Market Introduction

The US, Canada, and Mexico are the major economies in North America. Technological advancements have led to a highly competitive market in the region as population is getting attracted toward digital technologies. With the high adoption of automation technologies in operations, the smart devices with remote connectivity are enhancing the service experience for bank customers. Significant innovations in retail banking through digital technologies improve customer personal banking experience, while commercial banking is pressurized to catch up. Increasing demand for innovation at banks for a faster and smooth transaction drives the market growth in North America. The bank counter in North American countries is being transformed to automated desks for improved and fast service applications. At present, one of the demanding technologies in the banking sector is check scanners. The check scanner enables remote deposit capture benefits with reduced time of transaction recording, transportation cost, and less dependence on courier services. The banks, specifically in the US, are adopting the check scanner technology to improve the customer banking experience. For instance, according to the Federal Reserve, around 84% of the US customers visit the bank counter at least once a year. Hence, to provide enhanced service, banks are adopting automated systems. The Panini, one of the prominent market players in the US is also serving the advanced banking technologies for multiple banks, such as U.S. Bank, KeyBank, and American National Bank. Also, out of the top 20 banks of the US, majority of banks are already using the Digital Check products for remote deposit capture, teller capture, or both applications. Similarly, the Digital Check company provides the check scanner solution in Canada for almost four top banks out of five. For instance, Digital Check installed the SecureLink solution combined with TellerScan TS500 check scanner at Security First Bank to improve security while capturing cheque at a teller window. Market players are introducing advanced technology for the banks to enhance remote deposit capture (RDC) solutions. For instance, in September 2020, in response to the increasing demand for RDC Check Scanner, Panini introduced a new Vision E check scanner. The Vision E check scanners are designed to meet customer's requirements with an affordable solution. At the same time, it also offers driverless and API-free batch check scanning for remote deposit capture (RDC) applications. In January 2019, BLM Technologies, provider of complete technology solutions, offered a new Canon imageFORMULA CR-L1 compact check transport/scanner for the market. The company is serving advanced technologies for thousands of customers in the US as a complete solution.

The US is the worst-hit country in North America due to the COVID-19 outbreak. Increasing number of infected individuals led the US federal government to shut down the country borders for international travelers in 2020. The majority of the manufacturing plants either discontinued their operations or continued operating with minimum staff; moreover, travel restrictions disrupted the supply chain of components and parts. These are among the critical issues faced by manufacturers in North American countries in 2020 and early 2021. On the contrary, with a decline in the manufacturing of cheque scanners, the scope of remote deposit capture technology is projected to gain momentum in the upcoming years. Upon facing the consequences of slowdown in the production and sales of cheque scanners, banks are looking forwards to bring latest products such as remote deposit capture technology for enabling digital check deposit services to small business located in remote areas.

Market Overview and Dynamics

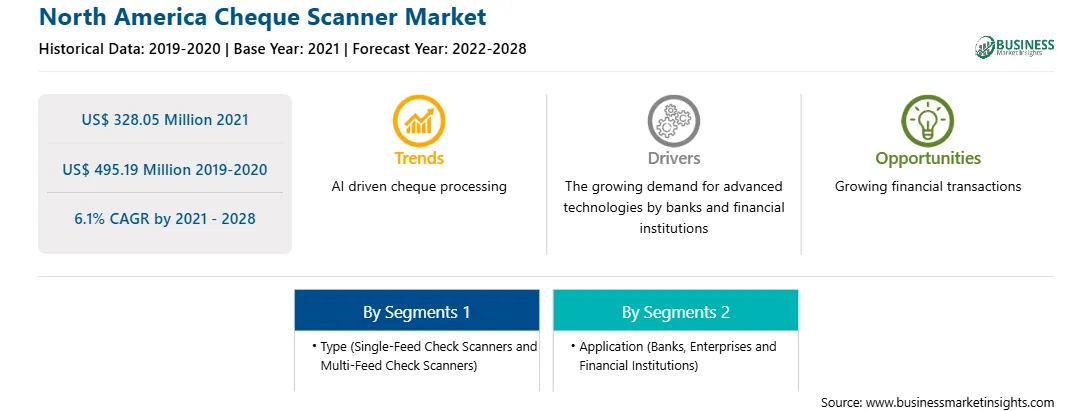

The cheque scanner market in North America is expected to grow from US$ 328.05 million in 2021 to US$ 495.19 million by 2028; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028. Opportunity for continuous innovations; vendors need to improve and enhance their offerings to be relevant in the market. For instance, Digital Check introduced enhanced API, SecureLink 2.0, which contains enhanced functionality that is a major update to the original SecureLink by Digital Check. Securelink 2.0 offers user specific application that can be operated on a network, including PCs, handheld devices, and touchscreens. SecureLink is used by financial institutions and corporations around the globe to operate cheque scanner in aggregation with thin-client teller workstations, virtual desktop environments, and standalone kiosks. Similarly, RDM offers EC9600i series network cheque scanner that offers simple driverless one touch setup. The solution utilizes RDM’s Independence TM platform technology, an intelligent, self-contained, and secured network. This enables the scanner to connect to PC, Mac, mobile devices, and payment terminals within any operating system or browser directly via driverless USB or on a network via Ethernet, including thin clients such as Citrix. Like Digital Check and RDM, other vendors operating in the market also need to capture the opportunity of offering advance solution that are capable of solving check processing and clearance issues effectively. Banks and financial institution are looking for solutions that require lower set up/implementation cost and time and can be easily operated. This is bolstering the growth of the cheque scanner market.

Key Market Segments

Based on type, the market is segmented into single-feed check scanner and multi-feed check scanner. In 2020, the multi-feed check scanner segment held the largest share in North America cheque scanner market. Based on application the market is divided into banks, enterprises & financial institutions. The banks segment accounts for largest market share in the 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the cheque scanner market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ARCA, Canon Inc., Digital Check, Eastman Kodak Company, Epson, MagTek Inc, NCR Corporation, Panini S.p.A., and RDM Corporation among others.

Reasons to buy report

NORTH AMERICA CHEQUE SCANNER MARKET SEGMENTATION

By Type

By Application

By Country

Company Profiles

Strategic insights for the North America Cheque Scanner provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 328.05 Million |

| Market Size by 2028 | US$ 495.19 Million |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cheque Scanner refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Cheque Scanner Market is valued at US$ 328.05 Million in 2021, it is projected to reach US$ 495.19 Million by 2028.

As per our report North America Cheque Scanner Market, the market size is valued at US$ 328.05 Million in 2021, projecting it to reach US$ 495.19 Million by 2028. This translates to a CAGR of approximately 6.1% during the forecast period.

The North America Cheque Scanner Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cheque Scanner Market report:

The North America Cheque Scanner Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cheque Scanner Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cheque Scanner Market value chain can benefit from the information contained in a comprehensive market report.