The defense aircraft industry is tremendously dynamic in terms of orders, component supply, production volume, supply, cost, and profits. Governments of various countries, as well as private and public companies, are investing huge capital in enhancing aircraft capabilities to meet the aircraft requirements during combat/non-combat scenarios.

For instance, the US government announced the opening of new F-16 production plant in North Carolina. The increasing threat of terrorism, border security, and troop transportation is creating an immense need for advanced military aircraft support.

Further, the manufacturers of defense aircraft models such as fixed wing and rotary wing are experiencing a rise in demand for their models from defense forces across region. Owing to the modernization strategies =adopted by governments and defense authorities. To deliver the desired quality of models, aircraft makers are integrating the models with advanced hardware and software. The military aircraft industry is heavily dominated by a few manufacturers, including Lockheed Martin Corporation, Boeing, Airbus Defense, Dassault Aviation, and Textron Inc. These market players are continuously focusing on enhancing their production capacity to meet the ever-growing demand for military aircrafts. CNC milling machines are used in aircraft production for manufacturing and assembling several aircraft parts. Thus, the rising production of military aircraft is driving the demand for CNC milling machines, thereby contributing to the growth of the market.

The US and Canada have a significant presence of automotive and aerospace manufacturing companies, which is influencing the rise in demand for CNC milling machines across the region, thereby contributing to the North America CNC milling machines market. Ford, Chevrolet, Jeep, GMC, Dodge, Cadillac, Chrysler, Tesla, and Lucid are among the major automotive manufacturers present in North America. The region has experienced a significant rise in investment by these automotive companies to expand their geographical presence and increase their annual production, which is further increasing the demand for CNC milling machines from the automotive industry. Since 2010, the US automotive industry has witnessed an increase in investments to develop new manufacturing plants. For instance, Ford, Rivian, and Hyundai invested ~US$ 33 billion in 2023 to establish electric vehicle and battery manufacturing plants nationwide. Similarly, in September 2023, Hyundai announced the development of its electric vehicle production plant in the US. CNC milling machines are widely used across the automotive industry for vehicle prototyping applications and for producing several parts of cars, such as internal panels, starter motors, cylinder heads, drive axles, and gearboxes. Thus, the constant growth in the automotive industry across the region is fueling the growth of the North America CNC milling machines market.

Strategic insights for the North America CNC Milling Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America CNC Milling Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America CNC Milling Machines Strategic Insights

North America CNC Milling Machines Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,629.30 Million

Market Size by 2028

US$ 2,602.95 Million

Global CAGR (2023 - 2028)

9.8%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By structure

By x-axis working range

By number of axis

By application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America CNC Milling Machines Regional Insights

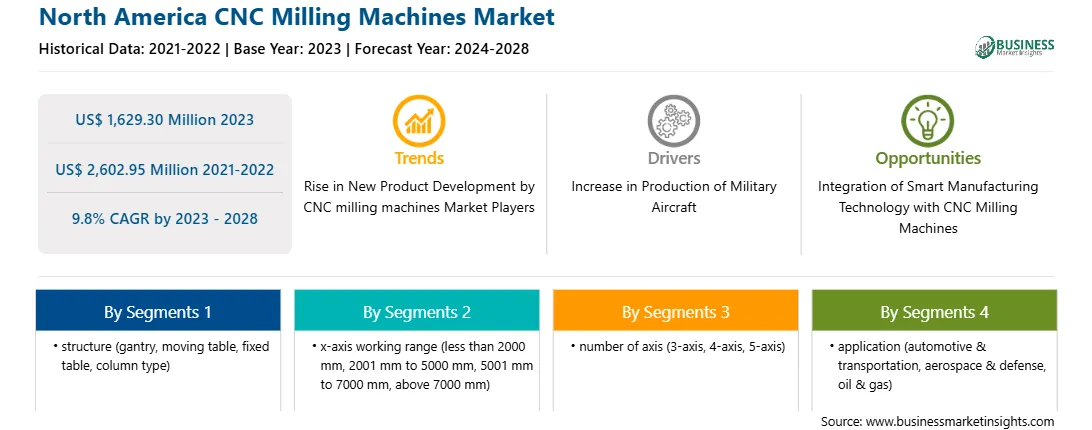

The North America CNC milling machines market is segmented into structure, x- axis working range, number of axis, application, and country. Based on structure, the North America CNC milling machines market is sub segmented into gantry, moving table, fixed table, and column type. The gantry segment registered the largest market share in 2023.

Based on x-axis working range, the North America CNC milling machines market is segmented into less than 2000 mm, 2001 mm to 5000 mm, 5001 mm to 7000 mm, and above 7000 mm. The less than 2000 mm registered the largest market share in 2023.

Based on number of axis, the market is segmented into 3-axis, 4-axis, 5-axis, and others. The 3-axis segment held the largest market share in 2023.

Based on application, the market is segmented into automotive & transportation, aerospace & defense, oil & gas, and others. The automotive & transportation segment held the largest market share in 2023.

Based on country, the market is segmented into US, Canada and Mexico. US dominated the market share in 2023.

Amera-Seiki Corp, AWEA Mechantronic Co Ltd, EMCO Gmbh, Fives SAS, JOBS SpA, KRC Machine Tool Solutions, Nidec Corp, Okuma Corp, Pietro Carnaghi SpA are the leading companies operating in the North America CNC milling machines market.

The North America CNC Milling Machines Market is valued at US$ 1,629.30 Million in 2023, it is projected to reach US$ 2,602.95 Million by 2028.

As per our report North America CNC Milling Machines Market, the market size is valued at US$ 1,629.30 Million in 2023, projecting it to reach US$ 2,602.95 Million by 2028. This translates to a CAGR of approximately 9.8% during the forecast period.

The North America CNC Milling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America CNC Milling Machines Market report:

The North America CNC Milling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America CNC Milling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America CNC Milling Machines Market value chain can benefit from the information contained in a comprehensive market report.