The presence of the world’s leading economies such as the US is the key driver for the growth of the current sampling resistance market in the region. Current sensing resistors are made of silicon or germanium and are used in nearly all industrial activities, including systems that support North America's technical competitiveness and national security. Various authorities believe that semiconductor technology and fabrication are crucial to the US's economic and national security goals. The US semiconductor industry dominates several elements of the semiconductor supply chain, such as resistors, capacitors, and motors. Semiconductors are another major American export. Further, the consumer electronics sector in North America is growing owing to the rising demand from developing countries. From 2012 to 2019, the retail revenue of the consumer electronics (CE) market in the US rose steadily. Prior to the COVID-19 pandemic, sales were expected to reach more than US$ 420 billion by 2020. The updated projection predicted sales of under US$ 407 billion in July 2020, a small drop from 2019. Consumer electronics retail sales in the US hit US$ 442 billion in 2021, according to projections. Smartphones were the items with the highest retail revenue in the consumer electronics industry, accounting for US$ 79 billion revenue in 2020. As a result, North American countries are producing more electronics, resulting in an increased demand for current sensing resistors and other components.

In case of COVID-19, North America is highly affected specially the US. North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities in the country, to control the spread of infection. Hence, the demand for passive components has steadily declined as a result of the suspension of operations in numerous industries, the closing of different production units, and people's unwillingness to enter the work force. Therefore, the COVID-19 epidemic and its repercussions have impacted the North America's current sampling resistance market in a negative manner.

Strategic insights for the North America Current Sampling Resistance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 576.48 Million |

| Market Size by 2028 | US$ 809.83 Million |

| Global CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Current Sampling Resistance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

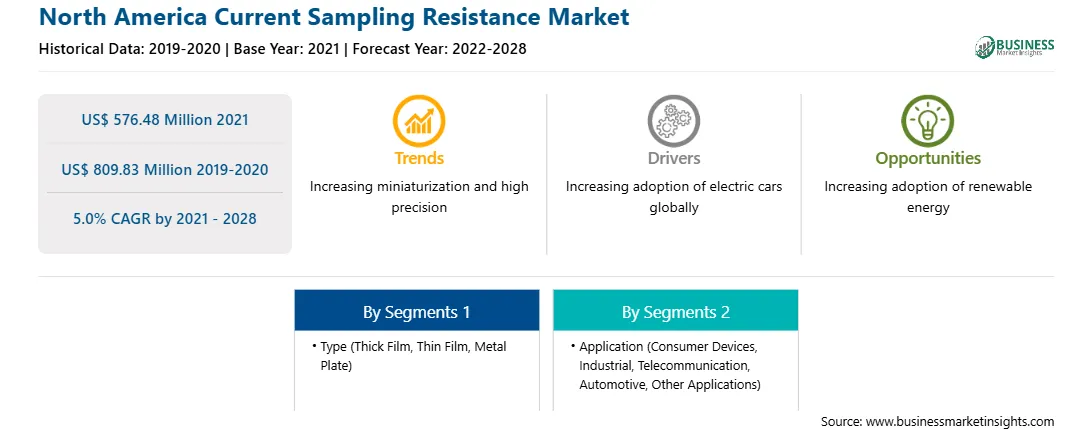

The North America current sampling resistance market is expected to grow from US$ 576.48 million in 2021 to US$ 809.83 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2021 to 2028. Surging large scale commercialization of IoT and IIoT will escalate the North America market in coming years. The use of the Internet of Things (IoT) and IIoT is constantly rising at a fast pace. According to the New Eclipse Foundation's IoT Commercial Adoption report, over 40% of industry executives indicate their businesses are adopting IoT solutions now, while another 22% say they expect to use IoT in the next two years. Furthermore, the poll found that IoT expenditure will rise, with 40% of companies expected to spend more on IoT solutions between 2020 and 2021. Further, government agencies across North America region are launching projects to make use of IoT technology. Components are critical because they allow IoT products and applications to gather, analyze, and send real-world signals and data. The adoption of IoT creates favorable possibilities for component manufacturers, as well as indicating that component sale to expand exponentially in the upcoming years across North America region.

In terms of type, the thick film segment accounted for the largest share of the North America current sampling resistance market in 2020. In terms of application, the industrial segment held a larger market share of the North America current sampling resistance market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America current sampling resistance market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cyntec Co., Ltd.; KOA Speer Electronics, Inc.; Panasonic Corporation; ROHM CO., LTD.; Samsung Electro-Mechanics Co, Ltd.; Susumu Co., Ltd; TT Electronics; Viking Tech Corporation; and Vishay Intertechnology, Inc.

The North America Current Sampling Resistance Market is valued at US$ 576.48 Million in 2021, it is projected to reach US$ 809.83 Million by 2028.

As per our report North America Current Sampling Resistance Market, the market size is valued at US$ 576.48 Million in 2021, projecting it to reach US$ 809.83 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The North America Current Sampling Resistance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Current Sampling Resistance Market report:

The North America Current Sampling Resistance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Current Sampling Resistance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Current Sampling Resistance Market value chain can benefit from the information contained in a comprehensive market report.