The North America coffee machines market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Coffee is among the largest commodities consumed by people. The coffee shop industry in the US includes 20,000 stores with combined annual revenue of about US$11 billion. Major companies include Caribou, Starbucks, Coffee Bean, Dunkin' Donuts, and Tea Leaf, and Diedrich (Gloria Jean's). Moreover, collaboration, partnership, and product launches are the major trends that tie into the industry's focus on growth and product/service innovation. For instance, in November 2020, Keurig has acquired the manufacturing, sales, and distribution rights along with licensed brands in around 37 counties in east Texas from The Red River Beverage Group and The Made-Rite Company. This will increase the customer base for the company to reach 1.5 million consumers. Moreover, in Feb 2021, the company has launched a touchless brewing machine on its bean-to-cup coffee makers designed for work environments. Using the new Keurig Remote Brew app, consumers can brew their favorite coffee or specialty beverages through a mobile device. Nespresso Momento has been designed to be easy to set up, use, clean, and service. It has an elegant touchscreen display that allows users to brew a variety of coffee sizes, including Americanos, with a single touch. Thus, the rising number of high-rated coffee shops has led the manufacturers toward innovation. Hence the above-mentioned factors are likely to act as a key trend for the coffee machine market.

In North America, the US witnessed an unprecedented rise in number of COVID-19 cases in 2020, which led to the discontinuation of manufacturing activities. In addition, decline in the overall brewing activities has led to the discontinuation of coffee machines manufacturing activities in the US. The similar trend was witnessed in other North American countries, such as Mexico, Canada, Cuba, Panama, and Costa Rica. However, with the economic activities regaining their pace, the coffee machine market in the region is likely to make up for this loss in 2021.

Strategic insights for the North America Coffee Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

