A cardiac event monitor is used to record the heart's electrical activity (ECG). It keeps the track of the heartbeat and rhythm. These monitors are employed for the long-term monitoring of symptoms that don't occur every day. Important heart health data can be tracked, recorded, and sent to patients’ doctors in real time using cardiac monitoring systems, allowing the care teams to monitor patients’ heart health from a distance. This reduces the need for frequent visits to the doctor's office.

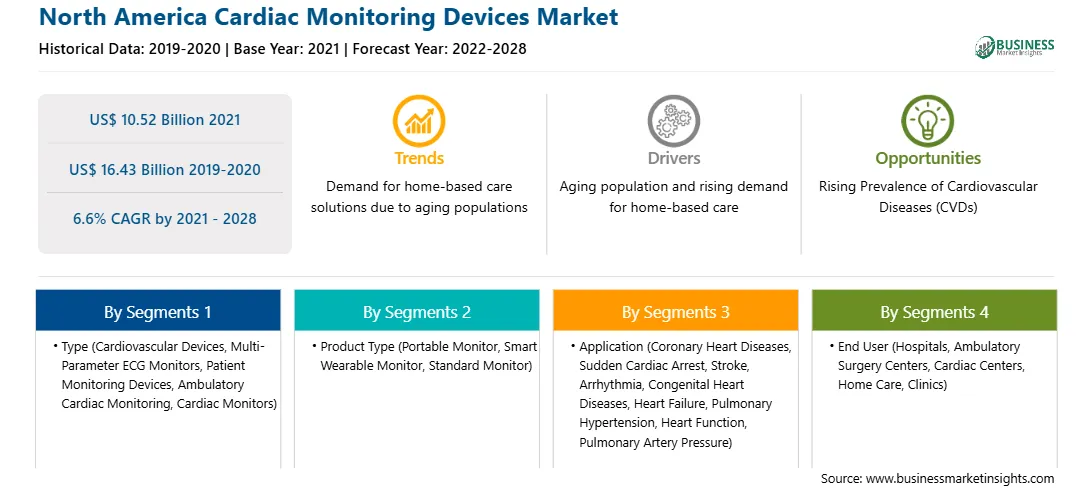

The North America cardiac monitoring devices market is analyzed on the basis of type, product type, application, end user, and country. By country, the market is broadly segmented into United States, Canada and Mexico. The report offers insights and in-depth analysis of the market, emphasizing parameters, such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the world's leading market players.

Every 40 seconds, someone in the United States gets a stroke. A stroke kills someone every 4 minutes. A stroke affects more than 795,000 people in the United States each year. The first or new strokes account for around 610,000 of these. The growing prevalence of cardiovascular diseases (CVDs) such as coronary heart diseases, sudden cardiac arrest, congenital heart diseases, heart failure, pulmonary hypertension, and pulmonary artery pressure (PA) is encouraging the introduction of improved monitoring methods. The simplicity of use and the ability of the quick detection of cardiovascular diseases (CVDs) are adding to the popularity of cardiac monitoring devices. According to the World Health Organization (WHO), ~30 million people experience a stroke each year. Moreover, the American Heart Association states more than 130 million people in the US, i.e., 45.1% of the population, are projected to have a type of CVD by 2035. In 2018, Coronary Heart Disease (CHD) was the leading cause (42.1%) of deaths attributable to CVD in the US, followed by stroke, high blood pressure, heart failure, diseases of the arteries, and other CVD. A few of the primary risk factors of CVDs include family history, ethnicity, and age; other risk factors include tobacco consumption, hypertension, obesity, high cholesterol, physical inactivity, diabetes, unhealthy diets, and alcohol consumption. Most CVD cases can be prevented through proactive monitoring and early diagnosis, which bolsters the need for cardiac monitoring devices.

The North America cardiac monitoring devices market is characterized by the presence of many small and big companies. To increase their market share, market players are adopting strategies such as new product launches, regional expansions, and technological advancements. Cardiac monitoring devices are safer and more effective than ever with continued innovation and technological advances, leading to increased acceptance of cardiac monitoring devices. Prominent players are investing in R&D to develop advanced technologies and improve their revenue shares.

A few of the recent developments related to the North America cardiac monitoring devices market are mentioned below:

The active participation of market players in product innovation and development, and increase in the approval of products are the factors fueling the growth of the North America cardiac monitoring devices market.

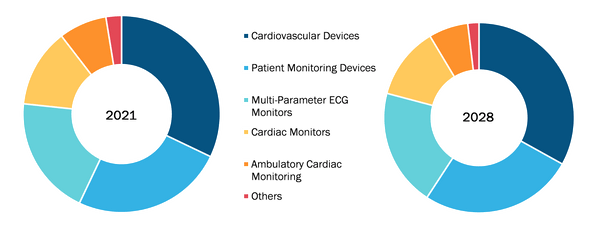

Based on type, the North America cardiac monitoring devices market is segmented into cardiovascular devices, multi-parameter ECG monitors, patient monitoring devices, ambulatory cardiac monitoring, and cardiac monitors. In 2020, the cardiovascular devices segment held the largest share of the market. Further, the market for the patient monitoring devices segment is expected to grow at the highest CAGR during 2021–2028. With a growing prevalence of chronic disorders such as stroke, coronary heart disease, sudden cardiac arrest, and congenital heart diseases, the demand for patient monitoring devices is increasing. Temperature monitoring, continuous glucose monitoring, and pulsed oximetry blood pressure monitoring are several applications of wearable patient monitoring, biosensors, and smart implants.

