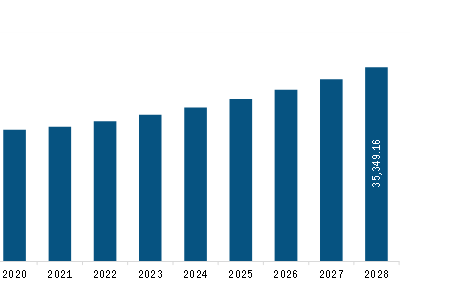

The North America composites market is expected to grow from US$ 25,512.91 million in 2022 to US$ 35,349.16 million by 2028. It is estimated to grow at a CAGR of 5.6% from 2022 to 2028.

Increasing Demand for Lightweight Materials from Automotive & Aerospace Industry fuels the North America Composites Market

Automotive manufacturers prefer lightweight materials for manufacturing automobiles while ensuring safety and performance. Lightweight materials have excellent potential for increasing fuel efficiency. A 10% decrease in vehicle weight can result in a 6–8% enhancement in fuel economy. Substituting cast iron and traditional steel components with lightweight materials such as high-strength steel, aluminium alloys, magnesium alloys, carbon fiber, and polymer composites can reduce the weight of a vehicle body, thereby reducing the fuel consumption of a vehicle. Advanced materials such as carbon fiber composites have the potential to reduce the weight of automotive components by 50-75%. The application of composites in the automotive sector continues to grow. Plastic composites have excellent acoustic and thermal properties compared to composites of non-renewable origin, making them ideal for vehicle’s interior parts. Further, they are suitable for the manufacturing of non-structural interior components, including seat fillers, seat backs, headliners, interior panels, and dashboards. Therefore, the high demand for composites from the automotive industry for the manufacturing of fuel-efficient, lightweight vehicles, coupled with growing sales of electric vehicles, is driving the North America composites market.

In addition, aircraft manufacturers are making efforts to enlarge primary thermoplastic structures in business jets and commercial aircraft. They have been the early adopters of long fiber-reinforced thermoplastics. Materials such as composites and polymers are significantly lighter than steel, brass, alloys, iron, etc. The use of these materials allows manufacturers to reduce the weight of airplane parts, subsequently facilitating fuel cost reductions. The development of super lightweight aerospace composites enables significant mass savings in aerospace components. Thus, the increasing need for light-weight materials to construct aviation components and parts is also a significant factor contributing to the growth of the North America composites market.

North America Composites Market Overview

The North America composites market is segmented into the US, Canada, and Mexico. The region holds an extensive growth opportunity for the composites market players due to the growing utilization of composites by its end-use industries, including automotive, construction, aerospace, and electronics. The composites are utilized in various interior, exterior, structural, and other applications. The construction sector in North America is witnessing growth due to a robust economy and increased federal and state financing for commercial and institutional structures in the region. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, North America registered vehicle production of 13.42 million. Due to the properties of composites, including noncorrosive properties, prefabrication capabilities, and design flexibility, they are increasingly preferred in bridge construction and renovations. Thus, the expansion of the construction sector is expected to fuel the North America composites market during the forecast period.

North America Composites Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Composites Strategic Insights

North America Composites Report Scope

Report Attribute

Details

Market size in 2022

US$ 25,512.91 Million

Market Size by 2028

US$ 35,349.16 Million

Global CAGR (2022 - 2028)

5.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Fiber Type

By Resin Type

By End Use Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Composites Regional Insights

North America Composites Market Segmentation

The North America composites market is segmented into fiber type, resin type, end use industry, and country.

Based on fiber type, the North America composites market is segmented into carbon fiber composites, glass fiber composites, and others. The glass fiber composites segment held the largest share of the North America composites market in 2022.

Based on resin type, the North America composites market is segmented into thermoset and thermoplastic. The thermoset segment held a larger share of the North America composites market in 2022. The thermoset is segmented into polyester, vinyl ester, epoxy, polyurethane, and others. The Thermoplastic is segmented into polypropylene, polyethylene, polyvinylchloride, polystyrene, polyethylene terephthalate, polycarbonate, and others.

Based on end use industry, the North America composites market is segmented into automotive, aerospace and defense, wind, construction, marine, sporting goods, and others. The automotive segment held the largest share of the North America composites market in 2022.

Based on country, the North America composites market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America composites market in 2022.

DuPont de Nemours Inc; Gurit Holding AG; Hexion Inc; Mitsubishi Chemical Holdings Corp; Nippon Electric Glass Co Ltd; Owens Corning; SGL Carbon SE; Solvay SA; Teijin Ltd; and Toray Industries Inc are the leading companies operating in the North America composites market.

The North America Composites Market is valued at US$ 25,512.91 Million in 2022, it is projected to reach US$ 35,349.16 Million by 2028.

As per our report North America Composites Market, the market size is valued at US$ 25,512.91 Million in 2022, projecting it to reach US$ 35,349.16 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The North America Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Composites Market report:

The North America Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Composites Market value chain can benefit from the information contained in a comprehensive market report.