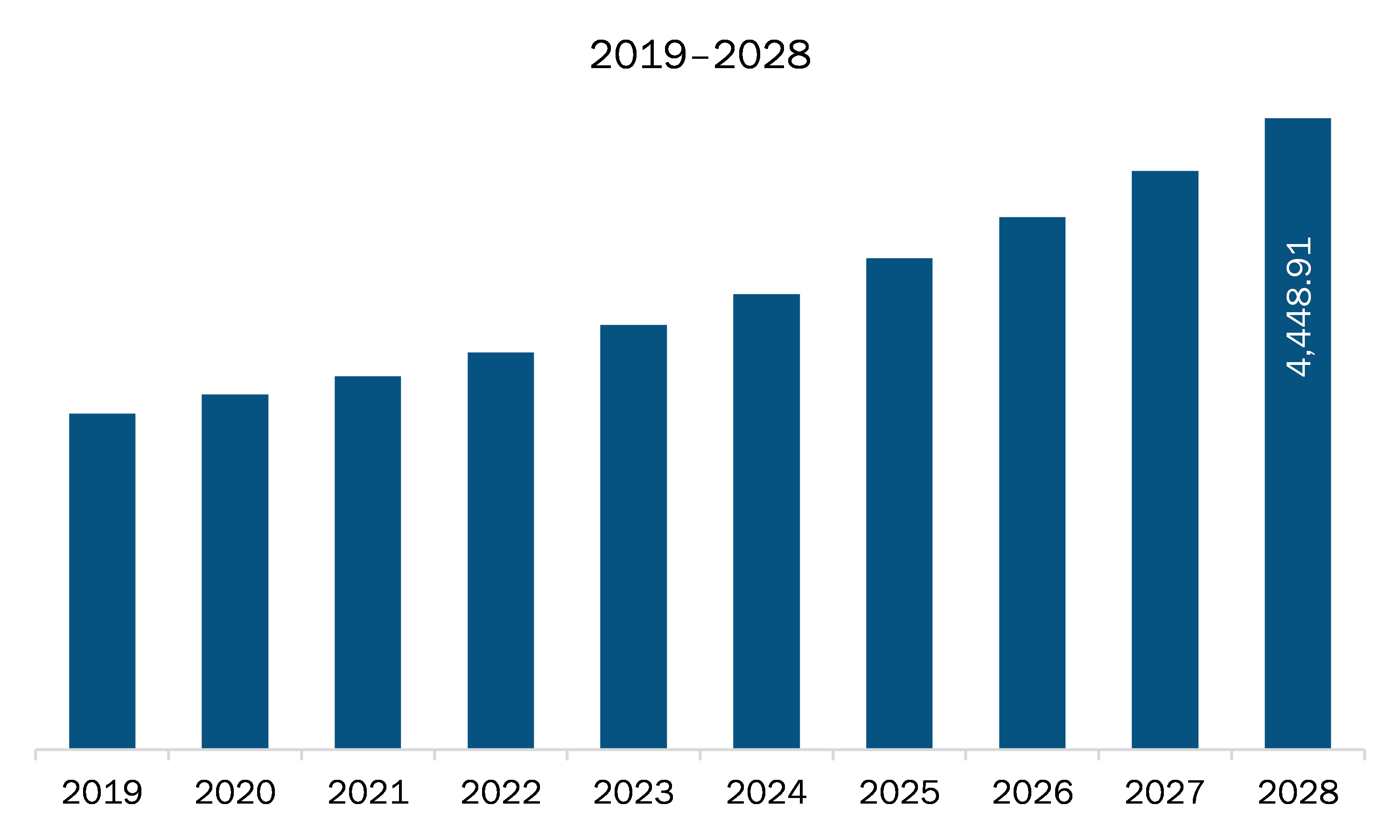

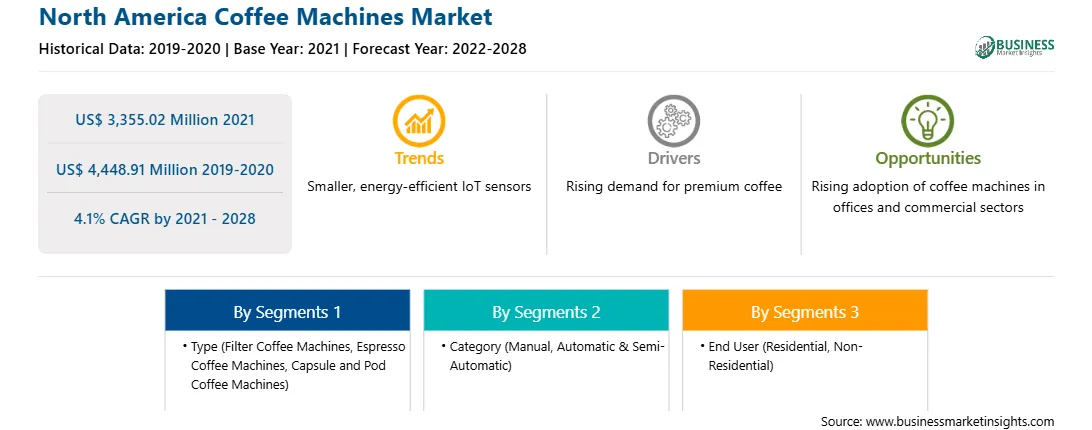

| Market size in 2021 | US$ 3,355.02 Million |

| Market Size by 2028 | US$ 4,448.91 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Coffee Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The coffee machines market in North America is expected to grow from US$ 3,355.02 million in 2021 to US$ 4,448.91 million by 2028; it is estimated to grow at a CAGR of 4.1% from 2021 to 2028. With the growing demand for non-alcoholic beverages and the prevalence of high-end coffee supplied by North America coffee chains such as Starbucks, The Coffee Bean, and Tea Leaf, North America's coffee business is set to grow. Millennials are widely credited with fueling America's coffee obsession. According to the USDA census, there are approximately 75.1 million millennial consumers in the United States, with an average per capita coffee consumption of 3.6 kg in 2018. Customers are increasingly willing to purchase coffee makers in order to replicate the coffee shop experience at home. The consumption of specialty coffee in the United States is increasing, and there has been a noticeable increase in the number of daily specialty coffee consumers in recent years. Premium coffee is becoming more popular as health and wellness trends spread across the country. According to a National Coffee Association poll, the number of daily specialty coffee users in the United States has increased significantly over the previous 18 years, from 9% in 1999 to 41% in 2017. Furthermore, specialty coffee accounted for 59 percent of all coffee cups consumed, compared to 41 percent of non-specialty coffee cups. Throughout the forecast period, the market will be driven by the ongoing demand for better-tasting coffee.

Based on type, the filter coffee machines segment accounted for the largest share of the North America coffee machines market in 2020. Based on category, the automatic and semi-automatic segment accounted for the largest share of the North America coffee machines market in 2020. Based on end-user, the residential segment accounted for the largest share of the North America coffee machines market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America coffee machines market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Keurig Green Mountain, Inc.; Robert Bosch Gmbh; Electrolux Ab.; Illycaffè S.p.A.; Koninklijke Philips N.V; Krups Gmbh (Groupe SEB); Morphy Richards; Nestlé S.A.; Panasonic Corporation; and Luigi Lavazza S.p.A.

The North America Coffee Machines Market is valued at US$ 3,355.02 Million in 2021, it is projected to reach US$ 4,448.91 Million by 2028.

As per our report North America Coffee Machines Market, the market size is valued at US$ 3,355.02 Million in 2021, projecting it to reach US$ 4,448.91 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The North America Coffee Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Coffee Machines Market report:

The North America Coffee Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Coffee Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Coffee Machines Market value chain can benefit from the information contained in a comprehensive market report.