Based on product type, the North America cardiac monitoring devices market is segmented into portable monitor, smart wearable monitor, and standard monitor. In 2020, the standard monitor segment held the largest share of the market. Moreover, the market for the smart wearable monitor segment is expected to grow at the fastest CAGR during 2021–2028. The PMMA is a plastic with excellent mechanical properties and minimal toxicity. The growing trend of smart wearable is encouraging the usage of commercial smart wearable monitors for health management. In the era of remote and personalized patient care, especially catalyzed by the COVID-19 pandemic, there is a high demand for wearable technologies for a wide range of clinical applications.

Based on application, the North America cardiac monitoring devices market is segmented into coronary heart diseases, sudden cardiac arrest, stroke, arrhythmia, congenital heart diseases, heart failure, pulmonary hypertension, heart function (HF/LVEDP), pulmonary artery pressure (PA), and others. The coronary heart diseases segment held the largest market share in 2020, and it is further expected to be the largest shareholder in the market by 2028. The increased prevalence of diabetes, hypertension, and high cholesterol levels is contributing to the growing risk of cardiovascular disease and accelerating the cases of coronary heart diseases.

End User Insights

Based on end user, the North America cardiac monitoring devices market is segmented into hospitals, ambulatory surgery centers (ASCs), and clinics. The hospitals segment held the largest market share in 2020, and it is further expected to be the largest shareholder in the market by 2028. Hospitals are the primary healthcare centers where cardiovascular diseases, including coronary heart diseases, stroke, sudden cardiac arrest, and arrhythmia, are extensively treated.

Strategic Insights

Product launches and mergers and acquisitions are the highly adopted strategies by the players operating in the North America cardiac monitoring devices market. A few of the recent key product developments are listed below:

According to data published by the American Medical Association, before the onset of the COVID-19 pandemic, routine monitoring of hospitalized patients with heart rate devices and continuous pulse oximetry contributed to the reduced death rate associated with chronic heart diseases. COVID-19 has created a demand to monitor patients treated in emergency departments (EDs) standard medical units and monitor some patients at home for clinical deterioration (e.g., hypoxemia) in order to maintain the hospital capacity. The pandemic highlighted the need for monitoring and therapy based on patient needs and risks. A combination of technological advances, medical urgency, and payment policy supported this change. The COVID-19 pandemic marks the beginning of a new era of cardiac management with remote patient monitoring (RPM). Real-time cardiovascular disease monitoring based on wearable medical devices can effectively reduce COVID-19 mortality. Thus, the demand for cardiac monitoring devices is expected to grow continuously during the forecast period as there is a rise in the number of product approvals and launches in the market.

The North America cardiac monitoring devices market is analyzed on the basis of type, product type, application and end user. Based on type, the market is categorized into cardiovascular devices (event monitors, electrocardiography (ECG), cardiac catheters, stents, defibrillators, guidewires, pacemakers, heart valves and others), patient monitoring devices (cardio monitoring devices, anesthesia monitoring devices, hemodynamic monitoring devices, fetal and neonatal monitoring devices, stress management devices and others), multi-parameter ECG monitors, cardiac monitors [cardiac event monitoring (CEM) holter, extended holter/AECG, and others], ambulatory cardiac monitoring (event recorders, implantable loop recorders, mobile cardiac telemetry, and others), and others. Based on product type, the North America cardiac monitoring devices market is segmented into the standard monitor, portable monitor, and smart wearable monitor. Based on application, the North America cardiac monitoring devices market is segmented into coronary heart diseases, stroke, sudden cardiac arrest, arrhythmia, heart failure, pulmonary hypertension, congenital heart diseases, pulmonary artery pressure (PA), heart function (HF/LVEDP), and Others. Based on end user, the market is segmented into hospitals, clinics, ambulatory surgery centers, cardiac centers, home care, and others. The North America cardiac monitoring devices, by country, is segmented into the US, Canada, and Mexico

Strategic insights for the North America Cardiac Monitoring Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 10.52 Billion |

| Market Size by 2028 | US$ 16.43 Billion |

| Global CAGR (2021 - 2028) | 6.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cardiac Monitoring Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Cardiac Monitoring Devices Market is valued at US$ 10.52 Billion in 2021, it is projected to reach US$ 16.43 Billion by 2028.

As per our report North America Cardiac Monitoring Devices Market, the market size is valued at US$ 10.52 Billion in 2021, projecting it to reach US$ 16.43 Billion by 2028. This translates to a CAGR of approximately 6.6% during the forecast period.

The North America Cardiac Monitoring Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cardiac Monitoring Devices Market report:

The North America Cardiac Monitoring Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cardiac Monitoring Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cardiac Monitoring Devices Market value chain can benefit from the information contained in a comprehensive market report.