North America Commercial Vehicle Transmission Oil Pump and Transmission System Market

No. of Pages: 182 | Report Code: TIPRE00025227 | Category: Automotive and Transportation

No. of Pages: 182 | Report Code: TIPRE00025227 | Category: Automotive and Transportation

The North America commercial vehicle transmission oil pump and transmission system market constitutes the US, Canada, and Mexico. Technological advancements in the region have led to a highly competitive market. Companies from various industries are enhancing the overall business processes to meet the customer demands for high-quality products. North America has a developed automotive industry. Therefore, it has one of the most significant commercial vehicle production and sales nations across the world. As per the International Organization of Motor Vehicle Manufacturers (OICA) data, in 2018, 2019, and 2020, the production of commercial vehicles was 12,408,395, 12,426,534, and 10,153,667 units, respectively. Moreover, the region has a presence of automotive manufacturers, such as Navistar, PACCAR, BMW, Freightliner (Daimler), Toyota, Volvo, and General Motors. Also, the governments of the countries in North America are taking initiatives for the development of the automotive sector. In 2020, The Department of Energy of the US administered the Advanced Technology Vehicle Manufacturing Loan Program worth US$ 40 billion. Such factors are driving the growth of the commercial vehicle transmission oil pump and transmission system market in North America.

North America is one of the leading regions in terms of the development and adoption of new technologies. This is mainly attributed to the favorable government policies that boost innovation and strengthen infrastructure capabilities. Hence, any hindrance to the growth of the industrial sector hampers the economic growth of the region. The US is the world’s worst-affected country due to the COVID-19 outbreak. The commercial vehicle transmission oil pump and transmission system market’s reliance on manufacturing companies, such as automobile companies and automobile component manufacturers, has been highlighted by the recent pause in manufacturing units due to the outbreak. The automobile industry is suffering a major setback owing to the strict restrictions on travel and the closures of international manufacturing activities, declining car sales, and large layoffs. The overall demand for transmission oil pumps and transmission systems is likely to increase once the industries attain normal operational conditions. These automotive parts are vital and much needed for the manufacturing of commercial vehicles. Favorable government policies, such as duty-free imports in Mexico, for the automotive sector in North America and ever-increasing investments by North American countries in advanced technology propel the demand for automotive parts in the region.

Strategic insights for the North America Commercial Vehicle Transmission Oil Pump and Transmission System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

