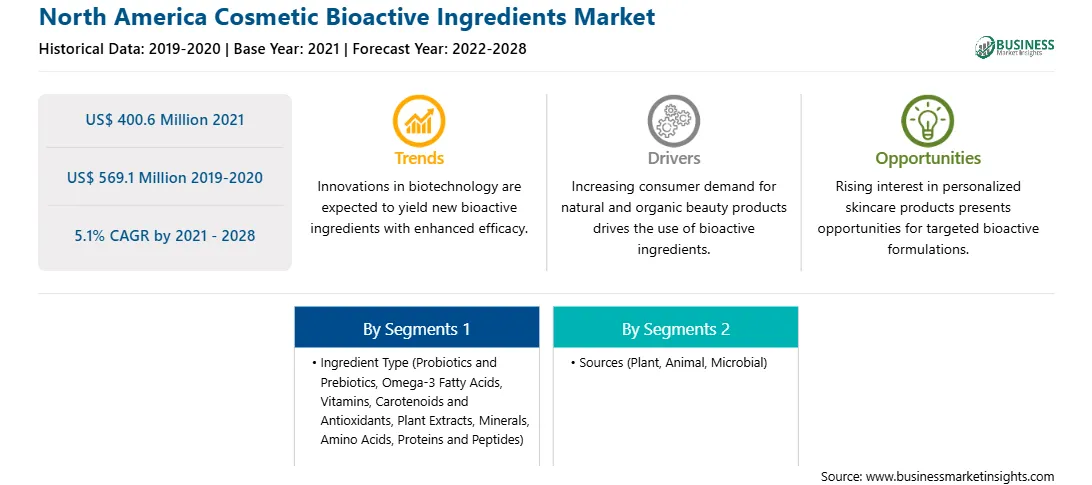

Amid the active ingredients usually used in cosmetics preparation, there is a global trend of incorporating vegetable source products due to their commercial appeal, safety, and rich composition, often related with a synergistic or multifunctional effect. Botanical extracts are high in secondary metabolites that exist in plants with high structural diversity. Both flavonoids and non-flavonoids are related to various cosmetic properties, such as photoprotection, antiaging, moisturizing, antioxidant, astringent, anti-irritant, and antimicrobial activity. With bioactive components and pharmacologic activities, bioactive ingredients provide dermatologic benefits with potential applications for skin rejuvenation, photoprotection, and wound healing. The North America cosmetic bioactive ingredients market growth is mainly attributed to rising preference for natural ingredients in cosmetic products and increasing launch of bioactive ingredients.

Moreover, the increasing research activities for development of bioactive ingredients is expected to bolster the market growth during the forecast period. However, stringent regulatory framework limits the growth of the North America cosmetic bioactive ingredients market.

Beauty habits change when the consumer is at home - a maximum number of women reported wearing little or no makeup when working from home. They are generally more relaxed and more focused on self-care than their beauty routines and makeup glamor. Working from home could be the “next to normal” for many, which will mean that some of the challenges/pressures will continue to affect the sector. Regardless of the channels and categories served, every brand has felt a profound impact from COVID-19 - those who can adapt quickly in these troubled times are ready to recover and be stronger on the other side of the pandemic. Based on the scenarios anticipated by global executives and current trends, we estimate that global beauty industry revenues could drop 20-30 percent in 2020, up to 35 percent. The short-term effects of the COVID-19 pandemic include changes in demand, revisions to the regulatory process, changes in the research and development process, and the shift towards e-commerce. The largest fashion and lifestyle e-commerce marketplace reported a boom in pampering and self-care beauty categories, including cosmetics, aromatherapy, and detox products; Sales of skin, nail, and hair care products increased compared to the previous year. The demand for beauty and personal care products is increasing. And demand is likely to remain buoyant even after the current crisis. These factors are expected to drive demand for North American cosmetic bioactive ingredients in the region over the forecast period.

Strategic insights for the North America Cosmetic Bioactive Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 400.6 Million |

| Market Size by 2028 | US$ 569.1 Million |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cosmetic Bioactive Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America cosmetic bioactive ingredients market is projected to reach US$ 569.1 million by 2028 from US$ 400.6 million in 2021; it is anticipated to grow at a CAGR of 5.1% from 2021 to 2028. In July 2020, the Institute for Environmental Solutions (IES) launched the study to develop bioactive cosmetic ingredients with high added value from the by-products of medicinal plants. The Pro-Enrich project, that is active since May 2018, is focused on developing novel functional proteins and bioactive ingredients from rapeseed, olive, tomato, and citrus. These proteins would have applications in food, cosmetics, pet food, and adhesives. Many cosmetic ingredients manufacturers are also focusing on collaborating with other research institutes.

In terms of ingredient type, the amino acids segment accounted for the largest share of the North America cosmetic bioactive ingredients market in 2020. Further, based on sources, the plant segment held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the cosmetic bioactive ingredients market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE; DuPont de Nemours, Inc.; FMC CORPORATION, Cargill, Incorporated, Sensient Technologies Corporation, DSM, Ajinomoto Co. Inc.; Roquette Frères; ADM; and Vytrus Biotech.

By Ingredient Type

By Sources

By Country

US

Canada

Mexico

The North America Cosmetic Bioactive Ingredients Market is valued at US$ 400.6 Million in 2021, it is projected to reach US$ 569.1 Million by 2028.

As per our report North America Cosmetic Bioactive Ingredients Market, the market size is valued at US$ 400.6 Million in 2021, projecting it to reach US$ 569.1 Million by 2028. This translates to a CAGR of approximately 5.1% during the forecast period.

The North America Cosmetic Bioactive Ingredients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cosmetic Bioactive Ingredients Market report:

The North America Cosmetic Bioactive Ingredients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cosmetic Bioactive Ingredients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cosmetic Bioactive Ingredients Market value chain can benefit from the information contained in a comprehensive market report.