Clinical research organizations (CROs) assist in the successful implementation of clinical trials through the services offered using high-quality facilities and deep subject matter expertise. CROs have begun acting as a backbone of the clinical trial industry through their efficient and cost-effective operations that benefit trial sponsors. For example, on average, CROs take 30% lesser time than in-house activity to conduct and complete clinical trials. With the rising number of CROs leading to high competition, a few of these businesses offer specialized imaging services, thus emerging as imaging CROs (iCROs). A few examples of iCROs include Keosys Medical Imaging and Medica Group PLC. CROs offer key knowledge insights in areas such as site qualification for imaging, acquisition of standardized images, and determination of read designs and criteria, thereby contributing to the growth of the overall North America clinical trial imaging market.

The North America clinical trial imaging market is segmented into the US, Canada, and Mexico. The US is the largest and fastest-growing market for clinical trial imaging. The market growth in the region is attributed to the US emerging as a leading clinical research destination and a growing number of innovative product launches by companies for applications in clinical trials. The US has emerged as a leading clinical research destination. Approximately half of the total clinical trials conducted globally are conducted in the US. Additionally, most pharma research companies prefer to perform clinical trials in the US owing to established medical infrastructure, fast approval timelines, a favorable regulatory framework, and accepted clinical trial-generated data.

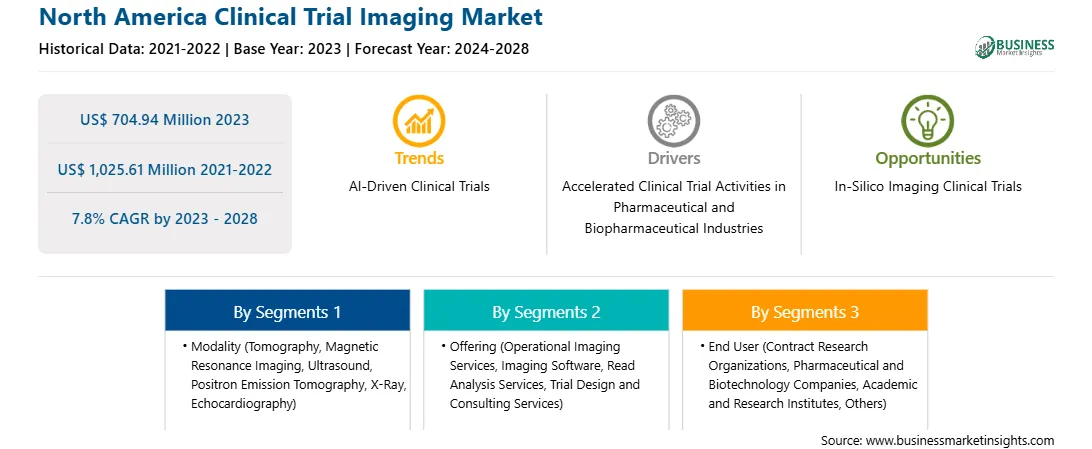

Strategic insights for the North America Clinical Trial Imaging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Clinical Trial Imaging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Clinical Trial Imaging Strategic Insights

North America Clinical Trial Imaging Report Scope

Report Attribute

Details

Market size in 2023

US$ 704.94 Million

Market Size by 2028

US$ 1,025.61 Million

Global CAGR (2023 - 2028)

7.8%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Modality

By Offering

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Clinical Trial Imaging Regional Insights

The North America clinical trial imaging market is segmented on the basis of modality, offering, end user, and country.

Based on modality, the North America clinical trial imaging market is segmented into tomography, magnetic resonance imaging (MRI), ultrasound, positron emission tomography (PET), X-ray, echocardiography, and others. The tomography segment registered the largest market share in 2023.

Based on offering, the North America clinical trial imaging market is segmented into operational imaging services, imaging software, read analysis services, trial design and consulting services, and others. The operational imaging services segment held the largest market share in 2023.

Based on end user, the North America clinical trial imaging market is segmented into contract research organizations (CROs), pharmaceutical and biotechnology companies, academic and research institutes, and others. The contract research organizations (CROs) segment held the largest market share in 2023.

Based on country, the market is segmented into US, Canada, and Mexico. The US dominated the market share in 2023.

BioTelemetry Inc, Calyx Inc, eResearch Technology Inc, ICON PLC, IXICO plc, Medical Metrics Inc, Medpace Holdings Inc, VIDA Diagnostics Inc, and WCG Clinical Inc are the leading companies operating in the North America clinical trial imaging market.

1. BioTelemetry Inc

2. Calyx Inc

3. eResearch Technology Inc

4. ICON PLC

5. IXICO plc

6. Medical Metrics Inc

7. Medpace Holdings Inc

8. VIDA Diagnostics Inc

9. WCG Clinical Inc

The North America Clinical Trial Imaging Market is valued at US$ 704.94 Million in 2023, it is projected to reach US$ 1,025.61 Million by 2028.

As per our report North America Clinical Trial Imaging Market, the market size is valued at US$ 704.94 Million in 2023, projecting it to reach US$ 1,025.61 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The North America Clinical Trial Imaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Clinical Trial Imaging Market report:

The North America Clinical Trial Imaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Clinical Trial Imaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Clinical Trial Imaging Market value chain can benefit from the information contained in a comprehensive market report.