Dental diseases are the most common noncommunicable diseases (NCDs), which affect people throughout their lives. The prevalence of the most important oral diseases continues to increase with changing lifestyles of the population of North America. According to the Centers for Disease Control and Prevention (CDC), over 85% of children and ~65% of adults (including people aged 65 and above) have various dental diseases. In addition, trauma resulting from factors such as tooth injury, oral or oral cavity, or teeth misalignment is common. According to the WHO, ~20% of people experience such trauma in the orodental region at some point in their lives. As stated by Nguyen Van Chuyen et al. in a research report published in July 2021, dental caries is a global health problem. Moreover, malocclusion is considered one of the most important dental health problems, along with periodontitis and tooth decay, according to a report published in Dentistry Journal in October 2021. The WHO considers its prevalence highly variable, with an estimated rate of 39% and 93% in children and adolescents, respectively. The prevalence of malocclusion is projected to rise in the coming years, thereby increasing the demand for invisible orthodontics, which, in turn, is boosting the cone beam computed tomography (CBCT) market. Dental treatment procedures are carried out with the assistance of digital imaging techniques. CBCT helps conduct anatomical characterization and find specific anomalies in dental implants through imaging. Moreover, CBCT helps make procedures more interactive and easier for dentists. Hence, the increasing prevalence of dental diseases bolsters the growth of the North America cone beam computed tomography market.

The North America cone beam computed tomography market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the increase in the incidence of breast cancer, the rise in product introduction in the region, and technological advancements in cone beam computed tomography. Factors such as a preventative approach to dental care and hygiene, access to independent clinics, and increased R&D activity in digital imaging in the region are also expected to fuel the market growth in the coming years. The US federal funding for Medicare & Medicaid is expected to boost the demand for digital imaging in dental care as patients pay fewer out-of-pocket expenses. The availability of new technologies and a huge patient base are a few other key factors contributing to the dominance of the North America cone beam computed tomography market.

Strategic insights for the North America Cone Beam Computed Tomography provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

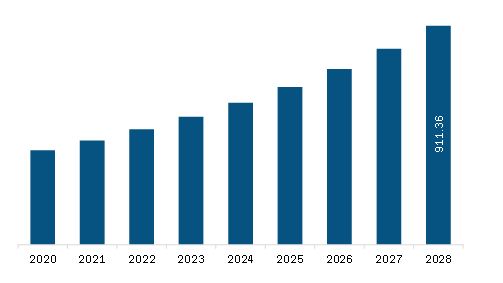

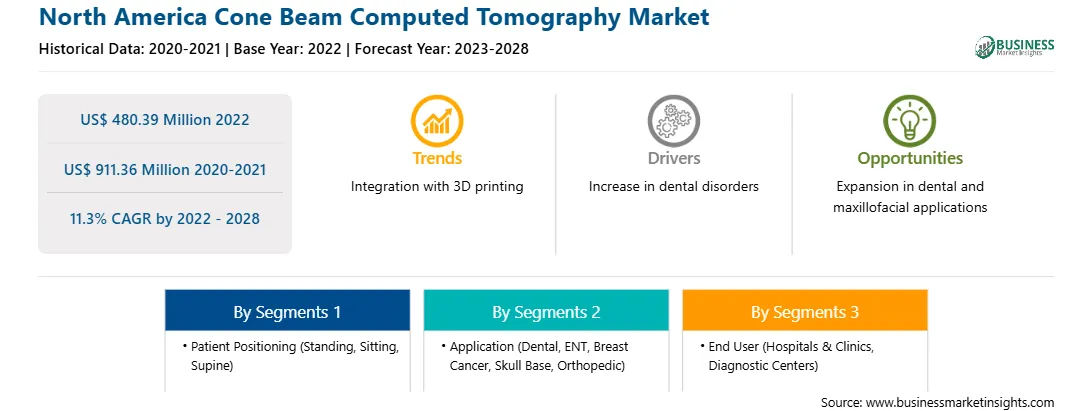

| Market size in 2022 | US$ 480.39 Million |

| Market Size by 2028 | US$ 911.36 Million |

| Global CAGR (2022 - 2028) | 11.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Patient Positioning

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cone Beam Computed Tomography refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America cone beam computed tomography market is segmented on the basis of patient positioning, application, end user, and country.

Based on patient positioning, the North America cone beam computed tomography market is segmented into standing, sitting, and supine. The standing segment held the largest share of the North America cone beam computed tomography market in 2022.

Based on application, the North America cone beam computed tomography market is segmented into dental, ent, breast cancer, skull base, orthopedic, and others. The dental segment held the largest share of the North America cone beam computed tomography market in 2022.

Based on end user, the North America cone beam computed tomography market is segmented into hospitals & clinics, diagnostic centers, and others. The hospitals & clinics segment held the largest share of the North America cone beam computed tomography market in 2022.

Based on country, the North America cone beam computed tomography market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America cone beam computed tomography market in 2022.

Dentsply Sirona Inc; Carestream Dental LLC.; Fussen Group; PreXion; Brainlab AG; Vatech Co., Ltd.; Planmeca Oy; and Canon Medical Systems are the leading companies operating in the North America cone beam computed tomography market.

The North America Cone Beam Computed Tomography Market is valued at US$ 480.39 Million in 2022, it is projected to reach US$ 911.36 Million by 2028.

As per our report North America Cone Beam Computed Tomography Market, the market size is valued at US$ 480.39 Million in 2022, projecting it to reach US$ 911.36 Million by 2028. This translates to a CAGR of approximately 11.3% during the forecast period.

The North America Cone Beam Computed Tomography Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cone Beam Computed Tomography Market report:

The North America Cone Beam Computed Tomography Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cone Beam Computed Tomography Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cone Beam Computed Tomography Market value chain can benefit from the information contained in a comprehensive market report.