Market Introduction

The cardiometabolic disease is characterized by a group of abnormalities and symptoms that raise the risk of individuals developing cardiovascular disease. Hypertension, obesity, insulin resistance, dyslipidemia, poor cholesterol profile (LDL), and glucose tolerance are some of the symptoms. Individuals suffering from cardiometabolic syndrome are prone to several other life-threatening diseases such as type 2 diabetes, stroke, coronary artery disease (CAD), cardiovascular disease (CVD), and many others.

Moreover, the increasing prevalence of cardiometabolic diseases is expected to bolster the market growth during the forecast period. However, underdiagnosis of CVDs in low- and middle-income countries (LMICs) limits the growth of the North America cardiometabolic diseases market.

The impact of COVID-19 continues to surge, and the resulting burden on medical systems has disrupted economies, healthcare systems, and ongoing clinical trials. The COVID-19 pandemic has also triggered the onset of or exacerbate cardiovascular diseases. Also, the COVID-19 is causing serious mental health issues, and the association between depression and cardiovascular disease has long been reported. As per the Cleveland Clinic, approximately 15% of patients with CVD and up to 20% of patients who have undergone coronary artery bypass graft surgery experience major depression. Even mild depression, such as a depressed mood, can increase the relative risk of coronary artery disease. Restrictive measures taken during the COVID-19 pandemic might have increased depression in patients with cardiovascular diseases. Also, many companies have reported a decline in sales of CVD and diabetes drugs in the US. For instance, in Q4 2020, Sanofi’s global diabetes sales decreased 8.4% due to a continued decline in the average US glargine price and some impact from the COVID-19 environment. Also, cardiovascular products sales decreased 7.1%, partially due to the COVID-19 environment.

Market Overview and Dynamics

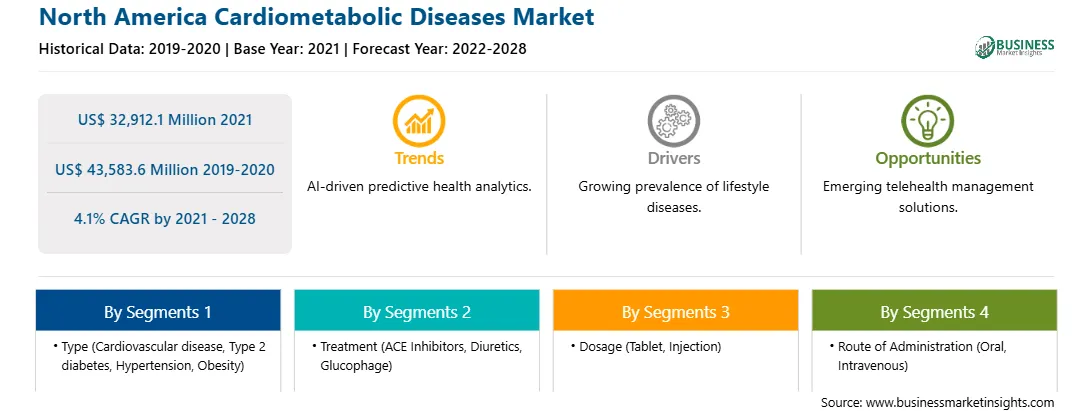

The North America cardiometabolic diseases market is projected to reach US$ 43,583.6 million by 2028 from US$ 32,912.1 million in 2021; it is anticipated to grow at a CAGR of 4.1% from 2021 to 2028. The integration of AI is further offering lucrative opportunities for the growth of the worldwide cardiometabolic disease market and is expected to continue supporting this market over the forecast period. In June 2021, The ACC and GE Healthcare collaborated through the support of and participation in ACC's Applied Health Innovation Consortium (AHIC) to build a roadmap for AI and digital technology in cardiology and develop new strategies for improved health outcomes.

Key Market Segments

In terms of type, the cardiovascular disease segment accounted for the largest share of the North America cardiometabolic diseases market in 2020. In terms of treatment, the ACE inhibitors segment accounted for the largest share of the North America cardiometabolic diseases market in 2020. In terms of dosage, the tablet segment accounted for the largest share of the North America cardiometabolic diseases market in 2020. In terms of route of administration, the oral segment accounted for the largest share of the North America cardiometabolic diseases market in 2020. In terms of end user, the hospital segment accounted for the largest share of the North America cardiometabolic diseases market in 2020. Further, based on distribution channel, the hospital pharmacy segment held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the cardiometabolic diseases market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Eli Lilly and Company., Bayer AG, Arrowhead Pharmaceuticals, Inc., Novartis AG, Boehringer Ingelheim International Gmbh, Novo Nordisk A/S, AstraZeneca, Alnylam Pharmaceuticals, Inc., Cardax, Inc., and Kowa Company, Ltd.

Reasons to Buy Report

NORTH AMERICA CARDIOMETABOLIC DISEASES MARKET SEGMENTATION

By Type

By Treatment

By Dosage

By Route of Administration

By End Users

By Distribution Channel

By Country

Companies Mentioned

Strategic insights for the North America Cardiometabolic Diseases provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 32,912.1 Million |

| Market Size by 2028 | US$ 43,583.6 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cardiometabolic Diseases refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Cardiometabolic Diseases Market is valued at US$ 32,912.1 Million in 2021, it is projected to reach US$ 43,583.6 Million by 2028.

As per our report North America Cardiometabolic Diseases Market, the market size is valued at US$ 32,912.1 Million in 2021, projecting it to reach US$ 43,583.6 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The North America Cardiometabolic Diseases Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cardiometabolic Diseases Market report:

The North America Cardiometabolic Diseases Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cardiometabolic Diseases Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cardiometabolic Diseases Market value chain can benefit from the information contained in a comprehensive market report.