown measure. With social distancing measures in effect, the automotive, electronics & semiconductor, and other manufacturing industries have resumed their operations with less workforce capacity. In the last quarter of 2020, companies from many industries began their operations virtually and employees started to work from home, which has bolstered the demand for data centers. The sudden rise in the demand for increased server storage has fostered the growth of the data center colocation market and is expected to continue its growth during the forecast period.

Strategic insights for the North America Data Center Colocation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 18,550.54 Million |

| Market Size by 2028 | US$ 45,093.81 Million |

| Global CAGR (2021 - 2028) | 13.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Data Center Colocation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

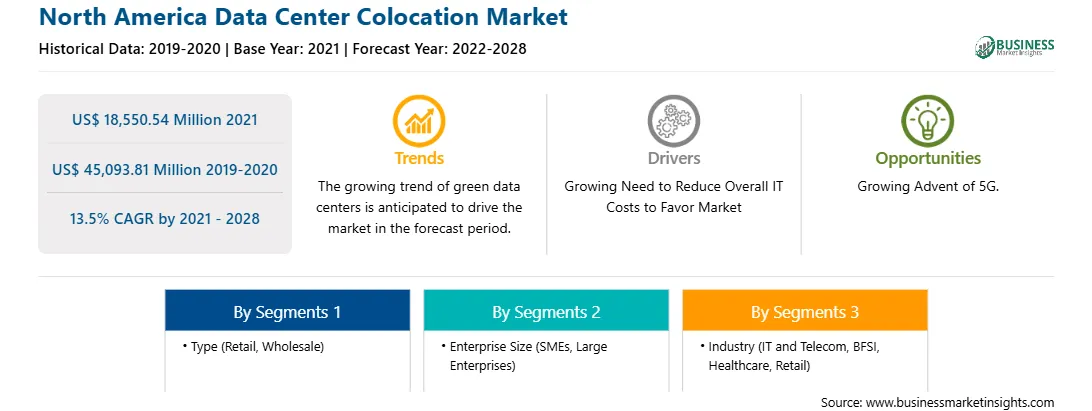

The data center colocation market in North America is expected to grow from US$ 18,550.54 million in 2021 to US$ 45,093.81 million by 2028; it is estimated to grow at a CAGR of 13.5% from 2021 to 2028. Edge computing has emerged as an ideal solution for companies involved in streamlining their data gathering processes and a large number of customers demanding low-latency streaming content. Companies can deliver faster services and free up valuable bandwidth for several other activities that are performed closer to the network’s core by relocating their considerable processing workloads to devices and edge data centers on the outer edges of the network. Moreover, the growth of edge computing significantly depends on the rapid adoption of devices enabled with the internet of things (IoT). The IoT edge devices have developed incredible applications across diverse industries with their capabilities to collect data beyond the reach of conventional networks and extend services with the use of cellular and Wi-Fi connections. However, these functionalities still require a backbone of infrastructure for operating effectively and efficiently. As a result, companies have begun to re-architect their corporate IT infrastructures with respect to colocation and interconnection points of presence. Through the combination of colocation services with regional edge computing data centers, companies can extend their edge network reach quickly and cost-effectively. E-commerce and retail sectors are embracing the edge data center. There is a growing demand for edge data centers in the pharmaceutical industry due to the regulatory requirements and generation of the humungous amount of data. The flexibility of not being dependent upon a centralized infrastructure enables enterprises to adapt quickly to developing markets and scale their data and computing requirements more efficiently. Thus, the increasing development in edge computing creates lucrative growth opportunities for the data center colocation market players.

The North America data center colocation market is segmented into type, enterprise size, industry, and country. Based on type, the market is segmented into retail and wholesale. The retail segment dominated the market in 2020 and wholesale segment is expected to be the fastest growing during the forecast period. Based on enterprise size, the data center colocation market is divided into SMEs and large enterprises. The large enterprises segment dominated the market in 2020 and SMEs segment is expected to be the fastest growing during the forecast period. Further, based on industry, the market is segmented into IT & Telecom, BFSI, healthcare, retail, and others. The IT & Telecom segment dominated the market in 2020 and BFSI segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on data center colocation market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AT&T Intellectual Property; CoreSite Realty Corporation; CyrusOne, Inc. ; Cyxtera Technologies, Inc. ; Digital Realty Trust LP ; Equinix Inc. ; NTT Communications Corporation ; Telehouse; and Verizon Partner Solutions. are among others.

The North America Data Center Colocation Market is valued at US$ 18,550.54 Million in 2021, it is projected to reach US$ 45,093.81 Million by 2028.

As per our report North America Data Center Colocation Market, the market size is valued at US$ 18,550.54 Million in 2021, projecting it to reach US$ 45,093.81 Million by 2028. This translates to a CAGR of approximately 13.5% during the forecast period.

The North America Data Center Colocation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Data Center Colocation Market report:

The North America Data Center Colocation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Data Center Colocation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Data Center Colocation Market value chain can benefit from the information contained in a comprehensive market report.