Market Introduction

Cleanroom is controlled environment which has low level of pollutants such as air-borne microbes and particles, dust, aerosols which contaminate the surrounding area. Cleanroom Technology is basically used by industries for avoiding the adverse effects caused by the air pollutants and small particles in the manufacturing process of a product.

Strategic insights for the North America Cleanroom Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Cleanroom Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Cleanroom Technology Strategic Insights

North America Cleanroom Technology Report Scope

Report Attribute

Details

Market size in 2021

US$ 1,867.88 Million

Market Size by 2028

US$ 3,024.39 Million

Global CAGR (2021 - 2028)

7.1%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Type

By Construction Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Cleanroom Technology Regional Insights

Market Overview and Dynamics

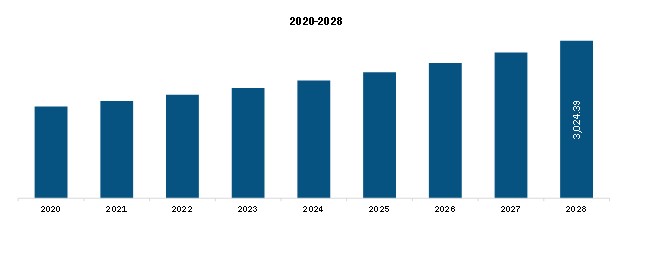

The North America cleanroom technology market is expected to reach US$ 3,024.39 million by 2028 from US$ 1,867.88 million in 2021; it is estimated to grow at a CAGR of 7.1% during 2021–2028. The market growth is attributed to the increasing adoption of this technology in the biopharmaceuticals industry and technological advancements in cleanrooms. However, high costs associated with cleanrooms restrict the cleanroom technology market growth in North America.

The cleanroom technology market in North America has made strides with a rise in the adoption of cleanrooms in manufacturing environments. Advancements in this technology, ranging from high-efficiency particulate absorption (HEPA) technology to unidirectional airflow systems and modular cleanroom technology, are boosting the market growth. In September 2019, G-CON Manufacturing and L7 Informatics, a life science process automation software provider, collaborated to develop a fully integrated cleanroom and manufacturing software solution. The two US-based companies would integrate L7's Enterprise Science Platform (ESP) into G-CON's proprietary cleanroom technology—POD. Further, the use of soft-walled modular materials in cleanroom construction eliminates the need of rebuilding the facilities from scratch. With the growing demand for therapeutic drugs and vaccines across North America, biopharmaceutical and pharmaceutical companies have shifted their focus on escalating their production capacities, which drives the demand for cleanrooms used in their production facilities, which help address the concerns regarding contamination, regulatory compliances, and operational efficiencies. In addition, a surge in investments in pharmaceutical contract research, development, and manufacturing organizations (CDMOs) would continue to support the cleanroom technologies market growth in North America during the forecast period.

North America is highly affected due to the COVID-19 pandemic. The US registered the highest number of deaths due to the COVID-19 pandemic in 2020. It led to chaotic situations in the medical industry across the countries, with the dramatically increased demand for diagnosing and therapeutic devices in hospitals. For instance, demand for ventilators, respirators, personal protective kits, and in vitro diagnostic (IVD) tests rose drastically in hospitals across North American countries. The FDA also maximized its efforts to support the health of people and rolled out several guidelines for hospitals and medical device companies. Various companies recapitalized their research and development activities for diagnostics tests and therapeutics against COVID. Thermo Fisher Scientific, F. Hoffmann-La Roche AG, EverlyWell, and Abbott, among others, have been the COVID-19 test kit manufacturers. Thermo Fisher Scientific has increased its production to be able to produce 5 million tests per week. Likewise, Abbott has received Emergency Use Authorization (EUA) for a point-of-care test that can provide results in minutes. Thus, scaling up of production capacities pharmaceutical companies supported the North America cleanroom technology market growth during the COVID-19 pandemic.

Key Market Segments

The North America cleanroom technology market, by type, is segmented into equipment and consumables. The equipment type segment is further sub-segmented into HVAC systems, high efficiency filters, fan filter units, laminar air flow systems, cleanroom air showers and desiccator cabinets. The consumables type is further sub-segmented into gloves, apparels, wipes, disinfectants, vacuum systems and others. The consumable segment held a larger share of the market in 2021 and is anticipated to register the highest CAGR in the market during the forecast period.

The North America cleanroom technology market, based on construction type, is segmented into standard cleanrooms, hardwall cleanrooms, softwall cleanrooms, and pass-through cabinets. In 2021, the standard cleanrooms segment held the largest share of the market, whereas the hardwall cleanrooms segment is expected to register the highest CAGR in the market during 2021–2028.

The North America cleanroom technology market, by end user, is segmented into pharmaceutical industry, biotechnology industry, medical device manufacturers, hospitals, and others. The pharmaceutical industry segment held the largest share of the market in 2021 and is anticipated to register the highest CAGR during the forecast period.

Major Sources and Companies Listed

A few of the primary and secondary sources associated with this report on the North America cleanroom technology market are Canadian MedTech Manufacturers’ Alliance (CMMA), Federal Economic Development Agency for Southern Ontario (FedDev), and Medical Technologies Companies of Canada (MEDEC).

Reasons to buy the report

NORTH AMERICA CLEANROOM TECHNOLOGY MARKET SEGMENTATION

By Construction Type

By End User

By Country

Company Profiles

The North America Cleanroom Technology Market is valued at US$ 1,867.88 Million in 2021, it is projected to reach US$ 3,024.39 Million by 2028.

As per our report North America Cleanroom Technology Market, the market size is valued at US$ 1,867.88 Million in 2021, projecting it to reach US$ 3,024.39 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The North America Cleanroom Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cleanroom Technology Market report:

The North America Cleanroom Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cleanroom Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cleanroom Technology Market value chain can benefit from the information contained in a comprehensive market report.