The food and food safety industries are subjected to numerous developments in safe packaging technologies. The constant population growth, the surge in disposable income, and an increase in the working population are creating a need for more packaged and ready-to-cook foods.

The companies in the chilled food packaging sector continuously focus on new trends and enhancements in food packaging, which greatly improve food quality and safety. Various innovations, such as advances in design and packaging materials, are expected to support the food processing industry. Also, the emergence of smart and intelligent packaging techniques is expected to support the growth of the food processing industry. The intelligent packaging system consists of sensors, RFID tags, smart indicators (freshness, oxygen, carbon dioxide, leakage, color, and pathogen), pigments & ink, and barcodes/QR codes. Smart packaging is evolving, and its market is expected to grow exponentially with technological developments in printed electronics and IoT to facilitate communication between end users.

There are emerging technologies in the field of nanotechnology and biosensors in the food industry, which are severely impacting food processing, production, packaging, transportation, and bioavailability of food nutrients. In the food industry, nanotechnology and biosensors increase flavor, extend product shelf-life, improve product safety, and inhibit bacterial growth and chemical reaction. Several companies are also developing nanomaterials and biosensors, which will impact food taste, related health benefits, and overall food safety. Thus, developing smart and intelligent food packaging materials is expected to benefit industry players operating in the chilled food packaging market.

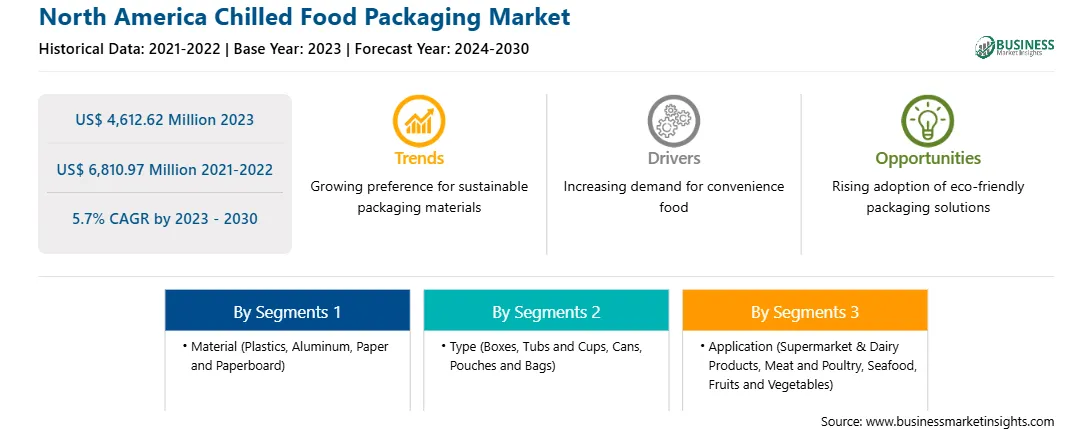

The North America chilled food packaging market is divided into the US, Canada, and Mexico. The major factors driving the growth of the chilled food packaging market in North America are the high demand for packaged food products and growing consumer preference of convenient food for on-the-go consumption. According to research commissioned by the American Frozen Food Institute (AFFI) and conducted by Technomic Inc., more than 90% of food service operators use chilled and frozen foods stored as inventory in their restaurants to offer a quick service experience to the customer. This has created a huge scope of expansion for the chilled food packing market in North America. Further, rising preferences of sustainable packaging solutions by chilled and frozen food companies for reducing costs and preserving the quality and nutritional value of the goods have created new opportunities in the chilled food packaging market. New technologies such as high-pressure processing and self-heating packaging for chilled food have led to the expansion of the food packaging industry in North America.

The rising government regulations relating to food safety packaging in North America positively impact the chilled food packaging market. Recently, the Safe Food for Canadians Regulations (SFCR) came into effect with an official declaration made by Canada's Minister of Health. It aims to transform the food safety protocols in Canada. The newly made food safety regulations are consistent and reliable with international standards and focus on preventing while eliminating unsafe and unhygienic food products from the marketplace. These regulations are imposed by the Canadian Food Inspection Agency (CFIA). Getting registered with the CFIA is mandatory for food imports, exports, manufacturing, processing, treating, preserving, grading, packaging, or labeling. Thus, enhancing food safety regulations and developing new packaging techniques propel the demand for chilled food packaging in the region.

Strategic insights for the North America Chilled Food Packaging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Chilled Food Packaging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Chilled Food Packaging Strategic Insights

North America Chilled Food Packaging Report Scope

Report Attribute

Details

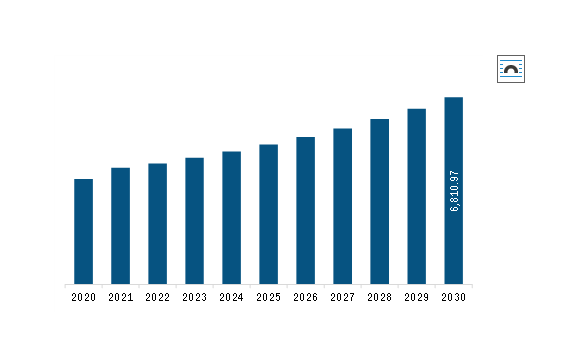

Market size in 2023

US$ 4,612.62 Million

Market Size by 2030

US$ 6,810.97 Million

Global CAGR (2023 - 2030)

5.7%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Material

By Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Chilled Food Packaging Regional Insights

North America Chilled Food Packaging Market Segmentation

The North America chilled food packaging market is segmented into material, type, value, application, and country.

Based on material, the North America chilled food packaging market is segmented into plastic, aluminum, paper and paperboard, and others. The plastic segment held a larger share of the North America chilled food packaging market in 2023.

Based on type, the North America chilled food packaging market is segmented into boxes, tubs and cups, cans, pouches and bags, and others. The pouches and bags segment held the largest share of the North America chilled food packaging market in 2023.

Based on application, the North America chilled food packaging market is segmented into dairy products, meat and poultry, seafood, fruits and vegetables, and others. The dairy products segment held the largest share of the North America chilled food packaging market in 2023.

Based on country, the North America chilled food packaging market is segmented into the US, Canada, and Mexico. The US dominated the North America chilled food packaging market in 2023.

Mondi Plc, Amcor Plc, Sonoco Products Co, Amerplast Ltd, Berry Global Group Inc, WestRock Co, Graphic Packaging Holding Co, Tetra Pak International SA, Sealed Air Corp are some of the leading companies operating in the North America chilled food packaging market.

The North America Chilled Food Packaging Market is valued at US$ 4,612.62 Million in 2023, it is projected to reach US$ 6,810.97 Million by 2030.

As per our report North America Chilled Food Packaging Market, the market size is valued at US$ 4,612.62 Million in 2023, projecting it to reach US$ 6,810.97 Million by 2030. This translates to a CAGR of approximately 5.7% during the forecast period.

The North America Chilled Food Packaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Chilled Food Packaging Market report:

The North America Chilled Food Packaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Chilled Food Packaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Chilled Food Packaging Market value chain can benefit from the information contained in a comprehensive market report.