Growing demand to utilize renewable resources has led to a surge in the installation and demand for wind farms, with large tracts of land and coastal areas devoted to the operation of wind turbines. Wind turbine manufacturers strive to produce more efficient and longer blades that lighter in weight. Advanced composite materials such as carbon fiber are widely used in wind turbines, specifically for manufacturing blades. The companies operating in the market have discovered that the longer the blades are on a turbine, the more energy can be generated. Carbon fiber plays a very important role in the wind energy industry. Large blades are typically designed by stiffness and deflection, rather than taking into consideration the material strength. The high stiffness characteristic of carbon fiber reduces blade deflection, allowing a larger tower diameter for a given blade-to-tower clearance. Carbon fiber is added in the spar cap, which is the backbone of the blade. Moreover, the carbon fibers are an effective alternative to the glass fibers used in the wind turbines. They show higher stiffness and lower density as compared to the glass fibers, thus, allowing the thinner, stiffer and lighter blades. Furthermore, they have relatively low damage tolerance, compressive strength, and ultimate strain. Therefore, carbon fibers are most used in the fabrication of wind turbine blades. Carbon fiber has proven to be an enabling technology for turbine manufacturers. These companies use carbon fiber in select structural parts of the blades and taking advantage of the lighter weight blades throughout the turbine system. Lighter blades require less robust turbine and tower components, so the cascading cost is also saved. All these factors are significantly driving the growth of carbon fiber market.

The North America carbon fiber market is divided into the US, Canada, and Mexico. The rising demand for carbon fiber especially across the aerospace industry in the region is significantly driving the market growth. Carbon fiber is majorly used in aerospace applications to fabricate engine blades, brackets, interior components, propellers/rotors, single aisle wings, and wide-body wings. Governments of various countries in North America have significantly invested in technology and research programs in the aerospace sector. The region is a hub for a few major aircraft manufacturing companies such as Raytheon Technologies Corporation, The Boeing Company, and The Lockheed Martin Corporation. The growth in end-use industries is creating opportunities for carbon fiber manufacturers to expand their production capacities in North America. Further, the manufacturers of carbon fiber are partnering with the industry players to cater to the rising product demand. For instance, in July 2022, Hexcel signed a partnership agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program to manufacture carbon fiber-based aircraft wings. Such developments are expected to provide lucrative growth opportunities for the carbon fiber manufacturers across North America over the forecast period.

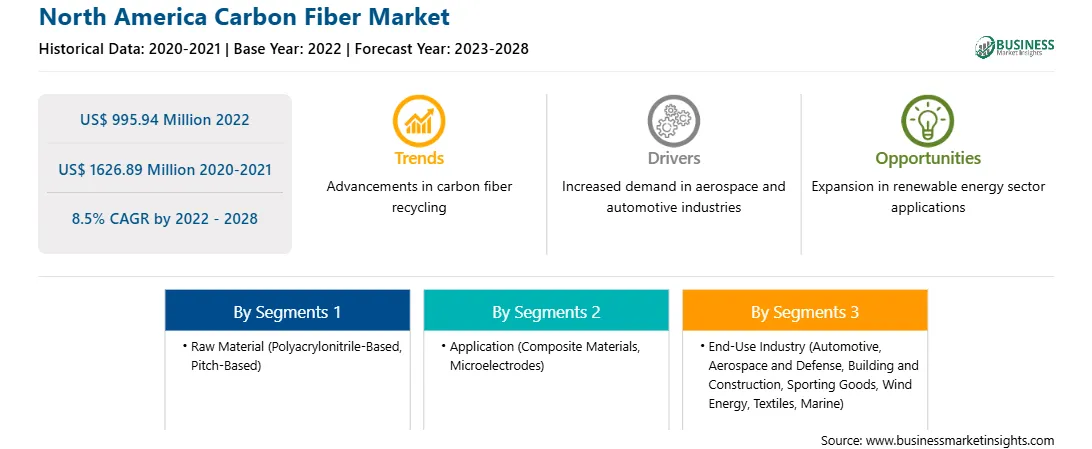

Strategic insights for the North America Carbon Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Carbon Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Carbon Fiber Strategic Insights

North America Carbon Fiber Report Scope

Report Attribute

Details

Market size in 2022

US$ 995.94 Million

Market Size by 2028

US$ 1626.89 Million

Global CAGR (2022 - 2028)

8.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Raw Material

By Application

By End-Use Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Carbon Fiber Regional Insights

North America Carbon Fiber Market Segmentation

The North America carbon fiber market is segmented into raw material, application, end use industry and country.

Based on raw material, the North America carbon fiber market is segmented into polyacrylonitrile-based and pitch-based. The polyacrylonitrile-based segment held a larger North America carbon fiber market share in 2022.

Based on application, the North America carbon fiber market is segmented into composite materials, microelectrodes, and others. The Composite Materials segment held the largest North America carbon fiber market share in 2022.

Based on end use industry, the North America carbon fiber market is segmented into automotive, aerospace and defense, building and construction, sporting goods, wind energy, textiles, marine, and others. The aerospace and defense segment held the largest North America carbon fiber market share in 2022.

Based on country, the North America carbon fiber market has been categorized into the US, Canada, and Mexico. The US dominated the North America carbon fiber market share in 2022.

SGL Carbon SE; DowAksa Advanced Composite Material Industries Ltd Co; Formosa Plastics Corp; Hexcel Corp; Hyosung Advanced Materials Corp; Kureha Corp; Solvay SA; Teijin Ltd; Toray Industries Inc; and Mitsubishi Chemical Corp are the leading companies operating in the carbon fiber market in the region.

The North America Carbon Fiber Market is valued at US$ 995.94 Million in 2022, it is projected to reach US$ 1626.89 Million by 2028.

As per our report North America Carbon Fiber Market, the market size is valued at US$ 995.94 Million in 2022, projecting it to reach US$ 1626.89 Million by 2028. This translates to a CAGR of approximately 8.5% during the forecast period.

The North America Carbon Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Carbon Fiber Market report:

The North America Carbon Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Carbon Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Carbon Fiber Market value chain can benefit from the information contained in a comprehensive market report.