Cell therapy bioprocessing is a subfield of bioprocess engineering that bridges cell therapy and bioprocessing (i.e., biopharmaceutical manufacturing). Cell therapy is one of the fastest-growing areas of the life sciences. It entails delivering entire living cells to a patient to treat disease.

Thus, the growing approvals for cell therapies is expected to create a significant demand for cell therapy bioprocessing in the coming years, which is further anticipated to drive the cell therapy bioprocessing market.

The global distribution of COVID-19 interfered with established clinical trials for a variety of reasons, as summarized in a recent Nature News article. Simultaneously, the pandemic has enabled massive private and public mobilization to promote new diagnostics, prophylactic vaccinations, and treatments. Cell and gene therapy manufacturers were involved in every aspect of this mobilization. According to clinicaltrials.gov, approximately 70 ongoing studies of cell and gene therapies to prevent or treat COVID-19 began on May 12, 2020. Products for cell therapy with anti-inflammatory pathways that appear to be well suited to COVID-19 therapy are also being investigated. Cell and gene therapy production may necessitate the use of a variety of human and animal biological materials. The risk that products derived from human plasma and blood will contaminate must be explained, but voluntary screening and testing of donors and donor materials used for SARS-CoV-2 can be a prudent measure. Manufacturing phase (open vs. closed): For early studies, those products are still produced in less closely or openly closed platforms, using an environmental protection biologic safeguard cabinet that is frequently located in a non-cGMP setting, despite an ongoing trend toward moving from the use of open production platforms to closed systems. This lower control level increases the risk of SARS-CoV-2 operators contaminating products. All such aspects will add to the future demand for the North America region's cell therapy bioprocessing market.

Strategic insights for the North America Cell Therapy Bioprocessing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

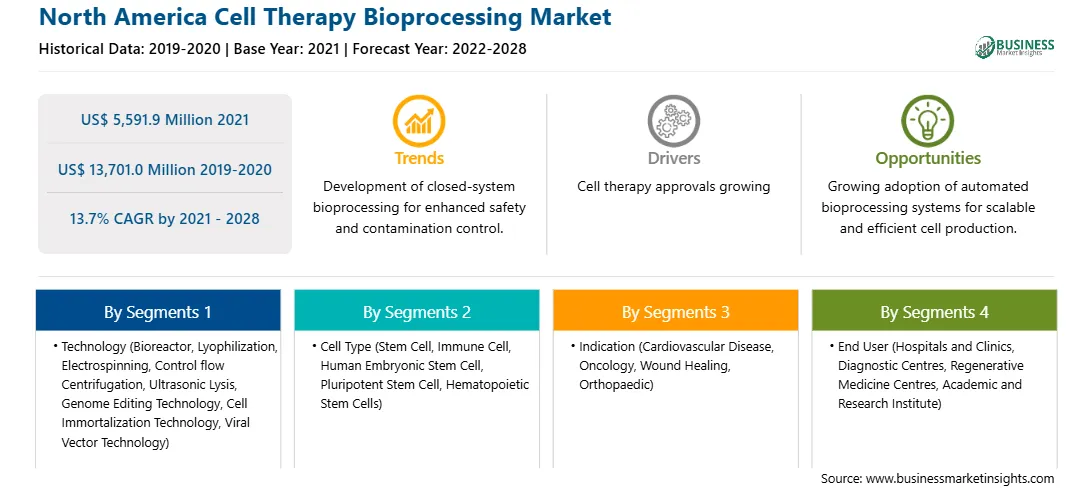

| Market size in 2021 | US$ 5,591.9 Million |

| Market Size by 2028 | US$ 13,701.0 Million |

| Global CAGR (2021 - 2028) | 13.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cell Therapy Bioprocessing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Cell therapy bioprocessing market in North America is expected to grow from US$ 5,591.9 million in 2021 to US$ 13,701.0 million by 2028; it is estimated to grow at a CAGR of 13.7% from 2021 to 2028. Automated procedures will also help in scaling-up the production volumes and continuous production of different batches with minimal tracking. It will also increase productivity by enabling the rapid expansion of manufacturing capability. There have been several instances of companies developing automated processes. In July 2020, Thermo Fisher Scientific Inc., and Lyell Immunopharma entered a partnership to develop and manufacture processes to design effective cell therapies for cancer patients. Under this partnership, the companies aim to improve fitness of T-cells and support the development of an integrated cGMP compliant platform (system and software) along with reagents, consumables, and instruments. Likewise, in March 2019, Lonza entered a partnership with Israel’s Sheba Medical Center to provide automated and closed CAR-T manufacturing using its point-of-care Cocoon cell therapy manufacturing platform. Thus, the adoption of automated procedures will help overcome the challenges associated with cell therapy bioprocessing and offer growth opportunities to the market players that will contribute to the market growth in the coming years.

In terms of technology, the bioreactors segment accounted for the largest share of the North America cell therapy bioprocessing market in 2020. In terms of cell type, the stem cell segment accounted for the largest share of the North America cell therapy bioprocessing market in 2020. In terms of indication, the oncology segment accounted for the largest share of the North America cell therapy bioprocessing market in 2020. In terms of end user, the academic and research institute segment held a larger market share of the cell therapy bioprocessing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Cell therapy bioprocessing market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Fresenius Kabi Ag., Asahi Kasei Corporation, Sartorius Ag, Merck Kgaa, Thermo Fisher Scientific Inc., Corning Incorporated, Cytiva (Ge Healthcare), Lonza, Repligen, and Catalent Inc.

By Technology

By Cell Type

By Indication

By End User

By Country

The North America Cell Therapy Bioprocessing Market is valued at US$ 5,591.9 Million in 2021, it is projected to reach US$ 13,701.0 Million by 2028.

As per our report North America Cell Therapy Bioprocessing Market, the market size is valued at US$ 5,591.9 Million in 2021, projecting it to reach US$ 13,701.0 Million by 2028. This translates to a CAGR of approximately 13.7% during the forecast period.

The North America Cell Therapy Bioprocessing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cell Therapy Bioprocessing Market report:

The North America Cell Therapy Bioprocessing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cell Therapy Bioprocessing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cell Therapy Bioprocessing Market value chain can benefit from the information contained in a comprehensive market report.