Increased Requirement of Medical Devices is Driving the North America Cleanroom Flooring Market

A large number of patients are undergoing diagnostic and surgical procedures as a result of the rising prevalence of chronic diseases and the growing emphasis of healthcare organizations on early diagnosis and treatment. As a result, the demand for medical equipment is increasing in inpatient admission, and surgical and diagnostic facilities, wherein maintaining hygiene and preventing infection are top priorities. These factors are bolstering the demand for cleanrooms in medical device manufacturing industries, which, in turn, boosts the cleanroom flooring market. Further, the demand for wearables, including fitness trackers and monitoring devices, has surged during the COVID-19 pandemic. The increased demand for these devices is ascribed to the emphasis on fitness among people around the North America. Moreover, the clientele for these gadgets grows with the introduction of upgraded versions at reasonable prices. Cleanrooms play a vital role in the manufacturing of these devices by filtering particulates such as dust, vaporized articles, or airborne organisms from entering the room, thereby minimizing airborne contamination. In addition, cleanrooms not only ensure the safety of products but also contribute to the safety of equipment operators and end users. Some of the raw materials used in medical device production produce contaminants that can be hazardous to operators and wearing gowns and protective equipment in cleanrooms provides them protection against these them. Moreover, air filtration systems keep the immediate environment safe for personnel. Thus, with the increasing demand for medical devices, the need for cleanrooms is on the rise in the medical device industry, which propels the North America cleanroom flooring market.

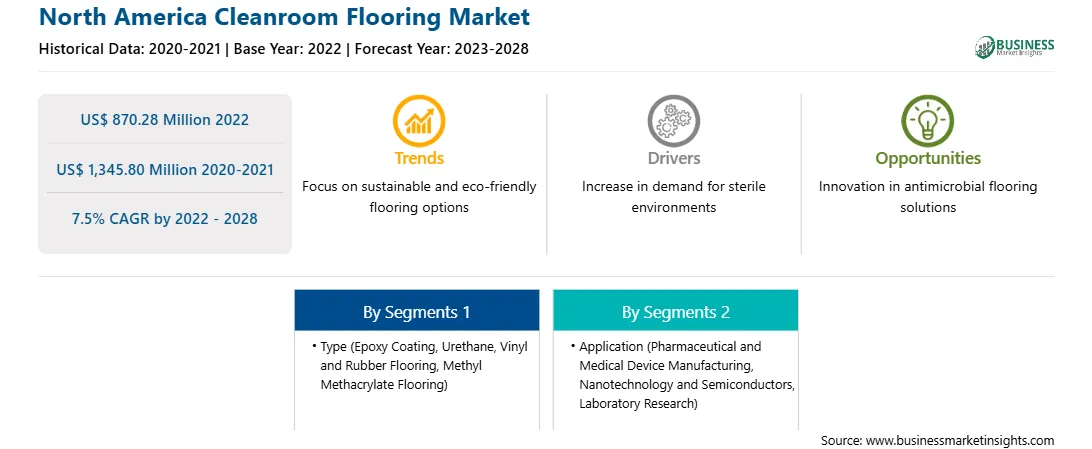

North America Cleanroom Flooring Market Overview

The North America cleanroom flooring market is segmented into the US, Canada, and Mexico. The demand for cleanrooms is high in the pharmaceuticals, medical, biotechnology, semiconductor, electronics, and food processing industries, which also makes them key consumers of cleanroom flooring. Several major pharmaceuticals, aerospace, biotechnology, and electronics companies, and healthcare research and development facilities are located in North America. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2020, North America accounted for 49.0% of world pharmaceutical sales. Moreover, pharmaceutical and biotechnology manufacturing are highly regulated industries, which leads to a continuous need for aseptic manufacturing conditions in these industries. The Food and Drug Administration (FDA) is the regulatory authority supervising the review, approval, and post-approval compliance of drugs. The FDA has set strict controls on the planning and construction of cleanrooms in the US. The regulations state that aseptic processing facilities should include easily cleanable floors, walls, and other hard surfaces.

North America Cleanroom Flooring Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Cleanroom Flooring provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Cleanroom Flooring refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Cleanroom Flooring Strategic Insights

North America Cleanroom Flooring Report Scope

Report Attribute

Details

Market size in 2022

US$ 870.28 Million

Market Size by 2028

US$ 1,345.80 Million

Global CAGR (2022 - 2028)

7.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Cleanroom Flooring Regional Insights

North America Cleanroom Flooring Market Segmentation

The North America cleanroom flooring market is segmented on the basis of type, application, and country. Based on type, the North America cleanroom flooring market is segmented into epoxy coating, urethane, vinyl and rubber flooring, methyl methacrylate flooring, and others. The epoxy coating segment held the largest market share in 2022.

Based on application, the North America cleanroom flooring market is segmented into pharmaceutical and medical device manufacturing, nanotechnology and semiconductors, laboratory research, and others. The nanotechnology and semiconductors segment held the largest market share in 2022.

Based on country, the North America cleanroom flooring market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

AES Clean Technology, Inc.; Gerflor SAS; E P Floors CORP; Forbo Flooring India PVT LTD; Florock Polymer Flooring INC; Lindner AG; and Polyflor Ltd. are the leading companies operating in the North America cleanroom flooring market.

The North America Cleanroom Flooring Market is valued at US$ 870.28 Million in 2022, it is projected to reach US$ 1,345.80 Million by 2028.

As per our report North America Cleanroom Flooring Market, the market size is valued at US$ 870.28 Million in 2022, projecting it to reach US$ 1,345.80 Million by 2028. This translates to a CAGR of approximately 7.5% during the forecast period.

The North America Cleanroom Flooring Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cleanroom Flooring Market report:

The North America Cleanroom Flooring Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cleanroom Flooring Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cleanroom Flooring Market value chain can benefit from the information contained in a comprehensive market report.