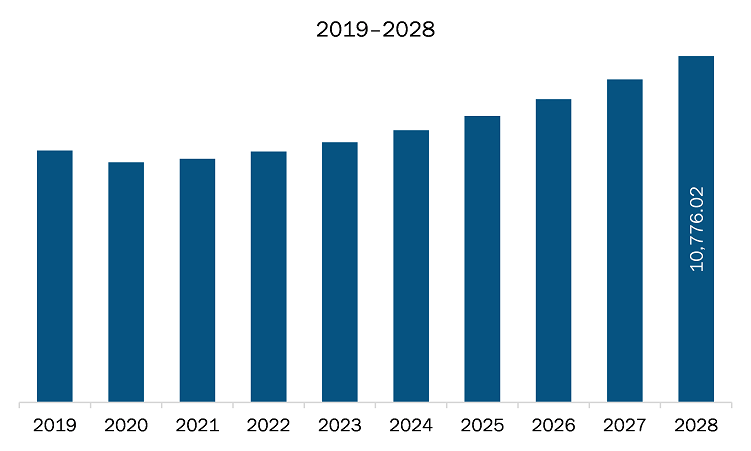

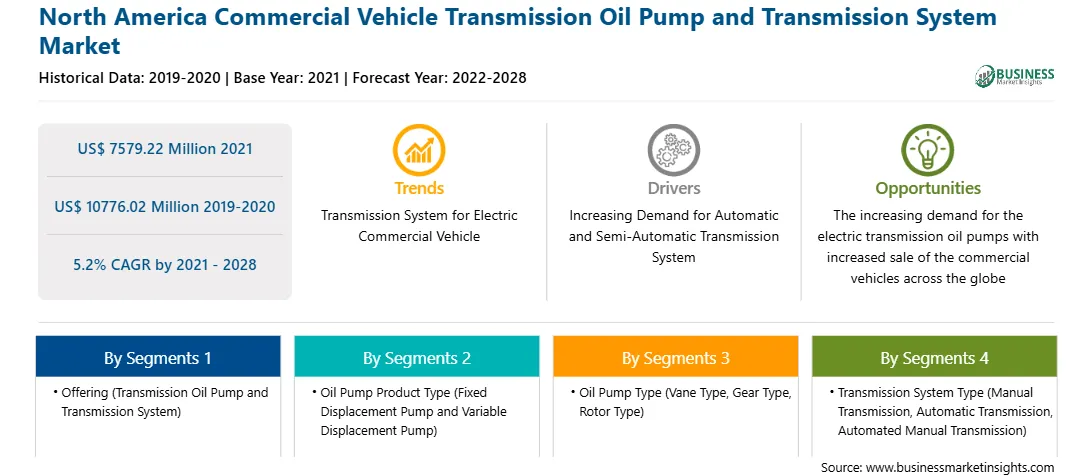

| Market size in 2021 | US$ 7579.22 Million |

| Market Size by 2028 | US$ 10776.02 Million |

| Global CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Commercial Vehicle Transmission Oil Pump and Transmission System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The commercial vehicle transmission oil pump and transmission system market in North America is expected to grow from US$ 7579.22 million in 2021 to US$ 10776.02 million by 2028; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028. Transmission for electric vehicles is utilized to transfer mechanical power from an electric traction motor to the wheels. Most of the electric cars are equipped with single-speed transmissions, which are sufficient for efficient operation in today's world. However, several vehicle types benefit from the usage of a multi-speed transmission. Furthermore, many of the major manufacturers in the EV transmission market are developing multi-speed transmission sailing operations and load shifting capabilities for electric vehicles to launch them shortly. To follow government rules regarding emission limits and future fuel usage, the development of electric vehicles is gaining traction at a rapid pace. Apart from the traction motor, the transmission or gearbox in the drive system is another critical component in an electric vehicle's power performance. Electric vehicles require enough power to overcome road load when driving. The wheel axle driving force curve and the road load curve can examine the acceleration and maximum speed performance of electric vehicles. Furthermore, it has been discovered that by using a multi-speed transmission with a different gear ratio, the motor's performance range can be enlarged (with massive torque at low speed and with the high rotate speed at high speed). As a result, an electric vehicle with transmission performs better on the road than the one with a single ratio gearbox. It can lower the motor's power requirements and improve the electric vehicle's performance. Thus, the gearbox is a better option for enhancing the vehicle's performance. For instance, Eaton's EV transmissions use the same proven, reliable, and efficient lay shaft architecture as automated manual transmissions (AMTs). Still, they don't have a clutch, and the traction motor synchronizes shifts. Lightweight countershaft gearboxes with a range of torque capacities and electric gearshift actuation enable smaller electric motors in the EV transmissions. Thus, transmission system for commercial electric vehicle provides a lucrative opportunity to the market.

In terms of offering, transmission system segment held a larger market share of the commercial vehicle transmission oil pump and transmission system market in 2020. Based on oil pump product type, fixed displacement pump segment held a larger market share in 2020. Based on oil pump type, gear type segment held a larger market share in 2020. Based on transmission system type, manual transmission segment held a larger market share in 2020. Based on vehicle type, HCV (Class VII to Class VIII) segment held a larger market share in 2020. Similarly Based on powertrain type, internal combustion engine segment held the largest share in the market.

A few major primary and secondary sources referred to for preparing this report on the commercial vehicle transmission oil pump and transmission system market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allison Transmission Holding INC; Daimler AG; Eaton Group; Mack Trucks; Scania; Sinotruk (Hong Kong) Limited; Shaanxi Fast Auto Drive Co. Ltd.; Volvo AG; Voith GmbH & Co. KGaA; ZF Friedrichshafen AG; Hyundai Transys; Mahle GmbH; Concentric AB; Scherzinger Pumpen GmbH & Co. KG; SHW AG; BorgWarner Inc.; and SLPT among others.

The North America Commercial Vehicle Transmission Oil Pump and Transmission System Market is valued at US$ 7579.22 Million in 2021, it is projected to reach US$ 10776.02 Million by 2028.

As per our report North America Commercial Vehicle Transmission Oil Pump and Transmission System Market, the market size is valued at US$ 7579.22 Million in 2021, projecting it to reach US$ 10776.02 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The North America Commercial Vehicle Transmission Oil Pump and Transmission System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Commercial Vehicle Transmission Oil Pump and Transmission System Market report:

The North America Commercial Vehicle Transmission Oil Pump and Transmission System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Commercial Vehicle Transmission Oil Pump and Transmission System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Commercial Vehicle Transmission Oil Pump and Transmission System Market value chain can benefit from the information contained in a comprehensive market report.