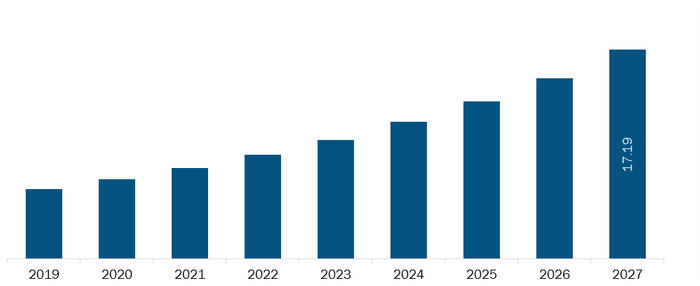

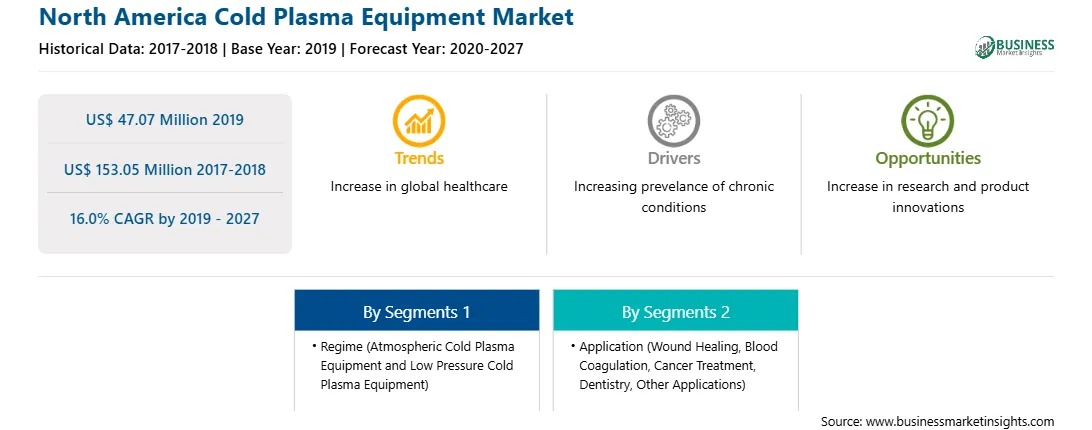

The North America cold plasma equipment market is expected to reach US$ 153.05 Mn in 2027 from US$ 47.07 Mn in 2019. The market is estimated to grow with a CAGR of 16.0% from 2019-2027.

The growth of the market is driven by factors such as the rising use of cold plasma in medical treatment, increasing hospital acquired infections (HAI) and others in the North American region. Whereas, adverse effects of cold plasma, and lack of reimbursement are likely to have a negative impact on the growth of the market in the coming years.

Cold Plasma is also called as non-thermal plasma and used in wide range of applications in various industries including medical and biomedical industries. It is a powerful tool which is used to provide antimicrobial treatment for wounds and injuries. The Cold Plasma Equipment technology offers non-thermal treatment of cancer, dentistry and others.

Cold plasma is proven effective in the biomedicine sector. Cold plasma is used in many medical treatments such as, atmospheric plasma on diabetes-induced enzyme glycation, oxidative stress, inflammation, disinfection, wound healing, cancer, dermatology, and scar treatment. Cold plasma have the ability to kill bacteria, including the drug-resistant bacteria to avoid further infection which helps in treating chronic wounds. This fastens the process of wound healing and prevents further complications and the related other discomforts. Although there are many other treatments for wound healing, it is expected that cold plasma therapy is one of the most effective treatment. Plasma sources which are used in plasma medicine are of "low temperature" plasma sources operated at atmospheric pressure. Certainly in this context, low temperature refers to temperatures similar to room temperature, which is usually slightly above. Increasing in cases of diabetes, wound and other inflammation, is growing the market. According to the International Diabetes Federation (IDF), in 2017, number of people with diabetes in North America was approximately 46 million which is expected to grow at 62 million in 2045. The increase in the disease prevalence is around 35% during the forecast period.

Diabetes affects many parts of the body, especially feet. According to recent Centers for Disease Control and Prevention (CDC) report, more than 100 million U.S. adults are now living with diabetes. The report finds that as of 2015, 30.3 million Americans – 9.4 percent of the U.S. population –have diabetes. Another 84.1 million have prediabetes, a condition that if not treated often leads to type 2 diabetes within five years. Diabetes was the seventh leading cause of death in the U.S. in 2015. Diabetic foot ulcers are sores that develop on the feet, and they can develop even from seemingly trivial injuries to the feet. Diabetic foot ulcers are a common cause of amputation due to diabetes. Due to rise in use of cold plasma to treat diabetic patient, in various kind of treatment, it is likely to increase the cold plasma equipment market.

The increasing use of cold plasma equipment in medical treatment cases in North America is expected to drive cold plasma equipment market the growing pharmaceutical industry in the country create a lucrative opportunity and the presence of an established market for cold plasma equipment.

Strategic insights for the North America Cold Plasma Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 47.07 Million |

| Market Size by 2027 | US$ 153.05 Million |

| Global CAGR (2019 - 2027) | 16.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Regime

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cold Plasma Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

NORTH AMERICA COLD PLASMA EQUIPMENT– MARKET SEGMENTATION

North America Cold Plasma Equipment Market - By Regime

North America Cold Plasma Equipment Market - By Application

North America Cold Plasma Equipment Market - By Country

Companies Mentioned

The List of Companies - North America Cold Plasma Equipment Market

The North America Cold Plasma Equipment Market is valued at US$ 47.07 Million in 2019, it is projected to reach US$ 153.05 Million by 2027.

As per our report North America Cold Plasma Equipment Market, the market size is valued at US$ 47.07 Million in 2019, projecting it to reach US$ 153.05 Million by 2027. This translates to a CAGR of approximately 16.0% during the forecast period.

The North America Cold Plasma Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cold Plasma Equipment Market report:

The North America Cold Plasma Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cold Plasma Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cold Plasma Equipment Market value chain can benefit from the information contained in a comprehensive market report.