North America includes the US, Canada, and Mexico. The market in North America held a significant share in the global market during the year 2020. The United States offers significant growth opportunities in the compounding pharmacies market, which is expected to drive the market’s growth at a considerable pace. Compounding pharmacy or compound pharmacy makes drugs prescribed by doctors for specific patients with needs that commercially available drugs can't meet. Pharmacists customize medication for skin conditions and rare diseases as per each patient's unique needs, as long as that drug is not available from a drug manufacturer. In the United States, as per the International Academy of Compounding Pharmacists (IACP), there are 56,000 community-based pharmacies and about half of them directly serve local patients and doctors. Moreover, as per IACP, 7,500 compounding pharmacies specialize in advanced compounding services; out of which 3,000 make sterile products. Compound drugs are exempt from FDA-approval as many compounding pharmacists mix up ingredients as per need. Therefore, these are regulated by state boards of pharmacy based on criteria set by the United States Pharmacopeia (USP) Convention. Most commonly compounded topicals are liquids, creams, ointments; others include lozenges, suppositories, and often capsules. However, Pills and tablets are not regularly compounded. Over the last ten years, the transmission of medications in alternative strengths, dosage forms, and flavors for infants and geriatric patients alone has driven a unique growth rate of compounding pharmacies. Apart from the advantages offered by compounding pharmacy, there are many start-ups that have been major reasons that specialty pharmacies are showing such a speedy growth as related to new opened pharmacy start-ups and pharmacies. Therefore, it has been estimated that about a 20% increase will be in the number of compounding pharmacies by 2020, and this trend will proceed further. Additionally, in the United States, compounding pharmacies account for more than 3% of all prescription drugs dispensed.

COVID-19 virus outbreak was first observed in December 2019 in Wuhan (China), and it has spread to ~100 countries across the world, with the World Health Organization (WHO) stating it as a public health emergency. The global impacts of COVID-19 are being felt across several markets. Although the healthcare sector had witnessed SARS, H1N1, and other outbreaks in the last few years, the severity of the COVID-19 has made the situation more complicated due to its mode of transmission. North America has been witnessing a growing number of COVID-19 cases since its outbreak. For instance, according to Worldometer, the number of cases increased to 30,081,657, with 547,234 deaths reported in the US as of March 22, 2021. The cases are also increasing in Mexico and Canada. In Mexico, the cases have reached 2,166,290, with 194,710 deaths. Similarly, in Canada, there are about 909,157 COVID cases, with 22,463 deaths reported so far. The COVID–19 pandemic outbreak has highly disrupted the socio-economy of various countries across the world. The majority of the people have lost their jobs during the pandemic. According to the Commonwealth Fund, the unemployment rate in mid-April 2020 was ~14.7%. In response to control the spread of the COVID–19 pandemic, many of the states-imposed lockdown resulting in the closing of many workplaces. It has dramatically slowed US economic activity in 2020. However, it has positively affected the few businesses in the US

Strategic insights for the North America Compounding Pharmacies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

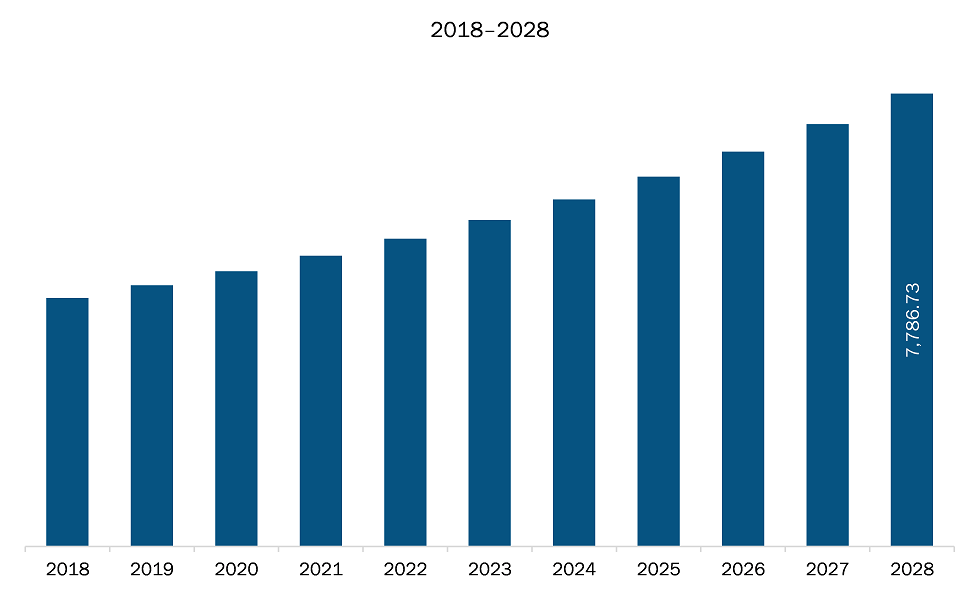

| Market size in 2021 | US$ 4,997.65 Million |

| Market Size by 2028 | US$ 7,786.73 Million |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Compounding Pharmacies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The compounding pharmacies market in North America is expected to grow from US$ 4,997.65 million in 2021 to US$ 7,786.73 million by 2028; it is estimated to grow at a CAGR of 6.5% from 2021 to 2028. Growing demand for compounding pharmacy during COVID-19; Due to the COVID-19 pandemic, the demand for compounding operations is increasing. The US FDA has released a note and allowed to compound certain hospital drugs used to treat patients on ventilators in response to soaring demand and shortage during the COVID-19 pandemic. As per new guidance, FDA policy applies to state-licensed pharmacies and federal facilities, which are regulated under Section 503A of the Federal Food, Drug, and Cosmetic Act. Due to increasing COVID-19 cases, on July 2020, Berkeley, CA-based Valor Compounding Pharmacy (Valor), has become a proactive partner in patient healthcare. The company produces medicines for patients as per their needs. Moreover, they designed several new programs, including flat-rate pricing for menopause, mental health, and erectile dysfunction; access to supplements to defend one's health from COVID-19; free shipping to patients' homes; and ValorConnect, after-hours support for doctors and patients to communicate with a pharmacist. Additionally, a newly-designed website provides interactive and user-friendly knowledge, providing to easily transfer or refill their medications and for physicians to prescribe online to Valor. This is bolstering the growth of the compounding pharmacies market.

Based on product, the market is segmented into oral medications, topical medications, suppositories, and others. In 2020, the oral medications segment held the largest share North America compounding pharmacies market. Based on therapeutic area, the market is divided into pain medications, hormone replacement therapies, dermatological applications, and others. In 2020, the pain medications segment held the largest share North America compounding pharmacies market.

A few major primary and secondary sources referred to for preparing this report on the compounding pharmacies market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Avella specialty pharmacy

The North America Compounding Pharmacies Market is valued at US$ 4,997.65 Million in 2021, it is projected to reach US$ 7,786.73 Million by 2028.

As per our report North America Compounding Pharmacies Market, the market size is valued at US$ 4,997.65 Million in 2021, projecting it to reach US$ 7,786.73 Million by 2028. This translates to a CAGR of approximately 6.5% during the forecast period.

The North America Compounding Pharmacies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Compounding Pharmacies Market report:

The North America Compounding Pharmacies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Compounding Pharmacies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Compounding Pharmacies Market value chain can benefit from the information contained in a comprehensive market report.